Cost of Goods Sold Calculator

Is this tool helpful?

Cost of Goods Sold (COGS) Calculator: Optimize Your Business Finances

How to Use the COGS Calculator Effectively

Our Cost of Goods Sold (COGS) Calculator is designed to help businesses quickly and accurately determine the direct costs associated with producing goods sold during a specific period. To use the calculator effectively, follow these simple steps:

- Enter your Beginning Inventory value in dollars.

- Input the total Purchases made during the period in dollars.

- Provide the Ending Inventory value in dollars.

- Click the “Calculate COGS” button to get your result.

The calculator will instantly compute your Cost of Goods Sold and display the result below the form. This user-friendly tool ensures accuracy and saves time in your financial calculations.

Understanding Cost of Goods Sold: Definition, Purpose, and Benefits

Cost of Goods Sold (COGS) is a crucial financial metric that represents the direct costs associated with producing goods that were sold during a specific period. It includes the cost of materials, direct labor, and any other direct expenses involved in manufacturing or acquiring the products. Understanding and accurately calculating COGS is essential for businesses to determine their gross profit, assess profitability, and make informed decisions about pricing and inventory management.

The Purpose of COGS

The primary purpose of calculating COGS is to determine the true cost of your products and, subsequently, your gross profit. By subtracting COGS from your total revenue, you can ascertain how much money your business is making from its core operations. This information is vital for:

- Assessing overall profitability

- Making informed pricing decisions

- Evaluating production efficiency

- Managing inventory levels

- Preparing accurate financial statements

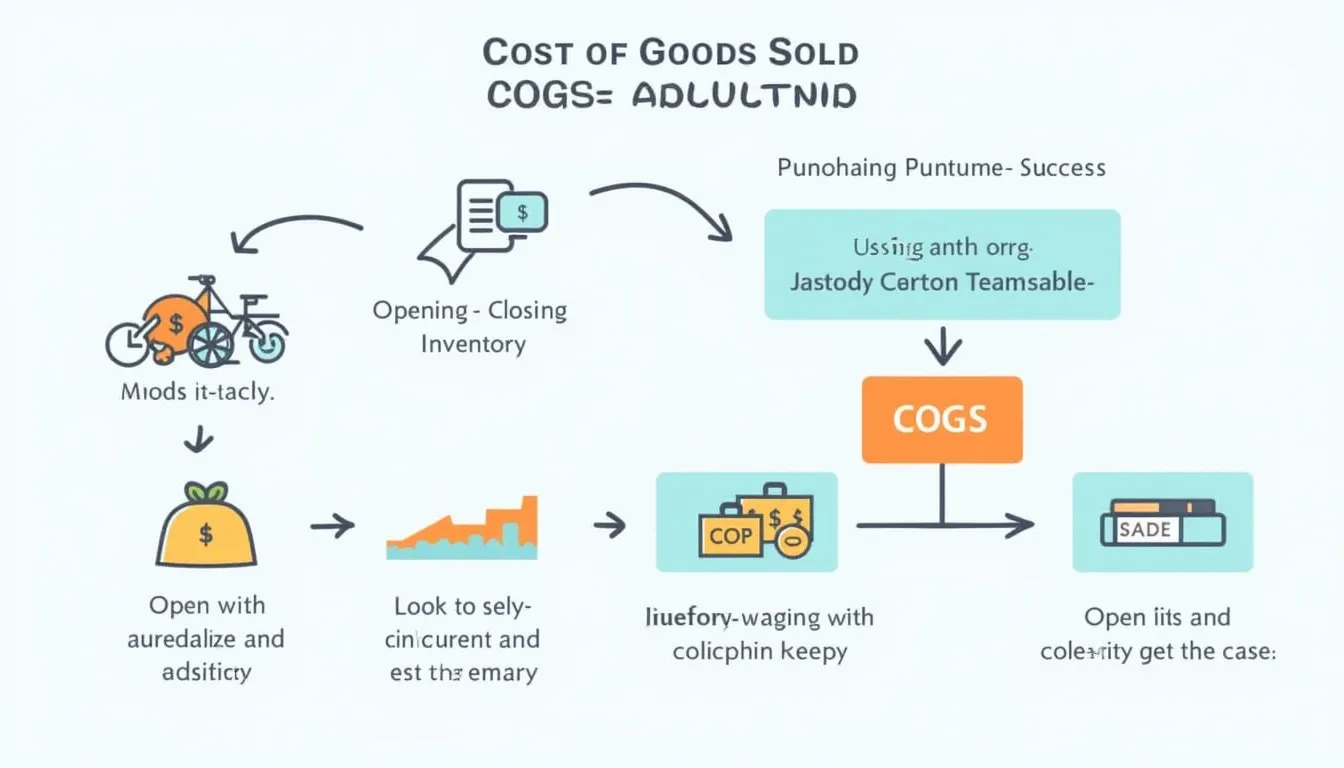

The COGS Formula

The formula for calculating Cost of Goods Sold is:

$$ COGS = Beginning\;Inventory + Purchases – Ending\;Inventory $$This formula takes into account the value of inventory at the start of the period, adds any purchases made during the period, and subtracts the value of inventory remaining at the end of the period. The result represents the cost of goods that were actually sold during that time frame.

Benefits of Using the COGS Calculator

Our COGS Calculator offers numerous benefits to businesses of all sizes:

- Accuracy: Eliminate human error and ensure precise calculations.

- Time-saving: Quickly compute COGS without manual calculations.

- Consistency: Maintain uniform calculations across different periods.

- Accessibility: Calculate COGS anytime, anywhere with an internet connection.

- User-friendly: Simple interface suitable for users with varying levels of financial expertise.

- Real-time results: Get instant COGS figures for immediate decision-making.

- Cost-effective: Free tool that provides valuable financial insights.

Addressing User Needs and Solving Specific Problems

The COGS Calculator addresses several key needs and solves specific problems for businesses:

1. Accurate Financial Reporting

By providing a quick and accurate way to calculate COGS, our calculator helps businesses ensure the accuracy of their financial statements. This is crucial for compliance with accounting standards and for providing stakeholders with reliable financial information.

2. Informed Pricing Decisions

Understanding your COGS is essential for setting appropriate prices for your products. Our calculator helps you quickly determine the base cost of your goods, allowing you to set prices that ensure profitability while remaining competitive in the market.

3. Inventory Management

By tracking beginning and ending inventory values along with purchases, the COGS Calculator helps businesses monitor their inventory levels more effectively. This can lead to better inventory management practices and reduced carrying costs.

4. Performance Evaluation

Regular calculation of COGS allows businesses to track their production efficiency over time. By comparing COGS across different periods, you can identify trends and areas for improvement in your production processes.

5. Tax Compliance

Accurate COGS calculations are crucial for tax reporting purposes. Our calculator helps ensure that you’re reporting the correct figures on your tax returns, potentially avoiding issues with tax authorities.

Practical Applications and Examples

Let’s explore some practical applications of the COGS Calculator through examples:

Example 1: Retail Store

A clothing store wants to calculate its COGS for the past month. They have the following information:

- Beginning Inventory: $50,000

- Purchases during the month: $30,000

- Ending Inventory: $45,000

Using our COGS Calculator, they would input these values and receive the following result:

COGS = $50,000 + $30,000 – $45,000 = $35,000

This means the store sold $35,000 worth of inventory during the month. They can use this information to calculate their gross profit and assess their pricing strategy.

Example 2: Manufacturing Company

A furniture manufacturer wants to determine their COGS for the quarter. Their data is as follows:

- Beginning Inventory: $200,000

- Purchases (materials, labor, etc.): $350,000

- Ending Inventory: $180,000

Using the COGS Calculator, they would get:

COGS = $200,000 + $350,000 – $180,000 = $370,000

This result shows that the cost of furniture sold during the quarter was $370,000. The company can use this figure to evaluate their production efficiency and pricing strategies.

Example 3: E-commerce Business

An online electronics store wants to calculate its COGS for the year. Their data:

- Beginning Inventory: $500,000

- Purchases throughout the year: $1,200,000

- Ending Inventory: $400,000

Using our calculator, they would find:

COGS = $500,000 + $1,200,000 – $400,000 = $1,300,000

This shows that the cost of goods sold over the year was $1,300,000. The business can use this information for annual financial reporting, tax purposes, and to assess their overall performance for the year.

Frequently Asked Questions (FAQ)

1. What is included in COGS?

COGS typically includes the direct costs associated with producing goods or acquiring products for resale. This can include:

- Raw materials

- Direct labor costs

- Manufacturing overhead directly tied to production

- Shipping costs

- Cost of products purchased for resale

2. How often should I calculate COGS?

The frequency of COGS calculations depends on your business needs and reporting requirements. Many businesses calculate COGS monthly, quarterly, and annually. Regular calculations can provide more frequent insights into your business performance.

3. Can COGS be negative?

In normal circumstances, COGS should not be negative. A negative COGS would imply that you’re making money on the cost of your goods, which is generally not possible. If you get a negative result, double-check your input values for accuracy.

4. How does COGS affect my taxes?

COGS is a business expense that can be deducted from your revenue when calculating taxable income. Accurate COGS calculations are important for ensuring you’re paying the correct amount of taxes and not overstating your profits.

5. What’s the difference between COGS and Operating Expenses?

COGS includes direct costs associated with producing goods or acquiring products for resale. Operating expenses, on the other hand, include indirect costs like rent, utilities, marketing, and administrative salaries that are not directly tied to production.

6. Can I use this calculator for service-based businesses?

While the COGS concept is primarily used for businesses that sell physical products, service-based businesses can adapt it to calculate the direct costs associated with providing their services. However, they might refer to it as “Cost of Services” instead of COGS.

7. How accurate is this COGS Calculator?

Our COGS Calculator is designed to provide accurate results based on the information you input. However, it’s important to note that we can’t guarantee that the webtool or results from our webtool are always correct, complete, or reliable. Our content and tools might have mistakes, biases, or inconsistencies. Always double-check important calculations and consult with a financial professional for critical business decisions.

Conclusion: Empowering Your Business with Accurate COGS Calculations

The Cost of Goods Sold (COGS) Calculator is an invaluable tool for businesses looking to gain deeper insights into their financial performance. By providing quick, accurate calculations of COGS, this tool empowers you to:

- Make informed pricing decisions

- Evaluate production efficiency

- Manage inventory more effectively

- Prepare accurate financial statements

- Comply with tax regulations

Understanding your COGS is crucial for assessing your business’s profitability and making strategic decisions. Our user-friendly calculator simplifies this process, saving you time and ensuring accuracy in your financial calculations.

Take control of your business finances today by using our COGS Calculator. Whether you’re a small business owner, a financial professional, or an entrepreneur, this tool will help you gain valuable insights into your cost structure and pave the way for improved financial management.

Start using the COGS Calculator now and unlock the potential for greater financial success in your business!

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.