Compound Interest Calculator

Is this tool helpful?

How to Use the Compound Interest Calculator Effectively

Our Compound Interest Calculator with Yearly Contributions is designed to help you visualize the growth of your investments over time. Here’s a step-by-step guide on how to use this powerful financial tool:

- Initial Principal: Enter the amount you’re starting with, e.g., $10,000.

- Initial Interest Rate: Input the interest rate for your initial investment as a percentage, e.g., 5%.

- Number of Yearly Contributions: Specify how many years you plan to make additional contributions, e.g., 10 years.

- Yearly Contribution Amount: Enter the amount you plan to contribute each year, e.g., $1,000.

- Subsequent Interest Rate: Input the interest rate for your subsequent investments, e.g., 4%.

- Click “Calculate” to see your future investment value.

The calculator will then display the total future value of your investment, taking into account both your initial principal and yearly contributions, compounded continuously.

Understanding Compound Interest and Yearly Contributions

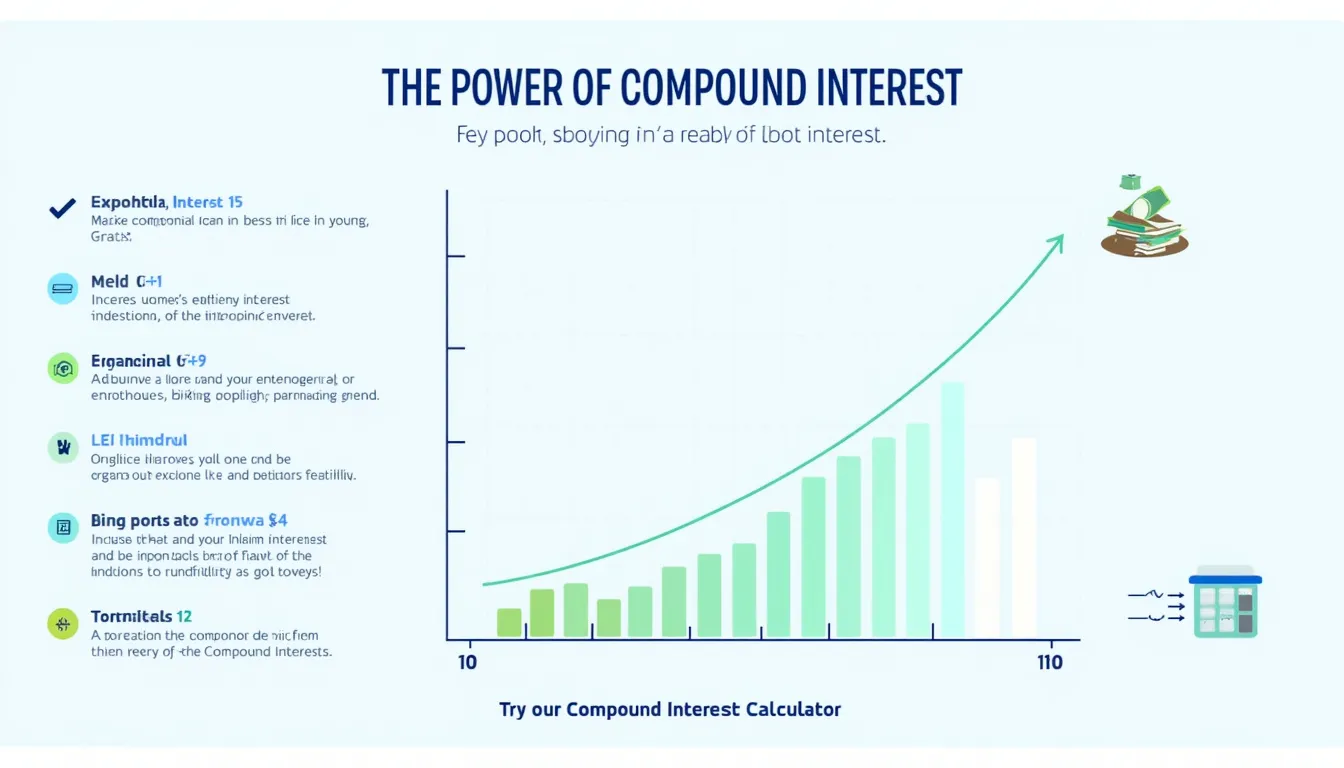

Compound interest is often called the eighth wonder of the world, and for good reason. It’s the process by which the interest earned on an investment is reinvested, generating additional earnings over time. When combined with regular contributions, the growth potential becomes even more impressive.

Our calculator uses the principle of continuous compounding, which assumes that interest is calculated and added to the principal continuously. This method typically results in slightly higher returns compared to daily or monthly compounding.

The mathematical formula for continuous compound interest is:

$$A = P * e^{rt}$$Where:

- A = the final amount

- P = the principal (initial investment)

- e = Euler’s number (approximately 2.71828)

- r = the interest rate (as a decimal)

- t = the time period

Our calculator extends this formula to account for yearly contributions, providing a more realistic view of long-term investment growth.

Benefits of Using the Compound Interest Calculator

Utilizing our Compound Interest Calculator with Yearly Contributions offers numerous advantages:

- Financial Planning: Gain insights into your long-term financial goals and retirement planning.

- Investment Strategy: Compare different investment scenarios to optimize your strategy.

- Motivation: Visualize the power of compound interest to stay motivated in your savings journey.

- Education: Learn about the impact of different variables on your investment growth.

- Time Value of Money: Understand how your money can grow over time with consistent contributions.

Addressing User Needs and Solving Financial Puzzles

Our calculator addresses several common financial questions and concerns:

1. How much will my investment be worth in the future?

By inputting your initial investment, interest rate, and time period, you can quickly see your potential future wealth. For example, if you start with $5,000, earn 6% interest, and contribute $2,000 annually for 20 years, your investment could grow to approximately $92,929.77.

2. How do additional contributions impact my investment growth?

The calculator allows you to see the dramatic effect of regular contributions. For instance, using the same example above but without yearly contributions, your investment would only grow to about $16,189.27. The difference of $76,740.50 illustrates the power of consistent saving.

3. What if my interest rate changes over time?

Our calculator accommodates different interest rates for your initial investment and subsequent contributions. This feature is particularly useful if you expect interest rates to fluctuate or if you plan to adjust your investment strategy over time.

4. How does continuous compounding compare to other methods?

Continuous compounding typically results in slightly higher returns compared to daily, monthly, or annual compounding. For example, $10,000 invested at 5% for 10 years would yield:

- $16,470.09 with annual compounding

- $16,486.54 with monthly compounding

- $16,487.21 with daily compounding

- $16,487.21 with continuous compounding (as used in our calculator)

While the differences may seem small, they can become significant with larger sums and longer time periods.

Practical Applications and Use Cases

Our Compound Interest Calculator with Yearly Contributions can be applied to various real-life scenarios:

1. Retirement Planning

Use the calculator to estimate how much you need to save each year to reach your retirement goals. For example, if you’re 30 years old and want to retire at 65 with $1 million:

- Initial Principal: $10,000

- Initial Interest Rate: 7%

- Number of Yearly Contributions: 35

- Yearly Contribution Amount: $5,000

- Subsequent Interest Rate: 7%

The calculator would show that you’d have approximately $1,029,675.63 by age 65, meeting your retirement goal.

2. Saving for a Child’s Education

Plan for your child’s college fund by estimating how much you need to save annually. If you start when your child is born and aim to have $100,000 by age 18:

- Initial Principal: $1,000

- Initial Interest Rate: 5%

- Number of Yearly Contributions: 18

- Yearly Contribution Amount: $3,500

- Subsequent Interest Rate: 5%

The calculator would show a future value of approximately $100,451.51, achieving your education savings goal.

3. Comparing Investment Options

Use the calculator to compare different investment strategies. For instance, compare a high-risk, high-return option with a more conservative approach:

High-risk option:

- Initial Principal: $20,000

- Initial Interest Rate: 10%

- Number of Yearly Contributions: 15

- Yearly Contribution Amount: $5,000

- Subsequent Interest Rate: 10%

Conservative option:

- Initial Principal: $20,000

- Initial Interest Rate: 5%

- Number of Yearly Contributions: 15

- Yearly Contribution Amount: $5,000

- Subsequent Interest Rate: 5%

The high-risk option would yield approximately $280,699.92, while the conservative option would result in about $174,382.62. This comparison can help you make informed decisions based on your risk tolerance and financial goals.

4. Debt Repayment Strategy

While primarily designed for savings, the calculator can also illustrate the cost of debt over time. By entering a negative initial principal, you can see how debt grows if left unpaid:

- Initial Principal: -$10,000 (representing debt)

- Initial Interest Rate: 18% (typical credit card rate)

- Number of Yearly Contributions: 5

- Yearly Contribution Amount: $0

- Subsequent Interest Rate: 18%

The result would show that the debt would grow to approximately $24,527.73 in just 5 years, emphasizing the importance of timely debt repayment.

Frequently Asked Questions (FAQ)

1. What is compound interest?

Compound interest is the interest calculated on the initial principal and the accumulated interest from previous periods. It’s essentially “interest on interest,” which can significantly boost your investment growth over time.

2. How does continuous compounding differ from other compounding methods?

Continuous compounding assumes that interest is calculated and added to the principal continuously, rather than at fixed intervals like daily, monthly, or annually. It typically results in slightly higher returns compared to other methods.

3. Why does the calculator ask for two different interest rates?

The calculator allows for an initial interest rate and a subsequent rate to account for potential changes in your investment strategy or market conditions over time. This flexibility provides a more realistic projection of your investment growth.

4. Can I use this calculator for different currencies?

Yes, the principles of compound interest apply regardless of currency. Simply input your figures in your preferred currency, and the calculator will provide results in that same currency.

5. How accurate are the results from this calculator?

While our calculator uses precise mathematical formulas, it’s important to note that real-world investments can be affected by various factors not accounted for in this tool, such as taxes, fees, or market fluctuations. Use the results as a guide rather than a guarantee.

6. Can I use this calculator for short-term investments?

Yes, you can use this calculator for any time period. However, the power of compound interest becomes more evident over longer periods.

7. What if I can’t contribute the same amount every year?

This calculator assumes consistent yearly contributions. For varying contribution amounts, you might need to calculate multiple scenarios or use a more advanced financial planning tool.

8. How does inflation affect these calculations?

This calculator doesn’t account for inflation. To factor in inflation, you can subtract the expected inflation rate from your interest rate to get a “real” rate of return.

9. Can this calculator be used for business investments?

While primarily designed for personal finance, the principles can apply to business investments. However, business investments often involve more complex factors that may require additional considerations.

10. Is the calculator suitable for all types of investments?

This calculator is best suited for fixed-rate investments or as a simplified model for variable-rate investments. For investments with highly variable returns, like stocks, the calculator can provide a rough estimate based on average expected returns.

Please note that we cannot guarantee that our webtool or the results from our webtool are always correct, complete, or reliable. Our content and tools might have mistakes, biases, or inconsistencies.

Conclusion: Harness the Power of Compound Interest

Our Compound Interest Calculator with Yearly Contributions is a powerful tool for visualizing your financial future. By understanding and leveraging the power of compound interest and consistent contributions, you can make informed decisions to achieve your financial goals.

Key benefits of using this calculator include:

- Accurate projections of investment growth over time

- Flexibility to account for changing interest rates

- Ability to see the impact of regular contributions

- Insights for retirement planning, education savings, and more

- Motivation to start saving and investing early

Remember, the earlier you start investing and the more consistently you contribute, the greater your potential for significant wealth accumulation. Use this calculator as a starting point for your financial planning journey, but always consult with a qualified financial advisor for personalized advice.

Take control of your financial future today. Input your numbers, explore different scenarios, and discover the incredible potential of your investments with our Compound Interest Calculator!

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.