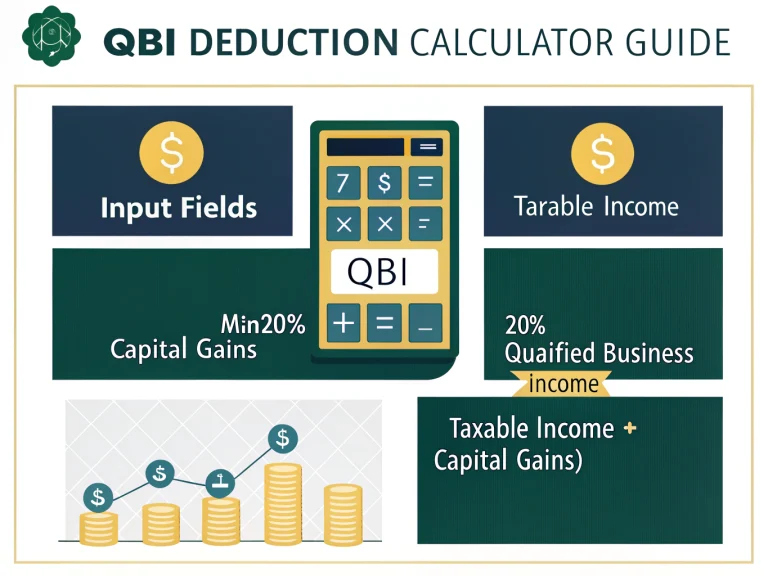

QBI Deduction Calculator: Estimate Your Qualified Business Income Tax Break

Use our Qualified Business Income (QBI) Deduction Calculator to estimate your Section 199A tax deduction. Enter your taxable income, capital gains, and QBI to calculate your potential tax savings. Features phase-out warnings for single filers between $170,000-$220,000 income range.