Capital Asset Pricing Model (CAPM) Calculator

Is this tool helpful?

How to use the tool

- Risk-Free Rate (%) – type the latest 3-month Treasury yield; e.g., 4.78 or 5.11.

- Beta – enter the asset’s beta from research reports; e.g., 0.65 or 1.80.

- Return on the Market (%) – add your forecast for market return; e.g., 10.0 or 6.2.

- Press “Calculate” to display the expected return.

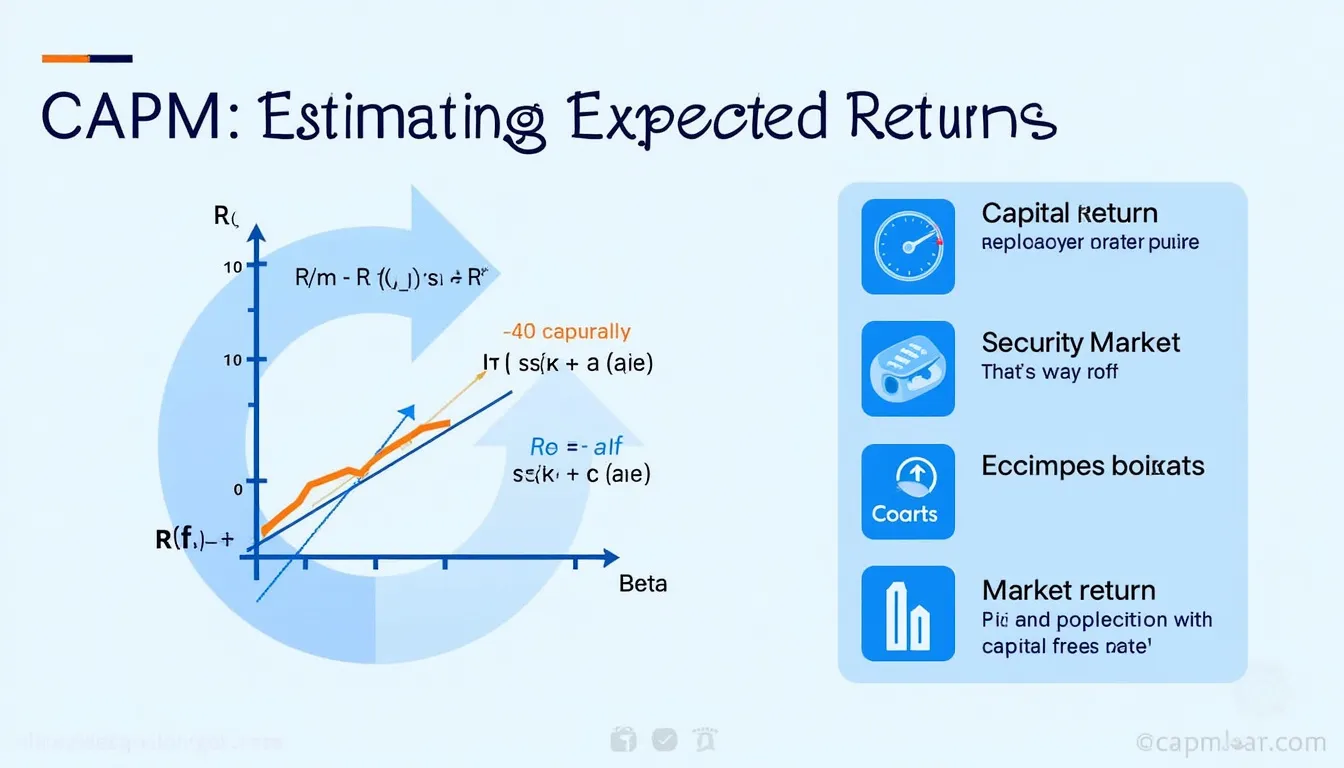

Underlying formula

The calculator applies

$$ E(R_i)=R_f+\beta_i\,(E(R_m)-R_f) $$

Example 1

- Rf=0.9 %

- β=1.3

- E(Rm)=11 %

$$ E(R)=0.9+1.3\,(11-0.9)=14.03\% $$

Example 2

- Rf=4.5 %

- β=0.7

- E(Rm)=8 %

$$ E(R)=4.5+0.7\,(8-4.5)=6.95\% $$

Quick-Facts

- Typical beta range: 0 – 2 (Investopedia, “Beta Definition”).

- 3-month U.S. T-bill yield averaged 5.36 % in 2024 (U.S. Treasury, 2024).

- Historical equity risk premium ≈ 5 % for U.S. stocks (Damodaran, 2024).

- Model introduced by Sharpe and Lintner in 1964 (Sharpe, 1964).

FAQ

What does the calculator return?

It outputs the asset’s required return, aligning risk and reward through the CAPM equation (Sharpe, 1964).

How do I find a current risk-free rate?

Use the yield on a matching-maturity Treasury bill; data update daily on treasury.gov (U.S. Treasury, 2024).

Why does beta matter?

Beta gauges volatility versus the market; a beta of 1.5 suggests 50 % more swing than the index (Investopedia).

What is the equity risk premium?

It is E(Rm) − Rf; U.S. average near 5 % over 1960-2023 (Damodaran, 2024).

Can an asset have negative beta?

Yes; gold funds often show beta −0.1, moving opposite equities (Morningstar “SPDR Gold Shares” 2023).

How precise is CAPM?

“CAPM explains roughly two-thirds of equity returns” (CFA Institute, 2019) but ignores idiosyncratic risk.

When should I update inputs?

Refresh after rate decisions, earnings releases, or portfolio rebalancing—at least quarterly (CFA Institute, 2020).

What if my beta is above 2?

High beta raises required return; consider hedging or diversification to control portfolio risk (Investopedia).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.