30-Year Mortgage Calculator

Is this tool helpful?

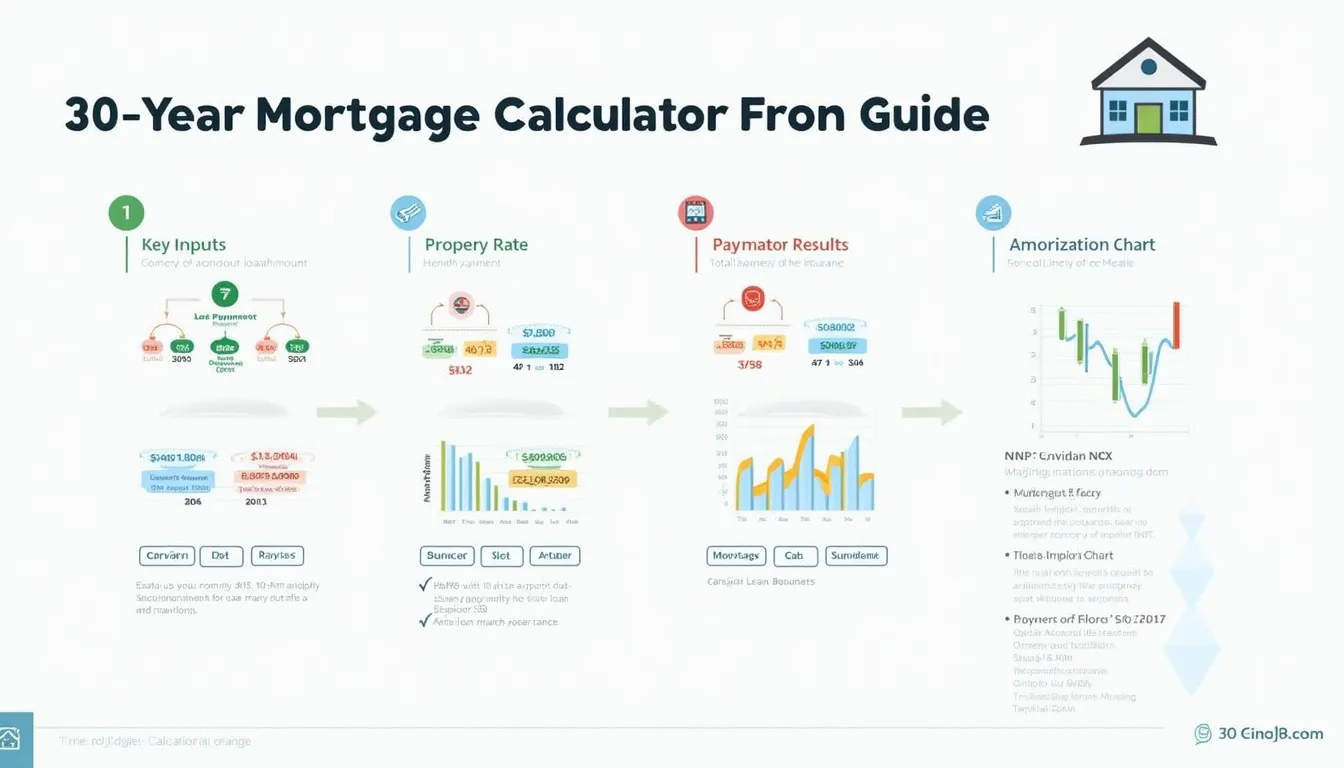

How to use the tool

1 — Loan Amount ($)

- Buying a $500 000 home with 20 % down? Enter $400 000.

- Purchasing a $650 000 condo with 10 % down? Enter $585 000.

2 — Annual Interest Rate (%)

- Quote from Lender A: 5.2.

- VA loan offer: 4.75.

3 — Annual Property Tax ($) (optional)

- Mid-Atlantic city estimate: $6 800.

- Rural county estimate: $3 250.

4 — Annual Home Insurance ($) (optional)

- Standard brick home: $1 600.

- Coastal house with wind coverage: $2 400.

5 — Monthly PMI ($) (optional)

- 3 % down conventional loan: $150.

- FHA loan with 96.5 % LTV: $220.

6 — Press “Calculate” and read:

- Monthly Mortgage Payment (principal + interest).

- Total Monthly Payment (adds taxes, insurance, PMI).

- Total Interest Paid across 360 payments.

- Total Amount Paid = principal + interest.

- A year-by-year balance chart.

Key formulas

Monthly payment:

$$M = P rac{r(1+r)^n}{(1+r)^n – 1}$$

- P = loan principal

- r = monthly interest rate (APR / 12)

- n = number of payments (360 for 30 years)

Example calculation

P = $425 000, APR = 5.2 % → r = 0.004333, n = 360.

$$M = 425\,000 rac{0.004333(1+0.004333)^{360}}{(1+0.004333)^{360}-1} \approx \$2\,334$$

- Total interest ≈ $415 240.

- Total paid ≈ $840 240.

Quick-Facts

- Average 30-year fixed rate: 6.79 % (Freddie Mac PMMS, 2023).

- Standard loan term: 360 months (CFPB Mortgage Guide, 2022).

- PMI drops when equity reaches 22 % by schedule (CFPB, 2023).

- Median U.S. property-tax rate: 1.1 % of value (Tax Foundation, 2022).

- Average homeowners insurance premium: $1 428 (NAIC Report, 2023).

FAQ

How does interest rate affect payment?

A 0.5 percentage-point rise on a $350 000 loan adds roughly $110 to the monthly payment (Freddie Mac, 2023).

Can I remove PMI sooner?

You may request cancellation once your equity hits 20 %; “lenders must terminate at 78 % LTV” (CFPB, 2023).

What costs does the “Total Monthly Payment” include?

It adds prorated property tax, homeowners insurance, and PMI to principal + interest so you see the full housing expense.

Is extra principal allowed?

Most fixed-rate mortgages allow unlimited extra payments without penalty; confirm in your note (Fannie Mae Servicing Guide, 2022).

Will property taxes change?

Local governments reassess annually or biannually; average national increase was 4.1 % in 2022 (ATTOM Data, 2023).

Does the calculator handle bi-weekly schedules?

No. Divide the monthly payment by two and pay every two weeks to reduce interest and shorten term.

What if I refinance?

Enter the new balance, term, and rate to compare old and new payments; lower rates cut interest, shorter terms build equity faster.

Is this tool suitable for ARMs?

No. Adjustable-rate mortgages require future rate projections; use an ARM-specific calculator for accuracy.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.