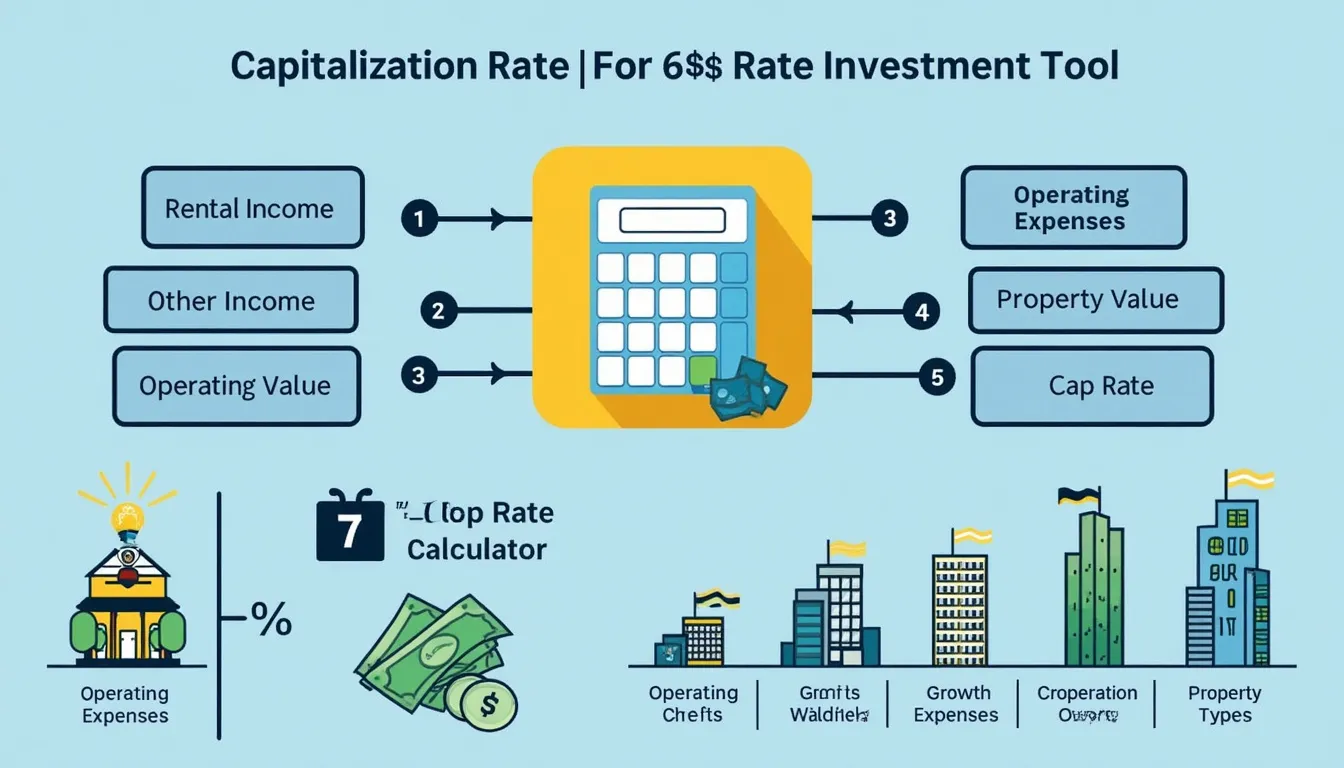

Capitalization Rate Calculator

Is this tool helpful?

How to use the tool

- Rental Income – enter the annual rent you collect, e.g., $85 000 or $140 000.

- Other Income – add ancillary revenue such as parking, e.g., $4 000 or $3 000.

- Operating Expenses – input yearly costs for taxes, maintenance, etc., e.g., $26 000 or $55 000.

- Market Value – type today’s property value, e.g., $900 000 or $1 600 000.

Formula

First, calculate Net Operating Income (NOI).

$$ \text{NOI}= \text{Rental Income}+ \text{Other Income}-\text{Operating Expenses} $$Then, find the capitalization rate.

$$ \text{Cap Rate}= rac{\text{NOI}}{\text{Market Value}}\times100\% $$Example 1

- Rental Income = $85 000

- Other Income = $4 000

- Operating Expenses = $26 000

- NOI = $63 000

- Market Value = $900 000

- Cap Rate = $63 000 / $900 000 × 100 = 7.00 %

Example 2

- Rental Income = $140 000

- Other Income = $3 000

- Operating Expenses = $55 000

- NOI = $88 000

- Market Value = $1 600 000

- Cap Rate = $88 000 / $1 600 000 × 100 = 5.50 %

Quick-Facts

- Average U.S. multifamily cap rate Q4-2023: 5.2 % (CBRE U.S. Cap Rate Survey, 2024).

- Typical operating expenses equal 30-45 % of gross income (IRS Pub. 527, 2023).

- Industrial properties traded at a median 6.1 % cap in 2023 (Moody’s Analytics CRE, 2024).

- Cap rates fall roughly 20 bps for every 100 bps drop in Treasury yields (Marcus & Millichap, 2023).

- FHA underwriting caps expense vacancy at 2-10 % depending on asset class (HUD MAP Guide, 2022).

FAQ

What does a high cap rate tell you?

A high cap rate signals greater expected return but also higher perceived risk, especially in secondary markets (NAR Commercial Outlook, 2023).

How often should you recalculate the cap rate?

Update annually or whenever rent, expenses, or valuation shifts by 5 % or more to keep comparisons meaningful (IRS Pub. 527, 2023).

Does financing change the cap rate?

No. Cap rate ignores debt; it reflects the property’s unleveraged income stream (CCIM Institute, 2023).

Can the cap rate be used to estimate value?

Yes – invert the formula: Property Value = NOI / Cap Rate. Lenders rely on this direct-capitalization method in appraisals (Appraisal Institute, 2022).

What is a “going-in” vs. “exit” cap rate?

Going-in uses today’s NOI; exit uses projected NOI at sale. Investors compare both to gauge hold-period growth (PwC Emerging Trends, 2024).

Which sectors show the lowest cap rates?

Prime CBD office and core coastal multifamily averaged below 4 % in 2023 due to strong demand and limited supply (CBRE, 2024).

How do interest rates affect cap rates?

“Cap rates track interest-rate movements but with a lag,” notes CBRE’s survey (CBRE, 2024). Rising yields push cap rates up as investors seek spread over risk-free returns.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.