Corporate Structure Setup Guide

Is this tool helpful?

How to Use the Corporate Structure Guide Generator Effectively

To make the most of our Corporate Structure Guide Generator, follow these steps:

- Specific type of corporate business structure: Enter the type of structure you’re interested in, such as “holding company” or “limited liability company (LLC)”. For example, you could input “Series LLC” or “Offshore Trust”.

- Primary goals for asset protection: Describe your main objectives for protecting your assets. You might enter “Separate personal and business assets to limit liability” or “Create a multi-layered structure to safeguard intellectual property”.

- Plans or ideas for generating revenue (Optional): If applicable, outline any revenue generation plans. For instance, “Establish a licensing framework for proprietary technology” or “Create a franchise model for expanding business operations”.

- Preferred jurisdiction for incorporating: Specify where you’d like to incorporate. Examples include “Wyoming” for its strong asset protection laws or “Singapore” for its favorable tax environment.

- Specific legal or regulatory compliance concerns (Optional): List any particular compliance issues you’re worried about. You might input “Ensure compliance with FATCA reporting requirements” or “Address concerns related to transfer pricing regulations”.

After filling out the form, click “Generate Corporate Structure Guide” to receive a tailored guide based on your inputs.

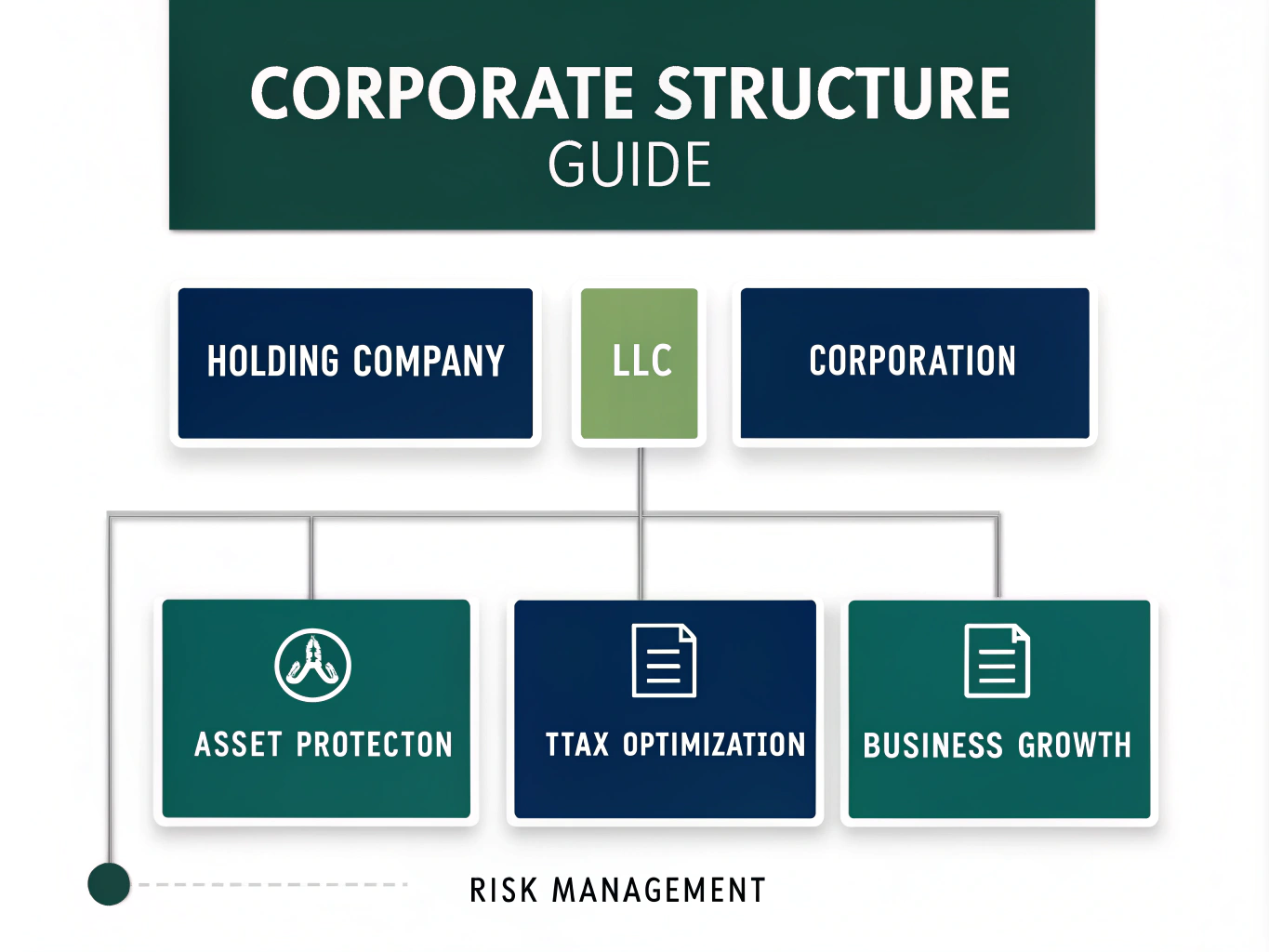

Understanding Corporate Business Structures: A Comprehensive Guide

Corporate business structures are legal frameworks that define how a company is organized, operated, and regulated. These structures play a crucial role in asset protection, tax optimization, and business growth strategies. Our Corporate Structure Guide Generator is designed to help entrepreneurs, business owners, and investors navigate the complex world of corporate structuring, providing personalized guidance based on specific needs and goals.

The Importance of Choosing the Right Corporate Structure

Selecting an appropriate corporate structure is a critical decision that can have far-reaching implications for your business. The right structure can:

- Protect personal assets from business liabilities

- Optimize tax efficiency

- Facilitate fundraising and investment

- Enable strategic business expansion

- Enhance credibility and professional image

Our guide generator takes into account your specific goals and concerns to provide tailored recommendations for establishing a corporate structure that aligns with your business objectives.

Benefits of Using the Corporate Structure Guide Generator

1. Personalized Recommendations

By inputting your specific business type, goals, and concerns, you receive customized advice that addresses your unique situation. This personalization ensures that the guidance you receive is relevant and actionable.

2. Time and Cost Savings

Researching corporate structures and their implications can be time-consuming and expensive. Our guide generator streamlines this process, providing you with valuable insights quickly and at no cost.

3. Comprehensive Coverage

The guide covers various aspects of corporate structuring, including legal considerations, tax implications, and compliance requirements. This holistic approach helps you make informed decisions about your business structure.

4. Risk Mitigation

By highlighting potential risks and compliance issues associated with different corporate structures, the guide helps you proactively address potential challenges and protect your assets.

5. Strategic Planning Support

The generated guide can serve as a valuable tool for strategic planning, helping you align your business structure with your long-term goals and growth plans.

Addressing User Needs and Solving Specific Problems

Asset Protection Strategies

One of the primary concerns for many business owners is protecting personal assets from business liabilities. The Corporate Structure Guide Generator addresses this need by recommending appropriate structures and strategies based on your asset protection goals.

For example, if you input “Separate personal and business assets” as your primary goal, the guide might recommend establishing a Limited Liability Company (LLC) or a Corporation. It would then provide detailed information on how these structures create a legal separation between personal and business assets, effectively shielding personal wealth from business creditors.

Tax Optimization

Tax efficiency is another crucial consideration when choosing a corporate structure. The guide generator takes into account your revenue generation plans and preferred jurisdiction to offer insights on tax-advantageous structures.

For instance, if you indicate plans for international expansion and specify a tax-friendly jurisdiction like Singapore, the guide might recommend setting up a holding company structure. It would then explain how this structure can help optimize your global tax position through strategies like:

- Profit pooling in low-tax jurisdictions

- Utilizing double taxation treaties

- Implementing transfer pricing strategies

Compliance Guidance

Navigating the complex landscape of legal and regulatory compliance is a significant challenge for many businesses. The Corporate Structure Guide Generator addresses this by providing tailored compliance guidance based on your specific concerns and chosen jurisdiction.

For example, if you express concerns about international tax reporting, the guide might offer information on:

- FATCA (Foreign Account Tax Compliance Act) reporting requirements

- CRS (Common Reporting Standard) obligations

- Transfer pricing documentation requirements

- Beneficial ownership reporting rules

Practical Applications and Use Cases

Case Study 1: Tech Startup Seeking Investment

Consider a technology startup looking to attract venture capital investment. The founder inputs the following information into the Corporate Structure Guide Generator:

- Business Structure: Delaware C-Corporation

- Asset Protection Goals: Protect intellectual property and limit founder liability

- Revenue Generation Plans: Develop and license proprietary software

- Jurisdiction: Delaware, USA

- Compliance Concerns: Securities regulations for future fundraising

Based on these inputs, the guide might recommend:

- Confirming the Delaware C-Corporation structure as ideal for attracting VC investment

- Establishing a subsidiary LLC to hold and manage intellectual property

- Implementing a robust IP licensing agreement between the parent company and subsidiary

- Setting up vesting schedules for founder shares to appeal to investors

- Providing guidance on SEC compliance for future funding rounds

Case Study 2: International Real Estate Investment Company

An investor planning to establish a real estate investment company with properties in multiple countries might input:

- Business Structure: Holding Company with Multiple Subsidiaries

- Asset Protection Goals: Isolate risks associated with individual properties

- Revenue Generation Plans: Rental income and property appreciation

- Jurisdiction: Luxembourg

- Compliance Concerns: International tax reporting and local property regulations

The generated guide could recommend:

- Establishing a Luxembourg SOPARFI (Société de Participation Financière) as the holding company

- Creating separate subsidiaries in each country where properties are held

- Implementing a tax-efficient structure for repatriating rental income

- Providing guidance on substance requirements to benefit from Luxembourg’s extensive tax treaty network

- Outlining compliance requirements for each jurisdiction, including property ownership regulations and tax reporting obligations

FAQ: Common Questions About Corporate Structures

Q1: What’s the difference between a holding company and an operating company?

A: A holding company is a corporate entity that owns assets, such as shares of other companies, real estate, or intellectual property, but doesn’t typically engage in day-to-day business operations. Its primary purpose is to hold and control these assets. An operating company, on the other hand, is actively involved in producing goods or providing services and generates revenue through its business activities.

Q2: Can I change my corporate structure after establishing my business?

A: Yes, it’s possible to change your corporate structure after establishing your business. This process is often referred to as corporate restructuring or reorganization. However, it can be complex and may have significant legal, tax, and operational implications. It’s advisable to consult with legal and financial professionals before undertaking such changes.

Q3: How does a Series LLC differ from a traditional LLC?

A: A Series LLC is a specialized form of Limited Liability Company that allows for the creation of separate “series” or divisions within a single LLC. Each series can have its own assets, members, managers, and operating agreement, and the debts and liabilities of one series are generally protected from the others. This structure can provide additional asset protection and flexibility compared to a traditional LLC, especially for businesses with multiple distinct operations or asset classes.

Q4: What are the benefits of incorporating in an offshore jurisdiction?

A: Incorporating in an offshore jurisdiction can offer several potential benefits, including:

- Tax optimization opportunities

- Enhanced privacy and confidentiality

- Asset protection from litigation in your home country

- Flexible corporate laws and regulations

- Access to international markets and banking systems

However, it’s important to note that offshore incorporation also comes with additional compliance requirements and potential scrutiny from tax authorities. It’s crucial to ensure full compliance with both offshore and onshore regulations.

Q5: How can a corporate structure help with succession planning?

A: A well-designed corporate structure can significantly facilitate succession planning in several ways:

- Continuity of Business: Unlike sole proprietorships, corporations can continue to exist even if the owner or key shareholders leave or pass away.

- Ownership Transfer: Shares in a corporation can be easily transferred to heirs or successors.

- Management Transition: Corporate bylaws can outline clear procedures for appointing new management.

- Tax Efficiency: Certain structures, like family limited partnerships, can offer tax-efficient ways to transfer wealth to the next generation.

- Asset Protection: Properly structured entities can protect business assets from personal liabilities of successors.

Q6: What is a “nominee director” and when might I need one?

A: A nominee director is an individual or company appointed to the board of directors to represent the interests of another party, often the beneficial owner of the company. Nominee directors are commonly used in offshore structures to maintain privacy and meet local directorship requirements. They might be needed when:

- Local laws require resident directors

- You want to maintain anonymity in public records

- You need professional expertise in managing a foreign entity

However, it’s crucial to understand the legal implications and responsibilities associated with using nominee directors, as they can impact control and liability issues.

Q7: How does a trust differ from a corporation in terms of asset protection?

A: Trusts and corporations offer different approaches to asset protection:

- Ownership: In a corporation, assets are owned by the company itself. In a trust, assets are held by trustees for the benefit of beneficiaries.

- Control: Corporations are controlled by directors and shareholders, while trusts are managed by trustees according to the trust deed.

- Creditor Protection: Corporations provide limited liability to shareholders. Trusts, especially certain types like asset protection trusts, can offer strong protection against creditors of the beneficiaries.

- Perpetuity: Corporations can exist indefinitely. Trusts often have a limited lifespan, though some jurisdictions allow perpetual trusts.

- Privacy: Trusts generally offer more privacy than corporations, as trust details are typically not public record.

The choice between a trust and a corporation depends on specific goals, tax considerations, and the legal environment.

Q8: What is a “corporate veil” and how can it be protected?

A: The “corporate veil” refers to the legal concept that separates the personality and assets of a corporation from its shareholders, protecting them from personal liability for the company’s debts and obligations. To maintain this protection:

- Maintain corporate formalities (regular meetings, proper record-keeping)

- Keep personal and business finances strictly separate

- Ensure adequate capitalization of the company

- Avoid using the company for personal purposes

- Comply with all relevant laws and regulations

Failure to adhere to these principles can result in “piercing the corporate veil,” where courts may hold shareholders personally liable.

Q9: How do different corporate structures impact fundraising capabilities?

Different corporate structures can significantly impact a company’s ability to raise capital:

- C-Corporations: Preferred by venture capitalists due to favorable tax treatment for investors and the ability to issue different classes of stock.

- S-Corporations: Limited to 100 shareholders and one class of stock, which can restrict fundraising options.

- LLCs: Flexible for early-stage funding but may be less attractive to institutional investors due to tax complications.

- Limited Partnerships: Common in venture capital and private equity funds, allowing for different classes of partners.

The choice of structure should align with your long-term funding strategy and investor preferences.

Q10: What are the key considerations when setting up a multinational corporate structure?

When establishing a multinational corporate structure, consider the following:

- Tax Efficiency: Evaluate the tax implications in each jurisdiction and potential for treaty benefits.

- Regulatory Compliance: Ensure adherence to local laws and international regulations (e.g., FATCA, CRS).

- Operational Flexibility: Design a structure that allows for efficient fund flows and management control.

- Asset Protection: Implement strategies to protect assets across different jurisdictions.

- Exit Strategy: Consider how the structure will impact potential mergers, acquisitions, or public listings.

- Transfer Pricing: Develop a robust transfer pricing strategy to manage inter-company transactions.

- Substance Requirements: Ensure each entity meets local substance requirements to avail of tax benefits.

A well-designed multinational structure can provide significant advantages, but it requires careful planning and ongoing management to navigate the complex international business environment.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.