Cash Conversion Cycle Calculator

Is this tool helpful?

How to use the tool

- Inventory Conversion Period – Type the average days stock sits before sale.

Try 45 days or 60 days.

Formula: $$\text{Inventory Days}= rac{\text{Average Inventory}}{\text{Cost of Goods Sold}}\times365$$ - Receivables Conversion Period – Enter the days customers take to pay.

Try 35 days or 48.6 days.

Formula: $$\text{Receivable Days}= rac{\text{Average A/R}}{\text{Revenue}}\times365$$ - Payables Conversion Period – Fill in the days you wait to pay suppliers.

Try 20 days or 28.4 days.

Formula: $$\text{Payable Days}= rac{\text{Average A/P}}{\text{Cost of Goods Sold}}\times365$$ - Click “Calculate.” The calculator returns:

$$\text{CCC}=\text{Inventory Days}+\text{Receivable Days}-\text{Payable Days}$$

Example calculations

- Scenario A: 45 + 35 – 20 = 60 days

- Scenario B: 60 + 48.6 – 28.4 = 80.2 days

Quick-Facts

- Global median CCC: 70 days in 2021 (PwC Working Capital Report 2022).

- World-class performers operate below 30 days (EY, 2021).

- Each 5-day CCC reduction can release 2 % of revenue as cash (McKinsey, 2020).

- Higher CCC correlates with lower return on assets (Journal of Corporate Finance, 2010).

FAQ

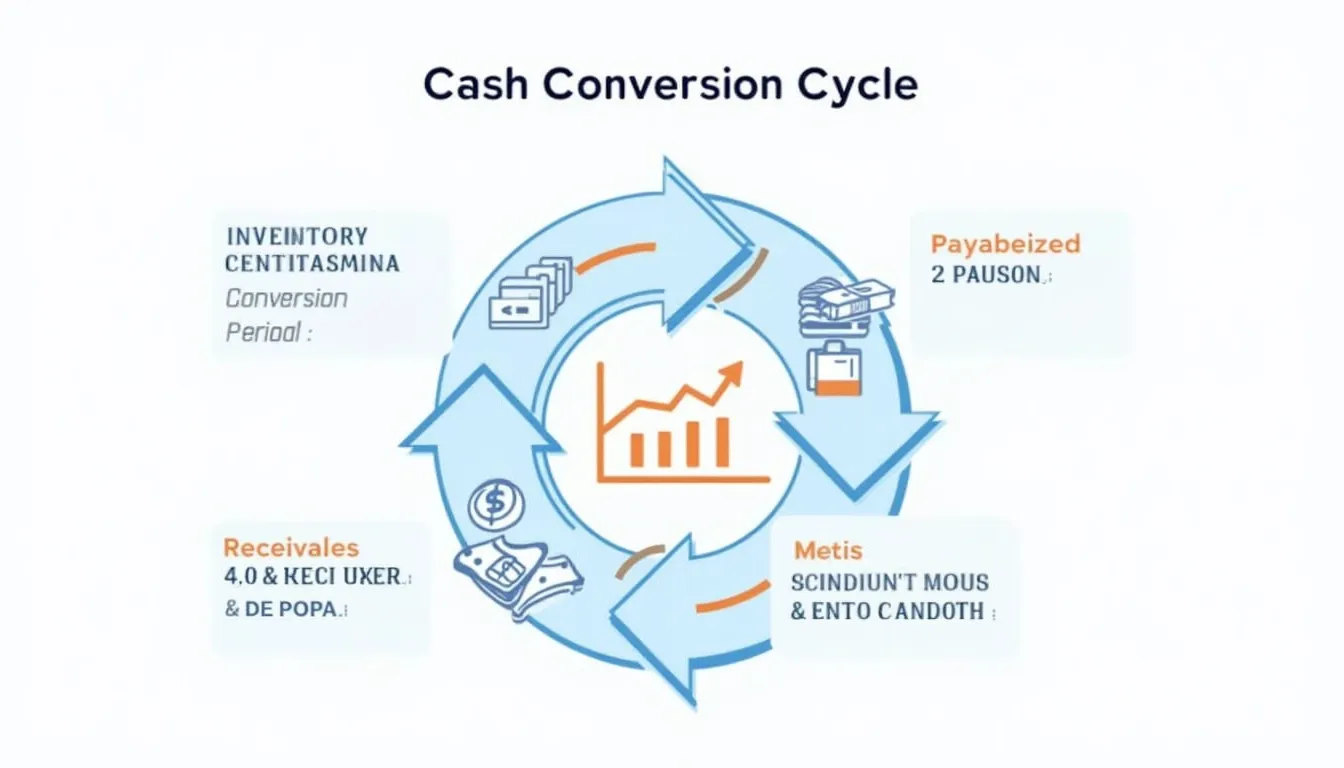

What is the Cash Conversion Cycle?

CCC is the days your cash sits in inventory and receivables minus the days you delay paying suppliers (Investopedia, 2023).

How does the calculator work?

It sums inventory and receivable days, subtracts payable days, and presents the net figure—no additional inputs required.

What is a “good” CCC?

Under 30 days is considered world-class for most industries (EY, 2021). Always benchmark against peers.

Can CCC be negative?

Yes. Retailers like Amazon collect cash before paying suppliers, producing a negative CCC that boosts liquidity (Amazon 10-K 2022).

How can you shorten a high CCC?

Negotiate longer supplier terms, speed up invoicing, offer early-payment discounts and improve demand forecasting (McKinsey, 2020).

Does industry matter?

Absolutely—energy firms average 45 days, while apparel retailers sit near 90 days (PwC, 2022).

How often should you track CCC?

Monthly reviews flag seasonal swings quickly and inform purchasing or credit-policy tweaks (CFI, 2023).

Why does CCC affect profitability?

Shorter cycles reduce working-capital financing needs, lowering interest expense and raising return on assets (Journal of Corporate Finance, 2010).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.