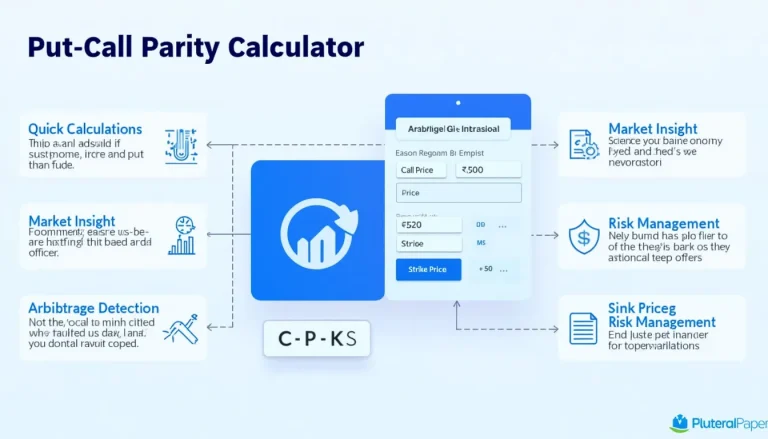

Put-Call Parity Calculator: Determine Future Price in Options Trading

Put-call parity lets you estimate the underlying’s forward price by combining one call, one put and cash. Enter call, put and strike; the tool applies S = C − P + K. Example: an $8.40 call, $3.10 put and $105 strike imply $110.30. About 76 % of listed options expire worthless (CBOE, 2023), so parity helps you avoid mispriced contracts.