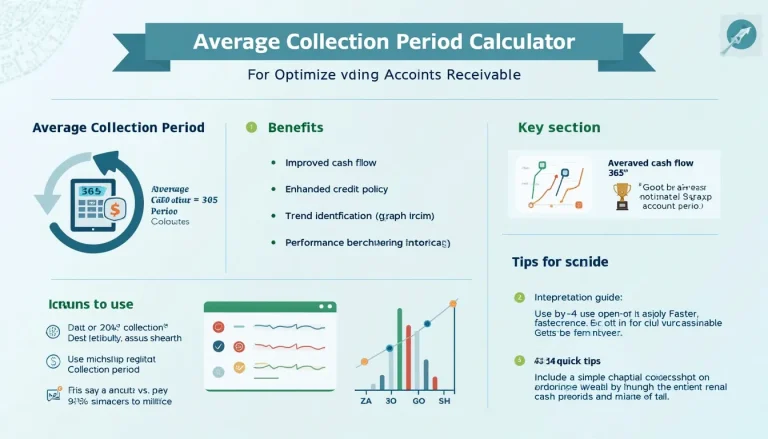

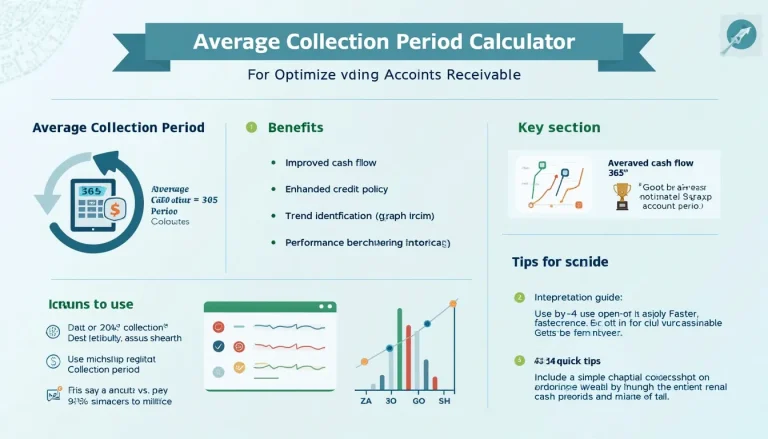

Average Collection Period Calculator: Optimize Your Accounts Receivable

The Average Collection Period Calculator is an essential tool for businesses looking to optimize their accounts receivable management. This powerful calculator helps companies determine the average time it takes to collect payment for credit sales, providing valuable insights into cash flow efficiency. By analyzing this metric, businesses can identify areas for improvement in their collection processes and implement strategies to reduce payment delays. The tool is particularly useful for finance professionals, accountants, and business owners who want to maintain healthy cash flow and improve overall financial performance. Whether you’re a small startup or a large corporation, our Average Collection Period Calculator can help you make data-driven decisions to streamline your accounts receivable and enhance your company’s financial health. Try it today to take control of your cash flow management.