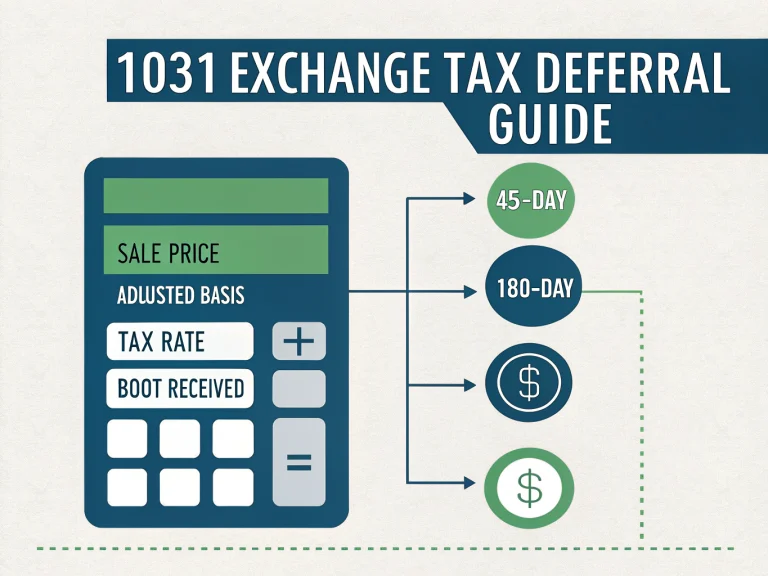

1031 Exchange Tax Deferral Calculator: Estimate Your Savings

Use our free 1031 Exchange Calculator to estimate your potential tax savings when conducting a like-kind exchange. This tool helps real estate investors calculate deferred taxes while considering sale price, adjusted basis, tax rate, and boot received. Includes important 45-day identification and 180-day closing deadline reminders.