Book Value per Share Calculator

Is this tool helpful?

How to Use the Book Value per Share Calculator Effectively

Our Book Value per Share Calculator simplifies the process of determining a company’s equity value on a per-share basis. To get accurate results, follow these clear steps using your financial data:

- Enter Total Common Stockholders’ Equity ($): For example, input 8,500,000 or 12,750,000 to represent the company’s net equity available to common shareholders.

- Input Number of Common Shares Outstanding: For instance, use 1,500,000 or 2,200,000 shares to reflect total shares currently held by investors.

- Click “Calculate”: The calculator will instantly process your inputs and display the Book Value per Share below.

- Review the Result: The computed Book Value per Share will help you assess the company’s equity value on an individual share basis.

Make sure all values are positive numbers, and the number of shares is greater than zero to avoid errors.

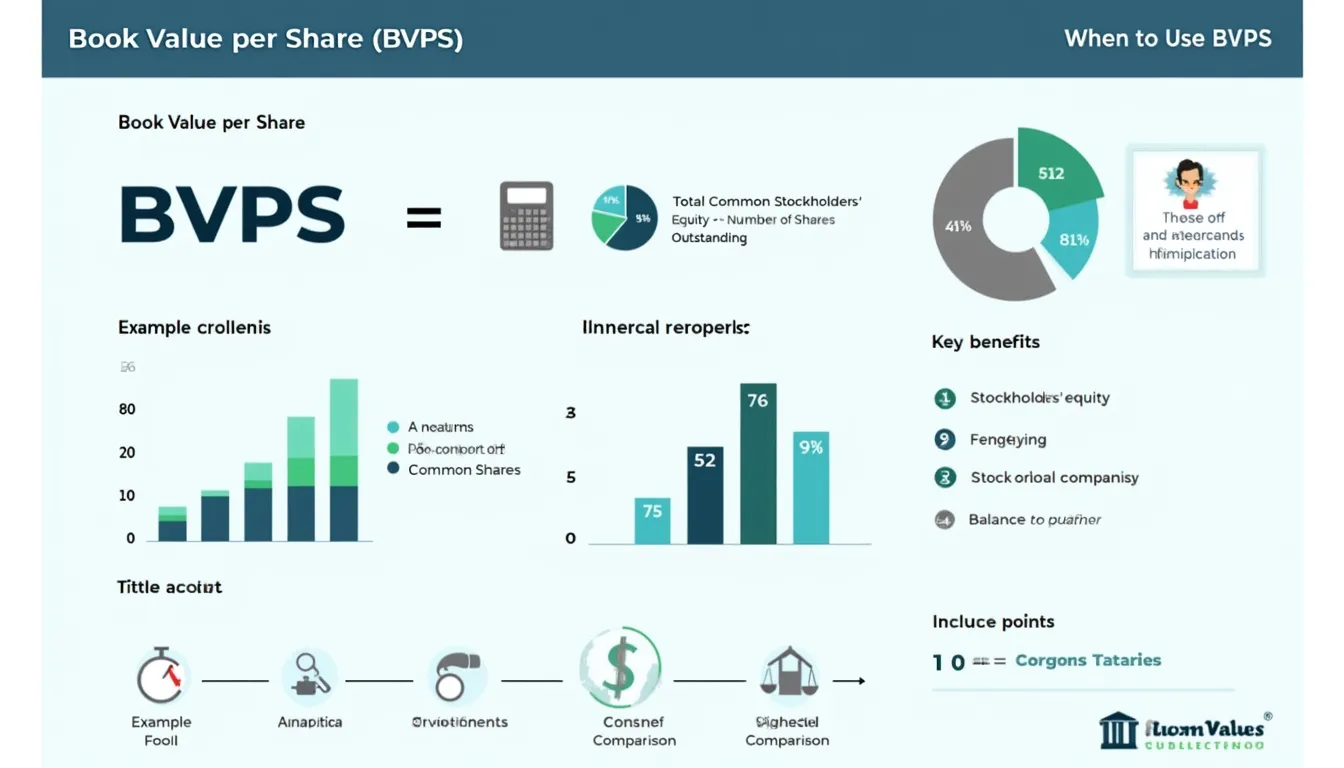

Understanding the Book Value per Share Calculator: Definition, Purpose, and Benefits

The Book Value per Share (BVPS) Calculator is a vital financial tool designed to help investors, analysts, and business owners swiftly determine a company’s net asset value per individual share. This measurement is foundational in financial analysis, helping you understand the intrinsic equity value backing each share.

The calculator employs the formula:

$$ \text{Book Value per Share} = \frac{\text{Total Common Stockholders’ Equity}}{\text{Number of Common Shares Outstanding}} $$

This formula offers a snapshot of what each share represents in terms of company equity, typically based on the company’s historical accounting values.

Key Benefits of Using This Book Value per Share Calculator

- Clear valuation baseline: Understand the minimum value of a company’s equity per share.

- Spot undervalued investments: Identify stocks trading below their book value for potential opportunities.

- Industry comparison: Compare companies within the same sector using consistent financial metrics.

- Financial health check: Gauge the company’s solvency and asset backing per share.

- Monitor share issuance or buybacks: Assess how equity actions impact per-share values.

Example Calculations Using the BVPS Calculator

To better illustrate the calculator’s functionality, here are sample calculations that demonstrate how the tool works in practice:

Calculation Example 1

Input Values:

- Total Equity: $9,000,000

- Number of Shares Outstanding: 1,800,000

Result:

$$ \frac{9,000,000}{1,800,000} = 5.00 $$

The Book Value per Share is $5.00, meaning each share represents five dollars of the company’s equity.

Calculation Example 2

Input Values:

- Total Equity: $14,400,000

- Number of Shares Outstanding: 3,200,000

Result:

$$ \frac{14,400,000}{3,200,000} = 4.50 $$

Here, the Book Value per Share comes out to $4.50, representing the equity tied to each outstanding share.

Why Use a Book Value per Share Calculator for Financial Analysis?

Our online Book Value per Share Calculator delivers fast, precise insights crucial for comprehensive financial analysis. Here’s why it should be a staple in your investment and business toolkit:

Efficiency and Accuracy

Manually calculating BVPS can be prone to errors, especially when dealing with large numbers or multiple companies. This calculator automates the process, providing error-free results in seconds.

Educational and Practical Value

Whether you’re a finance student, novice investor, or seasoned professional, the calculator helps deepen your understanding of equity valuation by instantly linking company figures to share values.

Real-Time Financial Decisions

Use the calculator to quickly compare Book Value per Share across different companies or time periods, aiding in smarter, data-driven investment decisions and financial reporting.

Responsive Design for Accessibility

Access the tool on any device — desktop, tablet, or smartphone — so you can evaluate company equity whenever and wherever you need to.

Practical Use Cases: Applying the Book Value per Share Calculator

Value Investing Analysis

Investors seeking undervalued stocks can quickly assess the per-share equity to identify companies where market price may not fully reflect intrinsic value.

Tracking Corporate Financial Growth

Financial managers and analysts monitor changes in BVPS over time to demonstrate growth trends and shareholder value improvement.

Industry Benchmarking

Portfolio managers compare Book Value per Share across industry peers to reveal relative financial strength and valuation differences.

Frequently Asked Questions About Book Value per Share

What does Book Value per Share represent?

It measures the net asset value of a company attributed to each outstanding share, reflecting the minimum equity backing per share based on accounting values.

How often should I calculate BVPS?

For public companies, quarterly updates aligned with financial statements are ideal. For private firms, semi-annual or annual calculations typically suffice unless major equity events occur.

Is a higher Book Value per Share always better?

Not necessarily. While a higher BVPS can indicate strong equity backing, it should be considered alongside growth prospects, industry standards, and market indicators.

How does BVPS relate to market price?

BVPS is an accounting metric based on historical costs, whereas market price reflects current investor sentiment and future expectations. Comparing these helps identify valuation disparities.

Can Book Value per Share be negative?

Yes, negative BVPS indicates the company has negative equity, a potential warning sign of financial distress.

How does stock dilution affect BVPS?

Issuing new shares typically lowers BVPS by spreading equity among more shares, while share buybacks usually increase BVPS by concentrating equity.

Conclusion: Unlocking Company Valuation with the Book Value per Share Calculator

Our Book Value per Share Calculator offers an essential, easy-to-use solution for investors and analysts aiming to uncover reliable equity values on a per-share basis. By automating calculations with precision and speed, it empowers smarter financial decisions and insightful valuations.

- Save time with instant and accurate BVPS calculations

- Compare companies efficiently within your portfolio or industry

- Identify undervalued stocks with greater confidence

- Track financial health and growth across reporting periods

- Deepen your understanding of equity valuation metrics

Make this tool a regular part of your financial analysis toolkit to enhance your investment strategies and business evaluations. Start calculating your company’s Book Value per Share today and unlock valuable insights that can guide smarter wealth-building decisions.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.