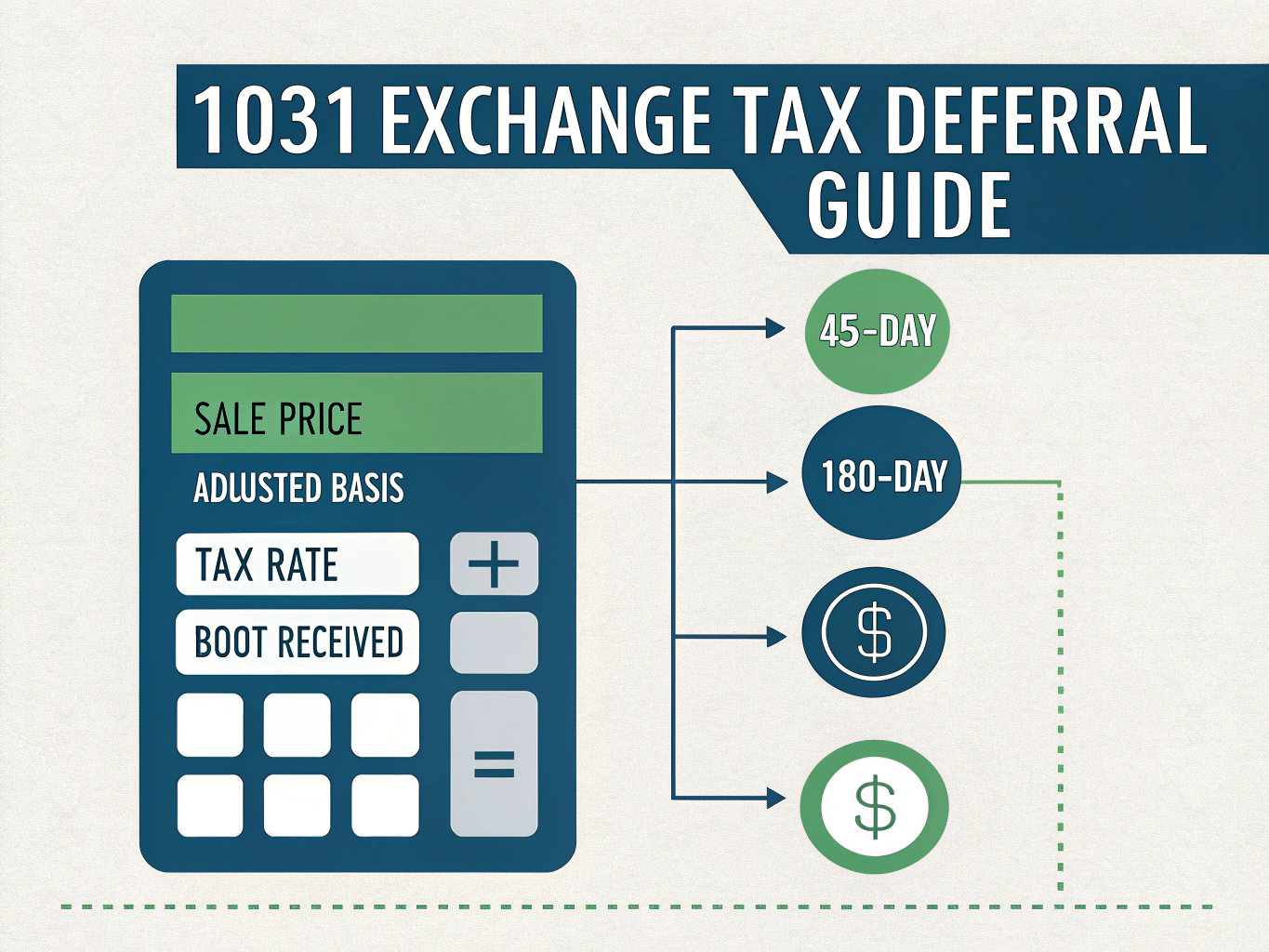

Section 1031 Exchange Calculator

Is this tool helpful?

How to Use the Section 1031 Exchange Evaluator Tool Effectively

To calculate your potential tax deferral using our Section 1031 Exchange Evaluator, follow these simple steps:

- Sale Price ($): Enter the total selling price of your relinquished property. For example, if you’re selling a commercial property for $750,000 or a residential investment property for $425,000, input these amounts in this field.

- Adjusted Basis ($): Input your property’s adjusted basis, which includes the original purchase price plus capital improvements, minus depreciation. For instance, if you purchased the property for $300,000, made $50,000 in improvements, and took $75,000 in depreciation, your adjusted basis would be $275,000.

- Tax Rate (%): Enter your applicable tax rate as a percentage. This typically combines federal capital gains tax (15-20%) and state taxes. For example, enter 23.8% if you’re subject to the highest federal capital gains rate plus the net investment income tax.

- Boot Received ($): If you receive any non-like-kind property or cash in the exchange, enter this amount. For example, if you receive $25,000 in cash along with your replacement property, input this amount.

Understanding Section 1031 Exchange Evaluator

The Section 1031 Exchange Evaluator is a sophisticated tool designed to help real estate investors calculate potential tax savings through a like-kind exchange. This powerful calculator determines the deferred tax amount based on the following formula:

$$ \text{Deferred Tax} = (\text{Sale Price} – \text{Adjusted Basis}) \times \text{Tax Rate} – \text{Boot Received} $$Key Components of the Calculation

The tool considers four essential elements:

- Property sale price

- Adjusted basis of the relinquished property

- Applicable tax rate

- Boot received (if any)

Benefits of Using the Section 1031 Exchange Evaluator

- Tax Planning: Accurately forecast potential tax savings before committing to an exchange

- Decision Support: Make informed decisions about whether a 1031 exchange is financially beneficial

- Time Management: Quick assessment of various exchange scenarios

- Compliance Awareness: Built-in reminders of critical 45-day and 180-day deadlines

- Financial Strategy: Evaluate different property combinations and their tax implications

Problem-Solving Applications

Real Estate Investment Optimization

Consider this practical example: An investor owns a rental property with:

- Sale Price: $850,000

- Adjusted Basis: $450,000

- Tax Rate: 25%

- Boot Received: $50,000

Using our calculator:

Deferred Tax = ($850,000 – $450,000) × 25% – $50,000 = $50,000

Strategic Investment Planning

The tool helps investors:

- Compare multiple exchange scenarios

- Evaluate the impact of different replacement properties

- Assess the financial implications of receiving boot

- Plan for required equity positions

Practical Applications and Use Cases

Portfolio Restructuring

Example scenario: An investor wants to exchange a small apartment building for multiple single-family rentals:

- Apartment Building Sale Price: $1,200,000

- Adjusted Basis: $800,000

- Tax Rate: 28%

- No Boot

The calculator shows a potential tax deferral of $112,000, helping the investor evaluate the exchange’s viability.

Property Upgrade Strategy

Consider an investor upgrading from a smaller to a larger commercial property:

- Current Property Sale: $2,500,000

- Adjusted Basis: $1,500,000

- Tax Rate: 30%

- Boot Received: $100,000

Frequently Asked Questions

General Questions

Q: What is boot in a 1031 exchange?

A: Boot refers to any non-like-kind property received in an exchange, including cash, debt relief, or personal property. It’s taxable to the extent of gain realized.

Q: How do I determine my adjusted basis?

A: Your adjusted basis includes the original purchase price, plus capital improvements, minus depreciation taken. Consult with your tax advisor for precise calculations.

Q: What types of properties qualify for 1031 exchanges?

A: Properties held for investment or used in a trade or business qualify. Personal residences and property held primarily for sale don’t qualify.

Technical Aspects

Q: How does the 45-day identification period work?

A: You must identify potential replacement properties within 45 days of selling your relinquished property. This identification must be in writing and delivered to a qualified intermediary or appropriate party.

Q: What happens if I receive more boot than anticipated?

A: Any boot received will be taxable to the extent of gain realized. The calculator helps you understand the tax implications of receiving various amounts of boot.

Q: Can I exchange into multiple properties?

A: Yes, you can exchange one property for multiple replacement properties as long as you follow the identification rules and complete the exchange within 180 days.

Strategic Planning

Q: When should I start planning my 1031 exchange?

A: Start planning well before selling your property. Use this calculator to evaluate different scenarios and consult with tax and legal advisors.

Q: How can I maximize my tax deferral?

A: To maximize deferral, aim to reinvest all equity and replace all debt in the replacement property. Avoid receiving boot when possible.

Q: What factors should I consider besides tax deferral?

A: Consider location, property type, management requirements, cash flow potential, and long-term appreciation prospects of replacement properties.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.