Investment Course Generator

Is this tool helpful?

How to Use the Investment Course Generator Effectively

The Investment Course Generator helps you build customized investment education programs matching your goals and audience. To get the best results, follow these simple steps when filling out the form:

-

Target Audience Level: Choose the skill level of your learners.

- Example 1: Novice – for complete beginners new to investing concepts.

- Example 2: Professional – for individuals working in finance who want to deepen expertise.

-

Course Duration: Specify how long your course will last.

- Example 1: 10 weeks for a focused short-term workshop.

- Example 2: 1 year for a comprehensive certification program.

-

Specific Focus Areas: Highlight particular topics or investment themes to emphasize.

- Example 1: Behavioral finance and investor psychology

- Example 2: Real estate investment trusts (REITs) and property portfolios

-

Assessment Preferences: Indicate your preferred ways to evaluate learners’ progress.

- Example 1: Interactive simulations and portfolio analysis

- Example 2: Research reports and group presentations

- Generate Outline: Submit the form by clicking the generate button. Review the tailored outline that the tool produces based on your inputs.

After generating your course outline, you can review the structured content and adapt it to fit your curriculum design. You can copy the outline and use it as a foundation to build engaging and focused investment courses for your audience.

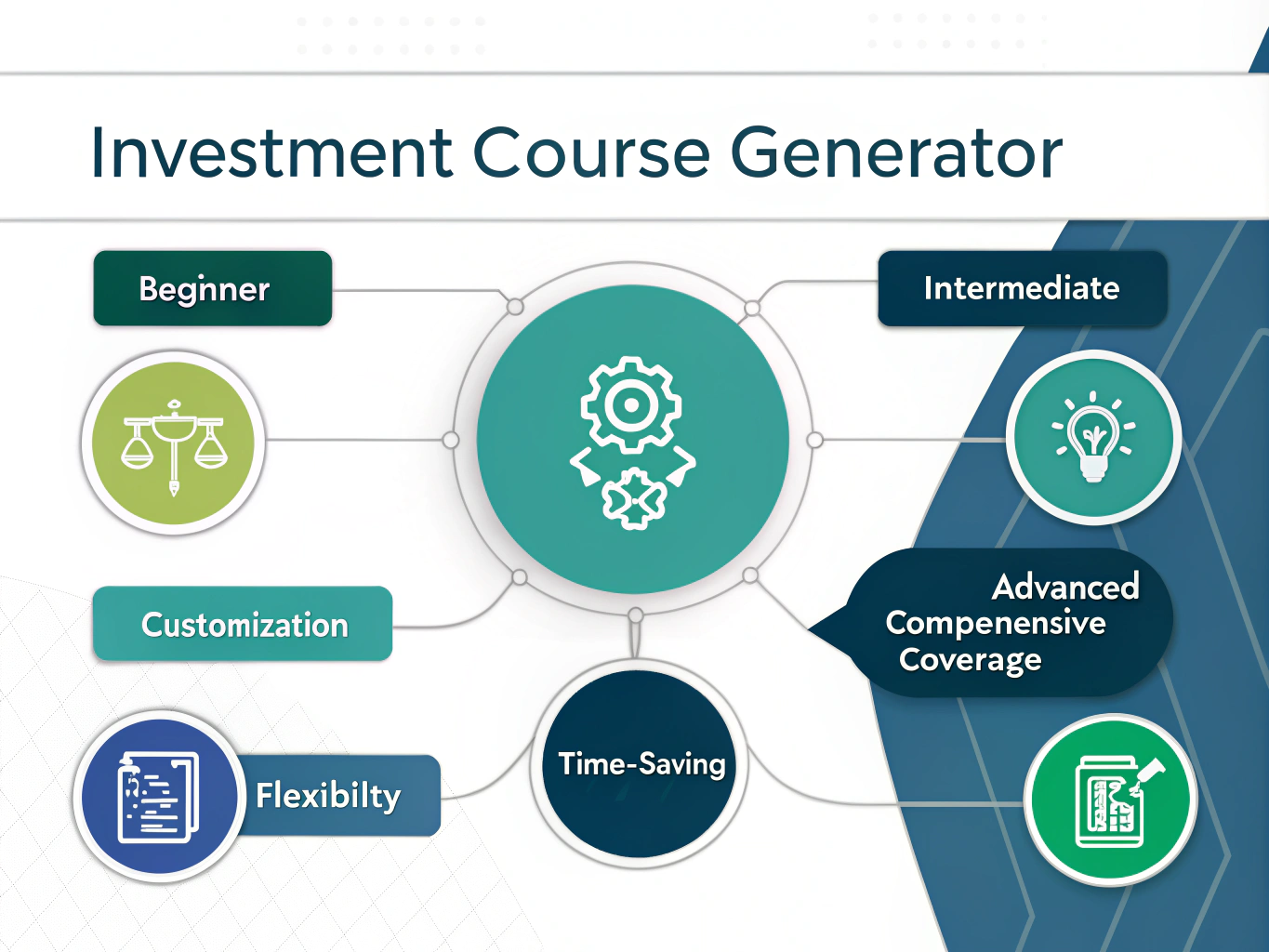

What Is the Investment Course Generator? Definition, Purpose, and Benefits

The Investment Course Generator is an online form-based tool that creates detailed outlines for investment education courses. It helps educators, financial trainers, and learning platforms build curriculum plans tailored to different experience levels, durations, and specific subject areas within investing.

Purpose of the Tool

This tool streamlines the course design process by generating logical, comprehensive structures that cover foundational concepts, intermediate lessons, and advanced strategies. It reduces the planning time and provides a clear roadmap to deliver effective investment education.

Key Benefits

- Customizable Learning Paths: Tailor courses based on learner skill level and desired focus areas.

- Comprehensive Curriculum: Build a well-rounded investment program covering theory, application, and current trends.

- Efficient Course Planning: Save time by automating course outline creation and focusing on content development.

- Flexibility: Adapt outlines for varied formats, from short workshops to extended professional programs.

- Updated Topics: Incorporate timely subjects like ESG investing, algorithmic trading, and cryptocurrency integration.

Practical Usage of the Investment Course Generator

This tool suits different educational contexts where customized investment courses are required. Here are practical applications to consider:

University Course Development

University faculty members can use the generator to create semester-long courses. For example, setting the audience level to Intermediate, duration to 14 weeks, and focus on Impact investing and sustainable portfolios generates an outline covering:

- Market fundamentals and sustainability criteria

- ESG assessment frameworks

- Case studies of sustainable investment funds

- Portfolio construction integrating social impact metrics

Professional Training Programs

Financial firms can design advanced courses for advisors. For instance, selecting Advanced level, 9 months, and focusing on Derivatives and risk hedging strategies produces content including:

- Options and futures pricing models

- Hedging techniques using derivatives

- Regulatory considerations and compliance

- Real-world portfolio risk management examples

Online Learning Platforms

Online education providers can create courses that cater to multiple investor profiles. Separate outlines for levels such as Beginner, Intermediate, and Expert can be generated, allowing learners to progress through increasingly complex topics at their own pace.

Corporate Finance Training

Corporations can train their finance teams on international investments by specifying audience level as Intermediate to Advanced, duration as 4 months, and focusing on Forex risk management and cross-border regulations. This yields an outline covering:

- Currency markets and exchange rate mechanics

- Hedging currency exposures

- International tax implications

- Practical case studies of global investment strategies

Why Use the Investment Course Generator for Curriculum Design?

1. Simplifies Complex Course Planning

You avoid the challenge of mapping all necessary investment topics yourself. The tool generates a logically sequenced outline ensuring comprehensive coverage from basics to complex strategies.

2. Adapts to Your Learners’ Skill Level

You can tailor course depth and complexity for novices, intermediates, or experts. For example, inclusion of fundamental concepts or advanced quantitative portfolio techniques changes depending on your input.

3. Balances Theory and Practice

The generated outlines integrate practical elements like case studies and real-world applications. This approach bridges academic theory with hands-on investment experience.

4. Keeps Curriculum Current

The tool incorporates emerging investment trends such as cryptocurrency, ESG investing, and algorithmic trading, ensuring your courses remain relevant in fast-changing markets.

Target Users Who Benefit from This Tool

You’ll find the Investment Course Generator useful if you are:

- An educator designing finance or investment courses at universities or colleges.

- A corporate trainer tasked with upskilling finance teams or advisors.

- An online learning platform curator building structured investment learning pathways.

- A professional development coordinator creating continuing education programs.

- An independent financial educator or consultant developing custom curricula.

Summary

The Investment Course Generator simplifies building tailored investment education programs by creating detailed course outlines that match your audience and objectives. You’ll save valuable time, ensure comprehensive topic coverage, and easily update content to reflect the latest trends. Use this tool to design clear, engaging investment courses that meet the specific needs of your learners.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.