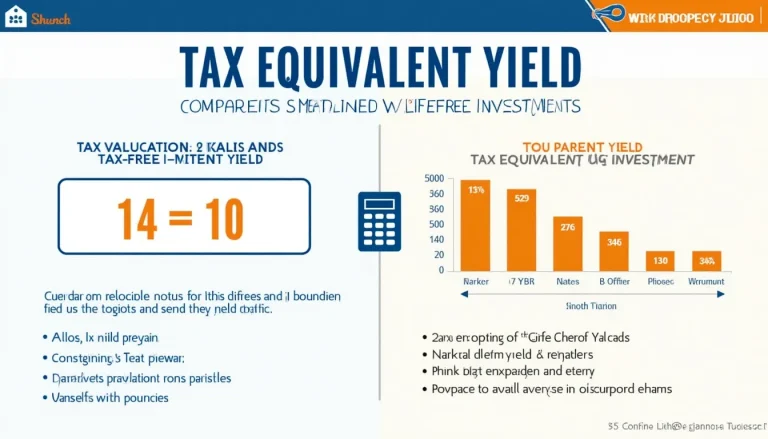

Tax Equivalent Yield Calculator: Compare Taxable and Tax-Free Investments

The Tax Equivalent Yield Calculator is an essential financial tool designed to help investors and financial professionals compare taxable and tax-free investment returns on an equal basis. This calculator determines the taxable yield required to match the return of a tax-free investment, accounting for your specific tax bracket and investment circumstances. By providing clear comparisons between different investment vehicles, such as municipal bonds and corporate securities, users can make more informed decisions about their investment strategies. Financial advisors and investment professionals will find this tool particularly valuable when explaining investment options to clients or optimizing portfolio allocations. Whether you’re evaluating municipal bonds or other tax-advantaged investments, this calculator helps you understand the true comparative value of different investment options. Start using our Tax Equivalent Yield Calculator today to make more informed investment decisions based on after-tax returns.