Investment Analysis and Notification Setup

Is this tool helpful?

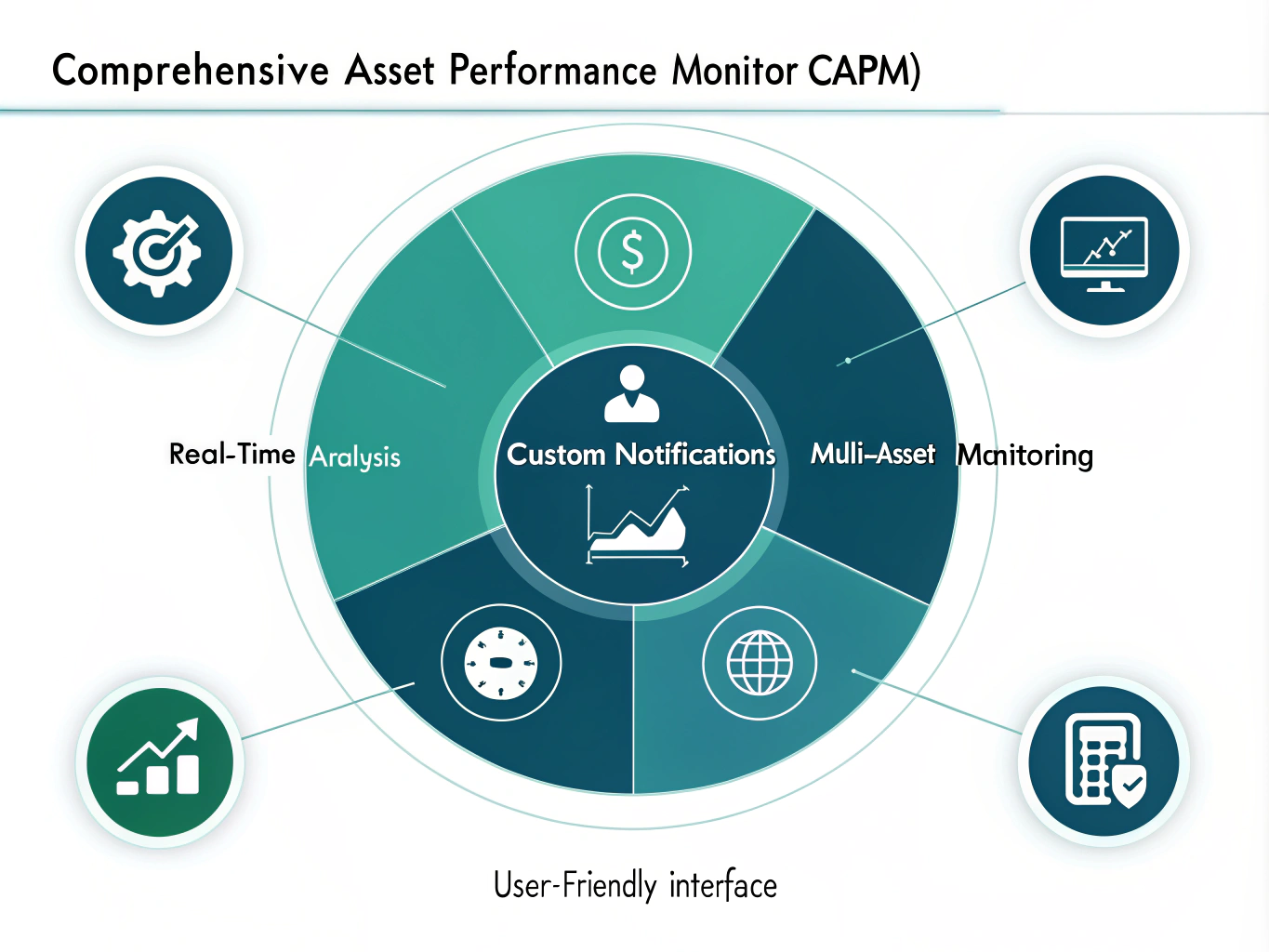

How to Use the Comprehensive Asset Performance Monitor (CAPM) Tool Effectively

The Comprehensive Asset Performance Monitor (CAPM) tool is designed to help you analyze stocks, digital assets, and cryptocurrencies while setting up automated notifications for market changes. Here’s a step-by-step guide on how to use this powerful tool effectively:

1. Specify Stock Categories or Sectors

In the first field, enter the specific stock categories or sectors you want to analyze. This helps the tool focus on the areas of the stock market that interest you most.

Sample inputs:

- Renewable Energy, Artificial Intelligence, Biotechnology

- Consumer Staples, Telecommunications, Real Estate Investment Trusts (REITs)

2. Define Digital Assets for Analysis

Next, specify the types of digital assets you want to include in your analysis. This field allows you to explore various forms of digital investments beyond traditional stocks.

Sample inputs:

- Digital Art NFTs, Tokenized Real Estate, In-Game Assets

- Metaverse Land, Decentralized Finance (DeFi) Tokens, Social Tokens

3. Select Cryptocurrencies to Analyze

Enter the names of specific cryptocurrencies you want to analyze. This enables you to focus on the digital currencies that align with your investment interests or portfolio.

Sample inputs:

- Polkadot, Solana, Chainlink

- Avalanche, Polygon, Algorand

4. Set Notification Criteria (Optional)

To make the most of the automated notification system, specify the criteria for triggering alerts. This optional field allows you to customize when and why you receive notifications about your selected assets.

Sample inputs:

- Price drops of 10% or more within 24 hours, Trading volume increase of 300% compared to 7-day average, Significant partnership announcements

- Sudden market cap increase of 20% or more, Regulatory news mentions, Technical indicator crossovers (e.g., 50-day moving average crossing 200-day moving average)

5. Define Analysis Period (Optional)

To tailor the historical performance analysis to your needs, enter the time period you want to examine. This optional field helps you focus on specific timeframes that may be most relevant to your investment strategy.

Sample inputs:

- 3 years, 18 months, 2 fiscal quarters

- Since market bottom of 2020, Last bull market cycle, Past decade

6. Submit and Review Results

Once you’ve filled in the required fields and any optional information, click the “Analyze and Set Up Notifications” button. The tool will process your inputs and generate a comprehensive analysis along with notification setup instructions. Review the results carefully to gain insights into your selected assets and understand how to implement the automated notification system.

Introduction to the Comprehensive Asset Performance Monitor (CAPM) Tool

In today’s fast-paced and complex financial landscape, investors and market enthusiasts need powerful tools to stay informed and make data-driven decisions. The Comprehensive Asset Performance Monitor (CAPM) tool is a cutting-edge solution designed to provide in-depth analysis of stocks, digital assets, and cryptocurrencies while offering a customizable automated notification system.

This innovative tool addresses the growing need for a unified platform that can analyze diverse asset classes, recognizing the increasing interconnectedness of traditional and digital financial markets. By combining robust analytical capabilities with real-time notification features, CAPM empowers users to stay ahead of market trends and make informed investment decisions.

Purpose and Benefits

The primary purpose of the CAPM tool is to simplify the complex task of monitoring and analyzing various asset classes simultaneously. It offers several key benefits:

- Comprehensive Analysis: By covering stocks, digital assets, and cryptocurrencies, CAPM provides a holistic view of the financial landscape, enabling users to identify trends and correlations across different asset classes.

- Customizable Notifications: The tool’s automated notification system allows users to stay informed about market changes without constant manual monitoring, saving time and reducing the risk of missing critical opportunities or threats.

- Data-Driven Insights: By analyzing market trends, volatility levels, and historical performance, CAPM equips users with valuable insights to support their investment strategies.

- Risk Management: The tool’s ability to highlight potential risks across different asset categories helps users make more balanced and informed decisions about their investments.

- Time Efficiency: By automating the analysis and notification processes, CAPM significantly reduces the time and effort required to stay up-to-date with multiple markets and asset types.

Benefits of Using the Comprehensive Asset Performance Monitor (CAPM) Tool

The CAPM tool offers a wide range of benefits for investors, traders, and financial analysts. Let’s explore these advantages in more detail:

1. Unified Asset Analysis

One of the most significant benefits of CAPM is its ability to analyze multiple asset classes within a single platform. This unified approach offers several advantages:

- Cross-Asset Insights: By examining stocks, digital assets, and cryptocurrencies together, users can identify correlations and divergences between different markets, potentially uncovering unique investment opportunities.

- Diversification Support: The comprehensive analysis helps users maintain a well-balanced portfolio by providing insights across various asset types, supporting effective diversification strategies.

- Emerging Trend Identification: By monitoring multiple asset classes simultaneously, users can spot emerging trends that may not be apparent when analyzing each market in isolation.

2. Customizable Notification System

The automated notification feature of CAPM is a powerful tool for staying informed about market changes. Its benefits include:

- Real-Time Alerts: Users receive timely notifications about significant market events, price changes, or news that could impact their investments.

- Personalized Monitoring: The ability to set custom criteria for notifications ensures that users only receive alerts that are relevant to their specific investment strategies and interests.

- Reduced Emotional Decision-Making: By relying on pre-set notification criteria, users can make more objective decisions based on data rather than reacting emotionally to market fluctuations.

3. In-Depth Market Analysis

CAPM provides users with comprehensive market analysis, offering several benefits:

- Historical Performance Context: By analyzing historical data, the tool helps users understand current market conditions in the context of past performance, aiding in more informed decision-making.

- Volatility Assessment: The tool’s analysis of volatility levels across different assets helps users gauge risk and potential reward more accurately.

- Market Trend Identification: By examining market trends, CAPM assists users in identifying potential opportunities and threats in various asset classes.

4. Time and Resource Efficiency

CAPM significantly enhances efficiency in market analysis and monitoring:

- Automated Analysis: The tool automates the process of gathering and analyzing data from multiple sources, saving users countless hours of manual research.

- Continuous Monitoring: With its automated notification system, CAPM provides 24/7 market monitoring without requiring constant user attention.

- Centralized Information: By consolidating analysis of multiple asset classes in one place, the tool eliminates the need to juggle multiple platforms or data sources.

5. Enhanced Risk Management

CAPM contributes to better risk management practices:

- Multi-Asset Risk Assessment: By analyzing various asset classes together, users can better understand their overall portfolio risk and make adjustments accordingly.

- Early Warning System: The notification feature acts as an early warning system for potential market risks, allowing users to take proactive measures to protect their investments.

- Volatility Comparison: The tool’s ability to compare volatility levels across different assets helps users balance their portfolios based on their risk tolerance.

How CAPM Addresses User Needs and Solves Specific Problems

The Comprehensive Asset Performance Monitor (CAPM) tool is designed to address several key challenges faced by investors and market analysts in today’s complex financial landscape. Let’s explore how CAPM solves specific problems and meets user needs:

1. Information Overload Management

Problem: In the digital age, investors are bombarded with an overwhelming amount of financial information from various sources, making it challenging to focus on what’s truly important.

Solution: CAPM filters and organizes relevant information based on user-specified criteria. By allowing users to focus on specific stock categories, digital assets, and cryptocurrencies, the tool helps cut through the noise and present only the most pertinent data.

Example: A user interested in the intersection of technology and sustainability might input “Green Tech, Clean Energy, Smart Grid” in the stock categories field. CAPM would then focus its analysis on these sectors, providing targeted insights without the distraction of unrelated market data.

2. Cross-Asset Correlation Analysis

Problem: Traditional analysis tools often focus on single asset classes, making it difficult for investors to understand the relationships between different types of investments.

Solution: CAPM’s unified approach to analyzing stocks, digital assets, and cryptocurrencies allows users to identify correlations and divergences across these different asset classes.

Example Calculation: Suppose a user inputs “Electric Vehicles” as a stock category, “Carbon Credit NFTs” as a digital asset, and “Ethereum” as a cryptocurrency. CAPM might reveal a positive correlation between the performance of electric vehicle stocks and Ethereum prices, while also showing how carbon credit NFTs behave differently during market fluctuations. This could be represented as:$$ Correlation_{EV,ETH} = 0.75 $$ $$ Correlation_{EV,CCN} = 0.20 $$ $$ Correlation_{ETH,CCN} = 0.15 $$Where EV represents Electric Vehicle stocks, ETH represents Ethereum, and CCN represents Carbon Credit NFTs. These correlation coefficients range from -1 to 1, with 1 indicating perfect positive correlation, 0 indicating no correlation, and -1 indicating perfect negative correlation.

3. Real-Time Market Monitoring

Problem: The fast-paced nature of financial markets makes it challenging for investors to stay on top of important developments across multiple assets without constant manual monitoring.

Solution: CAPM’s automated notification system allows users to set specific criteria for alerts, ensuring they’re informed of significant market events or changes without needing to watch the markets continuously.

Example: A user might set up notifications for “Price drops of 15% or more within 12 hours” for their selected assets. If a major cryptocurrency in their portfolio experiences a sudden decline, they would receive an immediate alert, allowing them to respond quickly to the market change.

4. Historical Context for Current Market Conditions

Problem: It’s often difficult for investors to put current market conditions into perspective without extensive historical analysis.

Solution: CAPM’s historical performance analysis feature allows users to examine asset performance over specified time periods, providing valuable context for current market trends.

Example Calculation: If a user inputs “5 years” as the analysis period for a particular stock category, CAPM might provide the following data:$$ AnnualizedReturn = \left(\frac{EndingValue}{BeginningValue}\right)^{\frac{1}{n}} – 1 $$Where n is the number of years (5 in this case).If the beginning value of the stock category index was 100 and the ending value after 5 years is 150, the calculation would be:$$ AnnualizedReturn = \left(\frac{150}{100}\right)^{\frac{1}{5}} – 1 = 0.0845 = 8.45\% $$This shows an annualized return of 8.45% over the 5-year period, providing context for evaluating current performance and future expectations.

5. Volatility Assessment Across Asset Classes

Problem: Comparing the volatility of different asset types can be challenging, especially when dealing with traditional investments alongside newer digital assets and cryptocurrencies.

Solution: CAPM provides volatility analysis across all selected assets, allowing users to compare risk levels between different investment types easily.

Example Calculation: CAPM might calculate the standard deviation of returns for each asset class over a specified period to represent volatility. For instance:$$ StandardDeviation = \sqrt{\frac{\sum_{i=1}^{n} (x_i – \mu)^2}{n}} $$Where xi represents each return value, μ is the mean return, and n is the number of observations.If calculated over a year of daily returns, the results might look like:– Stock Category: 15% annual volatility – Digital Asset: 25% annual volatility – Cryptocurrency: 40% annual volatilityThis allows users to quickly assess and compare the relative risk levels of different assets in their portfolio.

Practical Applications of the Comprehensive Asset Performance Monitor (CAPM) Tool

The CAPM tool has a wide range of practical applications for various users in the financial world. Let’s explore some real-world scenarios where this tool can be particularly valuable:

1. Portfolio Diversification Strategy

Use Case: An investor wants to diversify their portfolio across traditional stocks, emerging digital assets, and cryptocurrencies to balance risk and potential returns.

How CAPM Helps: The investor can use CAPM to analyze correlations between different asset classes, identify potential diversification opportunities, and set up notifications for significant changes in any of their chosen investments.

Example: The investor inputs “Renewable Energy, Artificial Intelligence” as stock categories, “Virtual Real Estate, Gaming NFTs” as digital assets, and “Bitcoin, Cardano” as cryptocurrencies. CAPM’s analysis might reveal low correlation between renewable energy stocks and gaming NFTs, suggesting a good diversification opportunity. The tool could also alert the investor to significant price movements or news events affecting any of these assets, helping them maintain their desired portfolio balance.

2. Trend Identification for Emerging Technologies

Use Case: A technology analyst wants to track the performance of emerging tech trends across both traditional stocks and the crypto/digital asset space.

How CAPM Helps: The analyst can use CAPM to monitor specific tech-related stock categories alongside relevant cryptocurrencies and digital assets, gaining a comprehensive view of how emerging technologies are performing across different market segments.

Example: The analyst inputs “Quantum Computing, Edge AI” as stock categories, “Decentralized Storage Tokens” as a digital asset category, and “Filecoin, Sia” as specific cryptocurrencies. CAPM’s analysis might reveal that while quantum computing stocks are seeing steady growth, decentralized storage tokens are experiencing more volatile but potentially higher returns. This comprehensive view helps the analyst identify cross-market trends in emerging tech.

3. Risk Management for Institutional Investors

Use Case: An institutional investor needs to monitor and manage risk across a diverse portfolio that includes both traditional and digital assets.

How CAPM Helps: The investor can use CAPM’s volatility analysis and automated notification system to keep track of risk levels across different asset classes and receive alerts when volatility exceeds certain thresholds.

Example: The investor sets up CAPM to monitor a range of assets, from blue-chip stocks to experimental cryptocurrencies. They configure notifications for “Volatility increase of 50% or more compared to 30-day average” for any asset class. If the cryptocurrency market suddenly becomes highly volatile, CAPM would alert the investor, allowing them to reassess their risk exposure and make necessary adjustments to their portfolio.

4. Identifying Arbitrage Opportunities

Use Case: A trader wants to identify potential arbitrage opportunities between related assets across different markets.

How CAPM Helps: By analyzing correlations and price movements across stock categories, digital assets, and cryptocurrencies, CAPM can help identify discrepancies that might represent arbitrage opportunities.

Example: The trader sets up CAPM to monitor technology stocks, blockchain-related digital assets, and major cryptocurrencies. The tool’s analysis might reveal a situation where a blockchain company’s stock price lags behind a surge in the value of its associated cryptocurrency or digital asset. This discrepancy could represent a potential arbitrage opportunity, which the trader can then investigate further.

5. Long-term Investment Strategy Development

Use Case: A financial advisor wants to develop long-term investment strategies for clients that incorporate both traditional and digital assets.

How CAPM Helps: The advisor can use CAPM’s historical performance analysis and trend identification features to assess the long-term potential of various asset classes and develop balanced, forward-looking investment strategies.

Example: The advisor inputs a range of conservative and aggressive investment options across stocks, digital assets, and cryptocurrencies, with an analysis period of 10 years. CAPM’s analysis might show that while certain tech stocks have provided steady long-term growth, select cryptocurrencies have offered higher returns but with significantly more volatility. This information helps the advisor create tailored strategies that align with each client’s risk tolerance and investment goals.

Frequently Asked Questions (FAQ)

1. What types of assets can I analyze with the CAPM tool?

The CAPM tool allows you to analyze three main categories of assets: stocks (including various market sectors), digital assets (such as NFTs and tokenized assets), and cryptocurrencies. You can specify particular categories or individual assets within each of these broader classes.

2. How often is the data updated in the CAPM tool?

The CAPM tool uses real-time data feeds to provide the most up-to-date information possible. However, the exact update frequency may vary depending on the specific asset and data source. For most actively traded assets, you can expect near-real-time updates.

3. Can I use CAPM for assets from different countries or markets?

Yes, CAPM is designed to handle assets from various global markets. When inputting stock categories or specific assets, you can include international markets. The tool will provide analysis based on the available data for each market.

4. How does the notification system work?

The notification system allows you to set custom criteria for alerts. Once you’ve specified your criteria (e.g., price changes, volume increases, news updates), CAPM will monitor your selected assets and send notifications when these criteria are met. The notifications can be delivered via email, SMS, or through a dedicated app, depending on your preferences.

5. Is there a limit to how many assets I can analyze simultaneously?

While CAPM is designed to handle multiple assets across different categories, the optimal number of assets for analysis may depend on your specific needs and the complexity of your criteria. The tool is capable of processing a large number of assets, but for the best performance and most manageable results, we recommend focusing on the assets most relevant to your investment strategy.

6. Can CAPM predict future market trends?

While CAPM provides comprehensive analysis of historical data and current market conditions, it’s important to note that it does not predict future market trends with certainty. The tool offers insights and analysis to support your decision-making, but all investments carry risk, and past performance does not guarantee future results.

7. How does CAPM handle the volatility of cryptocurrencies?

CAPM is designed to analyze assets with varying levels of volatility, including highly volatile cryptocurrencies. The tool provides volatility metrics and allows you to set custom notification thresholds, enabling you to monitor cryptocurrency volatility according to your risk tolerance and investment strategy.

8. Can I integrate CAPM with my existing trading platforms or portfolio management tools?

CAPM offers API integration capabilities, allowing it to be connected with various trading platforms and portfolio management tools. This integration can streamline your workflow by centralizing data and analysis from multiple sources.

9. How does CAPM ensure the accuracy of its analysis?

CAPM uses data from reputable financial data providers and employs robust analytical algorithms. However, as with any financial tool, it’s important to use CAPM as one of several resources in your investment decision-making process and to verify critical information independently.

10. Is CAPM suitable for both beginner and advanced investors?

Yes, CAPM is designed to be useful for investors at various levels of experience. Beginners can benefit from its comprehensive overview of different asset classes and automated notifications, while advanced investors can leverage its detailed analysis and customizable features to support more complex investment strategies.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.