Annual Debt Service Coverage Ratio Calculator

Is this tool helpful?

Welcome to our comprehensive guide on the Annual Debt Service Coverage Ratio (ADSCR) Calculator. This powerful tool is designed to help businesses, investors, and financial analysts assess the ability of an entity to cover its debt obligations using its operating income. In this article, we’ll explore how to use the calculator effectively, understand its importance, and leverage its results for better financial decision-making.

How to Use the Annual Debt Service Coverage Ratio Calculator

Our ADSCR Calculator is user-friendly and straightforward. Follow these steps to get accurate results:

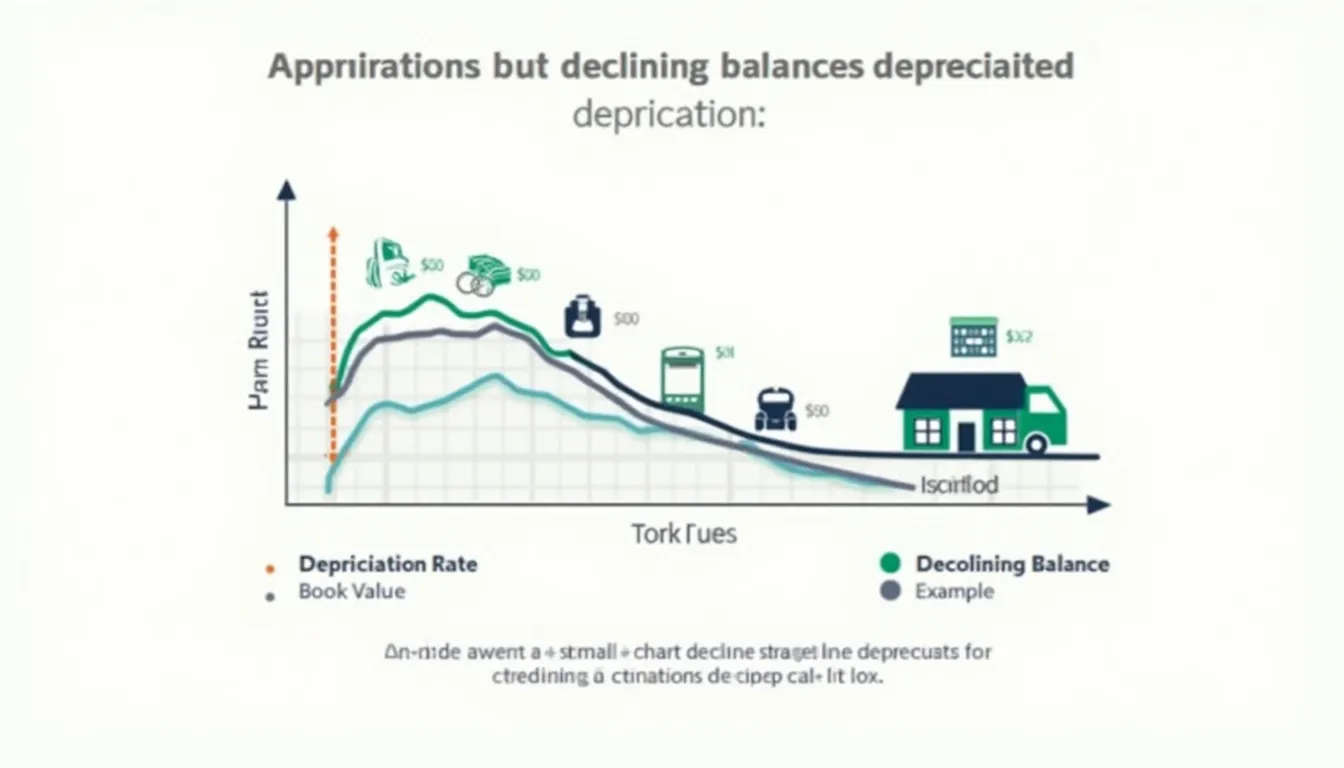

- Enter Net Operating Income (NOI): Input your annual net operating income in USD. This is your total revenue minus operating expenses, excluding taxes and interest payments.

- Input Depreciation: Enter the total depreciation amount for the year in USD.

- Add Non-Cash Expenses: Include any additional non-cash expenses in USD.

- Specify Annual Debt Service: Enter the total amount of debt payments (principal and interest) due in the year.

- Calculate: Click the “Calculate ADSCR” button to get your results.

The calculator will then display your Annual Debt Service Coverage Ratio along with an interpretation of the result.

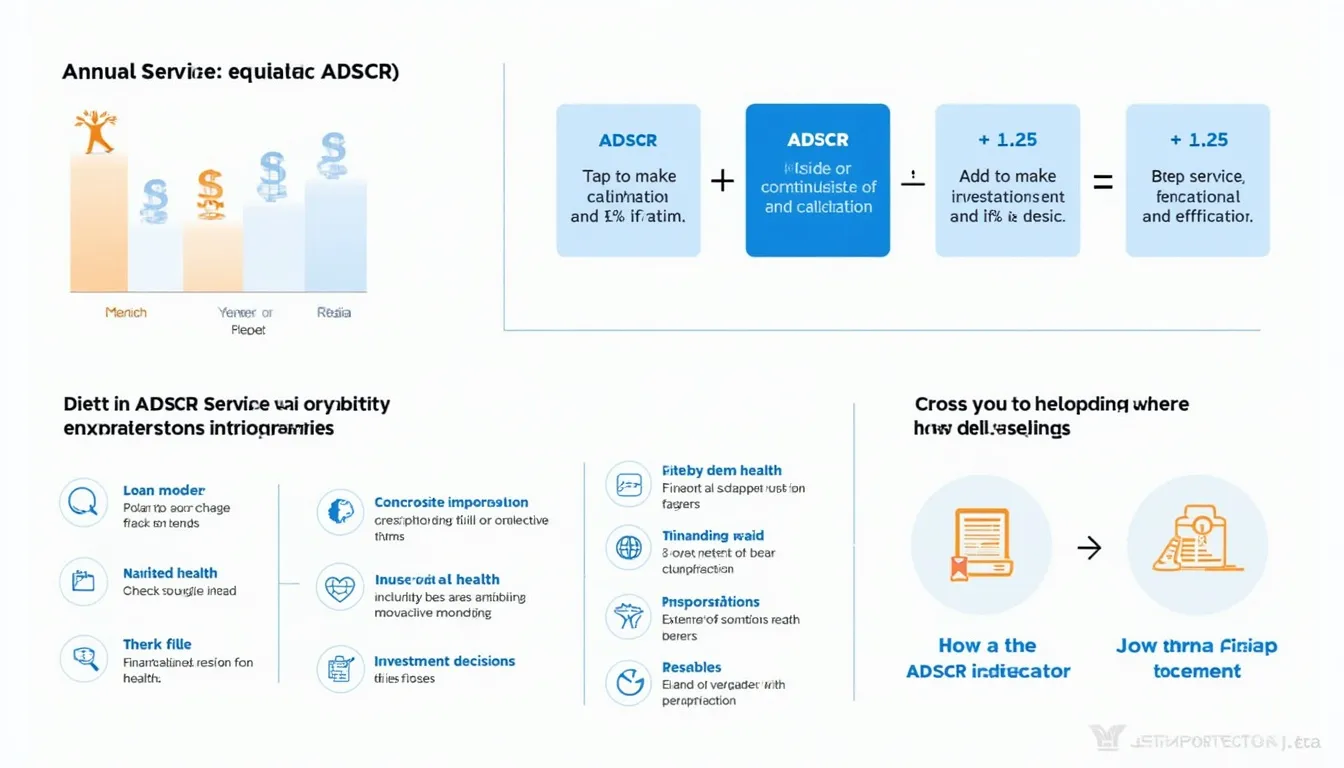

Understanding the Annual Debt Service Coverage Ratio

The Annual Debt Service Coverage Ratio is a crucial financial metric that measures a company’s ability to pay its debt obligations using its operating income. It’s calculated using the following formula:

$$ ADSCR = \frac{Net Operating Income + Depreciation + Non-Cash Expenses}{Annual Debt Service} $$This ratio provides insights into a company’s financial health and its capacity to take on additional debt. A higher ADSCR indicates a stronger ability to cover debt payments, while a lower ratio suggests potential financial stress.

Interpreting ADSCR Results

- ADSCR < 1: The entity may not have sufficient income to cover its debt obligations, indicating financial distress.

- 1 ≤ ADSCR < 1.25: The entity can cover its debt obligations but with little margin for error. This situation may be concerning to lenders.

- ADSCR ≥ 1.25: The entity has a good ability to service its debt with a comfortable margin, suggesting financial stability.

Benefits of Using the ADSCR Calculator

Utilizing our ADSCR Calculator offers numerous advantages:

- Quick Assessment: Instantly evaluate a company’s ability to meet its debt obligations.

- Decision Support: Aid in making informed decisions about taking on additional debt or refinancing existing loans.

- Risk Management: Identify potential financial risks before they become critical issues.

- Investor Confidence: Demonstrate financial health to potential investors or lenders.

- Benchmarking: Compare your company’s performance against industry standards or competitors.

- Strategic Planning: Use the results to guide long-term financial planning and goal-setting.

Addressing User Needs with the ADSCR Calculator

Our ADSCR Calculator is designed to address several key user needs and solve specific problems in financial analysis:

1. Financial Health Assessment

For business owners and managers, the ADSCR Calculator provides a quick and reliable way to assess the company’s financial health. By inputting your financial data, you can get an immediate snapshot of your ability to service debt, helping you identify potential issues before they escalate.

2. Loan Application Support

When applying for loans, lenders often require ADSCR calculations. Our calculator simplifies this process, allowing you to present accurate figures to potential lenders, potentially improving your chances of loan approval.

3. Investment Decision Making

Investors can use the ADSCR Calculator to evaluate the financial stability of potential investment opportunities. A higher ADSCR generally indicates a lower-risk investment, helping investors make more informed decisions.

4. Debt Management

For companies managing multiple debt obligations, the ADSCR Calculator can help in prioritizing debt repayment and restructuring efforts. It provides clarity on your overall debt servicing capacity, guiding strategic financial decisions.

5. Performance Monitoring

Regularly calculating your ADSCR allows you to track your company’s financial performance over time. This can help in identifying trends, setting performance targets, and measuring the impact of financial decisions.

Practical Applications and Use Cases

To illustrate the practical applications of the ADSCR Calculator, let’s explore some real-world scenarios:

Case Study 1: Real Estate Investment

A real estate investor is considering purchasing a commercial property. The property generates an annual net operating income of $500,000, with depreciation of $50,000 and non-cash expenses of $10,000. The annual debt service for the potential mortgage is $400,000.

Using our calculator:

- Net Operating Income: $500,000

- Depreciation: $50,000

- Non-Cash Expenses: $10,000

- Annual Debt Service: $400,000

The calculated ADSCR is 1.40, indicating that the property generates sufficient income to cover its debt obligations with a comfortable margin. This suggests it could be a sound investment.

Case Study 2: Small Business Loan Application

A small business owner is applying for a loan to expand operations. The company’s financials show:

- Net Operating Income: $200,000

- Depreciation: $30,000

- Non-Cash Expenses: $5,000

- Existing Annual Debt Service: $150,000

The ADSCR calculator shows a ratio of 1.57, which is favorable. The business owner can use this information to demonstrate to lenders that the company has a strong ability to service additional debt, potentially securing better loan terms.

Case Study 3: Corporate Financial Analysis

A financial analyst is evaluating a company’s ability to take on additional debt for a major expansion project. The company’s current financials are:

- Net Operating Income: $10,000,000

- Depreciation: $1,500,000

- Non-Cash Expenses: $500,000

- Current Annual Debt Service: $8,000,000

The ADSCR calculator yields a ratio of 1.50. While this indicates the company can cover its current debt obligations, it suggests caution in taking on significant additional debt. The analyst might recommend exploring alternative financing options or phasing the expansion project to maintain financial stability.

Frequently Asked Questions (FAQ)

1. What is a good Annual Debt Service Coverage Ratio?

Generally, an ADSCR of 1.25 or higher is considered good. However, the ideal ratio can vary by industry and lender requirements. A higher ratio indicates a stronger ability to service debt.

2. How often should I calculate my company’s ADSCR?

It’s recommended to calculate your ADSCR at least annually, but more frequent calculations (quarterly or monthly) can provide better insights into your financial trends and help in proactive financial management.

3. Can the ADSCR be negative?

No, the ADSCR cannot be negative. If your net operating income is negative, it means you’re operating at a loss, and the ADSCR calculation wouldn’t be applicable in this situation.

4. How does ADSCR differ from DSCR (Debt Service Coverage Ratio)?

ADSCR specifically looks at the annual debt service, while DSCR can be calculated for any time period (monthly, quarterly, etc.). The calculation method is the same, but ADSCR provides a yearly overview.

5. Can I use ADSCR to compare companies in different industries?

While ADSCR can be used for cross-industry comparisons, it’s important to consider industry-specific factors. Some industries naturally operate with higher debt levels, so comparing ADSCRs should be done cautiously and in context.

6. How do lenders use ADSCR?

Lenders often use ADSCR as a key metric in assessing loan applications. Many lenders have minimum ADSCR requirements, typically around 1.25 or higher, depending on the industry and loan type.

7. What if my ADSCR is below 1?

An ADSCR below 1 indicates that your operating income is insufficient to cover your debt obligations. This is a serious situation that may require immediate action, such as increasing revenue, reducing expenses, or restructuring debt.

8. How can I improve my ADSCR?

To improve your ADSCR, you can focus on increasing your net operating income (through higher revenue or reduced expenses), reducing your debt service (by refinancing or paying down debt), or increasing non-cash expenses like depreciation (though this should be done carefully and in line with accounting principles).

9. Is a very high ADSCR always good?

While a high ADSCR indicates strong debt servicing ability, an extremely high ratio might suggest that a company is not leveraging its assets effectively or missing growth opportunities. It’s about finding the right balance for your specific situation.

10. Can ADSCR be used for personal finance?

While ADSCR is primarily used for businesses, a similar concept can be applied to personal finance. Individuals can calculate their ability to cover debt payments using their income, which can be helpful in personal financial planning.

Please note that while our ADSCR Calculator is designed to provide accurate results based on the information you input, we cannot guarantee that the results are always correct, complete, or reliable. Our content and tools might have mistakes, biases, or inconsistencies. Always consult with a qualified financial professional for important financial decisions.

Conclusion: Empowering Financial Decision-Making with ADSCR

The Annual Debt Service Coverage Ratio is a powerful metric that provides crucial insights into an entity’s financial health and debt-servicing capacity. Our ADSCR Calculator simplifies the process of calculating this important ratio, offering a user-friendly tool for businesses, investors, and financial analysts.

By regularly using this calculator, you can:

- Assess your financial stability

- Make informed decisions about taking on new debt

- Demonstrate creditworthiness to lenders and investors

- Identify potential financial risks before they become critical

- Guide your long-term financial strategy

Remember, while the ADSCR is a valuable tool, it should be used in conjunction with other financial metrics and analyses for a comprehensive understanding of financial health. Regular calculation and monitoring of your ADSCR can lead to better financial management and more strategic decision-making.

We encourage you to use our ADSCR Calculator as part of your regular financial analysis routine. By staying informed about your debt service coverage, you’re taking an important step towards financial stability and success. Start calculating your ADSCR today and gain the insights you need to make confident financial decisions for your business or investments.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.