Mortgage Calculator

Is this tool helpful?

How to use the tool

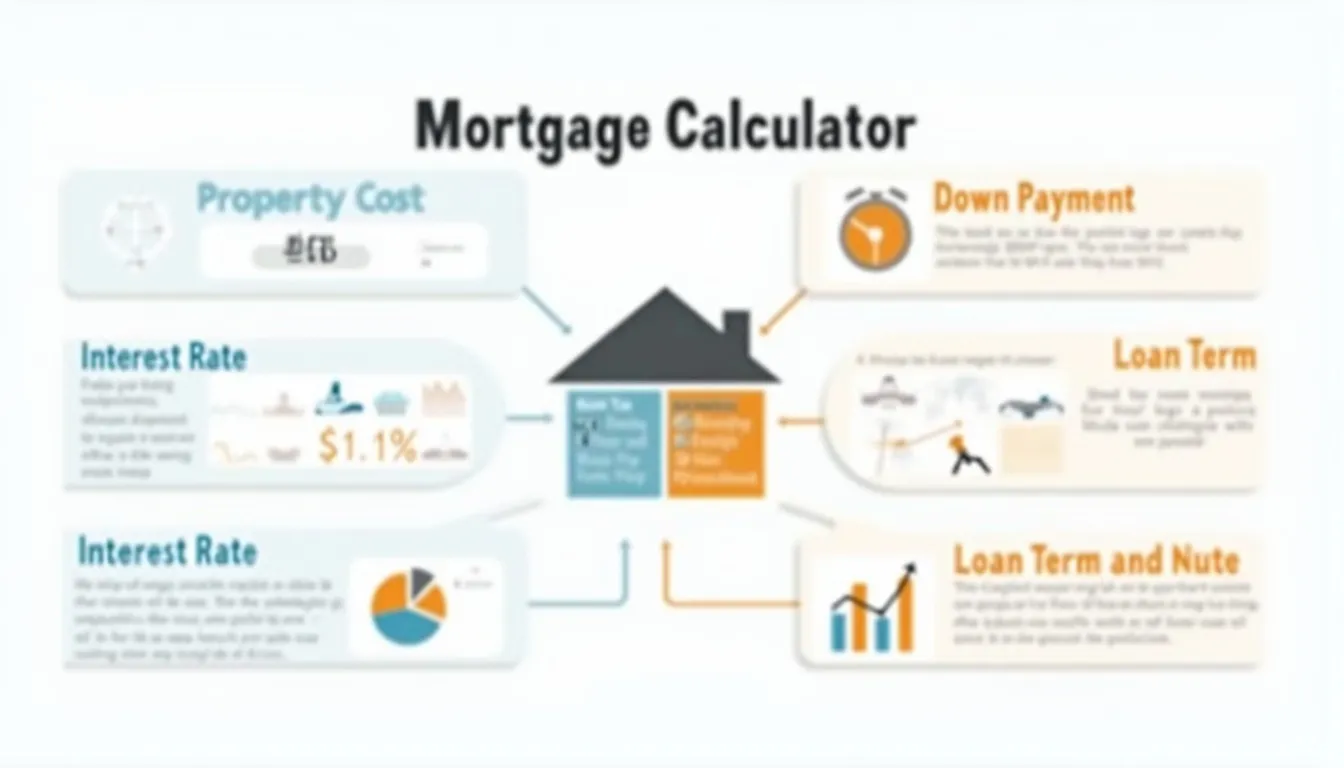

- Property Cost – Type the full purchase price. Try 750 000 or 1 050 000.

- Down-Payment % – Enter your upfront share. Test 12 % or 30 %.

- Mortgage Term (years) – Set repayment horizon: 18 or 35 years.

- Interest Rate % – Add annual rate such as 3.2 % or 6.1 %.

- Press “Calculate” – View down payment, loan amount, monthly payment, and amortization table.

Underlying formulas

The calculator uses the standard fixed-rate mortgage equation:

$$M = P \times rac{r(1+r)^{n}}{(1+r)^{n}-1}$$

- M = monthly payment

- P = loan amount (property cost − down payment)

- r = monthly interest rate (annual rate ÷ 12)

- n = total payments (years × 12)

Worked example A

Inputs: 750 000 price, 12 % down, 18 years, 3.2 % rate.

- Loan P = 750 000 × 0.88 = 660 000

- r = 0.032 / 12 = 0.002667

- n = 18 × 12 = 216

- M ≈ 660 000 × rac{0.002667 × 1.777}{0.777} ≈ $4 026

Worked example B

Inputs: 1 050 000 price, 30 % down, 35 years, 6.1 % rate.

- Loan P = 1 050 000 × 0.70 = 735 000

- r = 0.061 / 12 = 0.005083

- n = 35 × 12 = 420

- M ≈ 735 000 × rac{0.005083 × 8.41}{7.41} ≈ $4 250

Quick-Facts

- Average 30-year fixed mortgage rate: 6.63 % (Freddie Mac PMMS, 2023).

- Conventional loan minimum down payment: 3 % — “Borrowers may obtain a conventional mortgage with as little as 3 % down” (Fannie Mae Selling Guide, 2023).

- CFPB defines 43 % debt-to-income as the maximum for Qualified Mortgages (CFPB, 2022).

- An amortization schedule shows how each payment splits between principal and interest (Consumer Finance Gov, “Amortization”, 2022).

FAQ

What is a mortgage calculator?

A mortgage calculator is an online tool that converts price, down payment, term, and rate into your monthly payment and amortization schedule (CFPB, 2022).

How does it compute the monthly payment?

It applies the fixed-rate formula $$M = P \times rac{r(1+r)^{n}}{(1+r)^{n}-1}$$ where inputs are loan amount, monthly rate, and total payments (Investopedia, ”Mortgage Formula”).

Which input affects payment size the most?

Interest rate changes move payments quickly; a one-percentage-point rise on a 30-year $300 000 loan adds ≈ $190/month (Freddie Mac Mortgage Calculator, 2023).

How can you cut total interest?

Pay a larger down payment, choose a shorter term, or make extra principal payments; each reduces balance faster (Federal Reserve, “Paying Off Your Mortgage Early”, 2023).

Why does loan term matter?

Long terms lower each payment but extend interest accrual; 30-year loans can incur over double the interest of 15-year loans at identical rates (CFPB, 2022).

What is an amortization schedule?

An amortization schedule lists every payment, showing principal reduction and interest cost until balance hits zero (Consumer Finance Gov, 2022).

When should you refinance?

Refinance when new rates are 1 %+ lower and you plan to stay long enough to recoup closing costs, usually two to three years (Bankrate Refi Guide, 2023).

What debt-to-income ratio do lenders accept?

Most conventional lenders cap total debt at 43 % of gross income to meet Qualified Mortgage rules (CFPB, 2022).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.