Credit Card Management Advice

Is this tool helpful?

How to Use the Credit Card Management Advice Tool Effectively

To make the most of our Credit Card Management Advice Tool, follow these simple steps:

- Describe Your Financial Situation: In the first field, provide a brief overview of your current financial circumstances and credit card usage. For example, you might write: “I have three credit cards with a combined balance of $8,000. I’m making minimum payments but struggling to reduce the overall debt.”

- Enter Your Credit Card Debt: In the second field, input your total credit card debt amount. For instance, if you owe $8,000 across all your credit cards, enter “8000” (without quotation marks).

- Provide Your Credit Score: If you know your current credit score, enter it in the third field. For example, if your credit score is 680, simply type “680” into the box.

- State Your Financial Goals: In the last field, describe your financial objectives related to credit card usage and management. You might write something like: “I want to pay off my credit card debt within 18 months and increase my credit score by 50 points.”

- Get Personalized Advice: Click the “Get Credit Card Management Advice” button to receive tailored recommendations based on your inputs.

Remember, the more information you provide, the more personalized and helpful the advice will be. However, all fields are optional, so you can still receive general guidance even if you’re unsure about some details.

Understanding the Credit Card Management Advice Tool

Our Credit Card Management Advice Tool is a comprehensive solution designed to help individuals take control of their credit card usage, manage debt effectively, and improve their overall financial health. By analyzing user-provided information about their current financial situation, credit card debt, credit score, and financial goals, the tool generates personalized advice tailored to each user’s unique circumstances.

Purpose and Benefits

The primary purpose of this tool is to empower users with knowledge and strategies for responsible credit card management. Some key benefits include:

- Personalized debt reduction strategies

- Guidance on responsible credit card usage

- Tips for improving and maintaining a good credit score

- Advice on selecting the right credit card for individual needs

- Strategies for detecting and preventing fraudulent activity

- Budgeting tips to incorporate credit card usage into overall financial planning

By utilizing this tool, users can gain valuable insights into their credit card habits and receive actionable advice to improve their financial well-being.

Benefits of Using the Credit Card Management Advice Tool

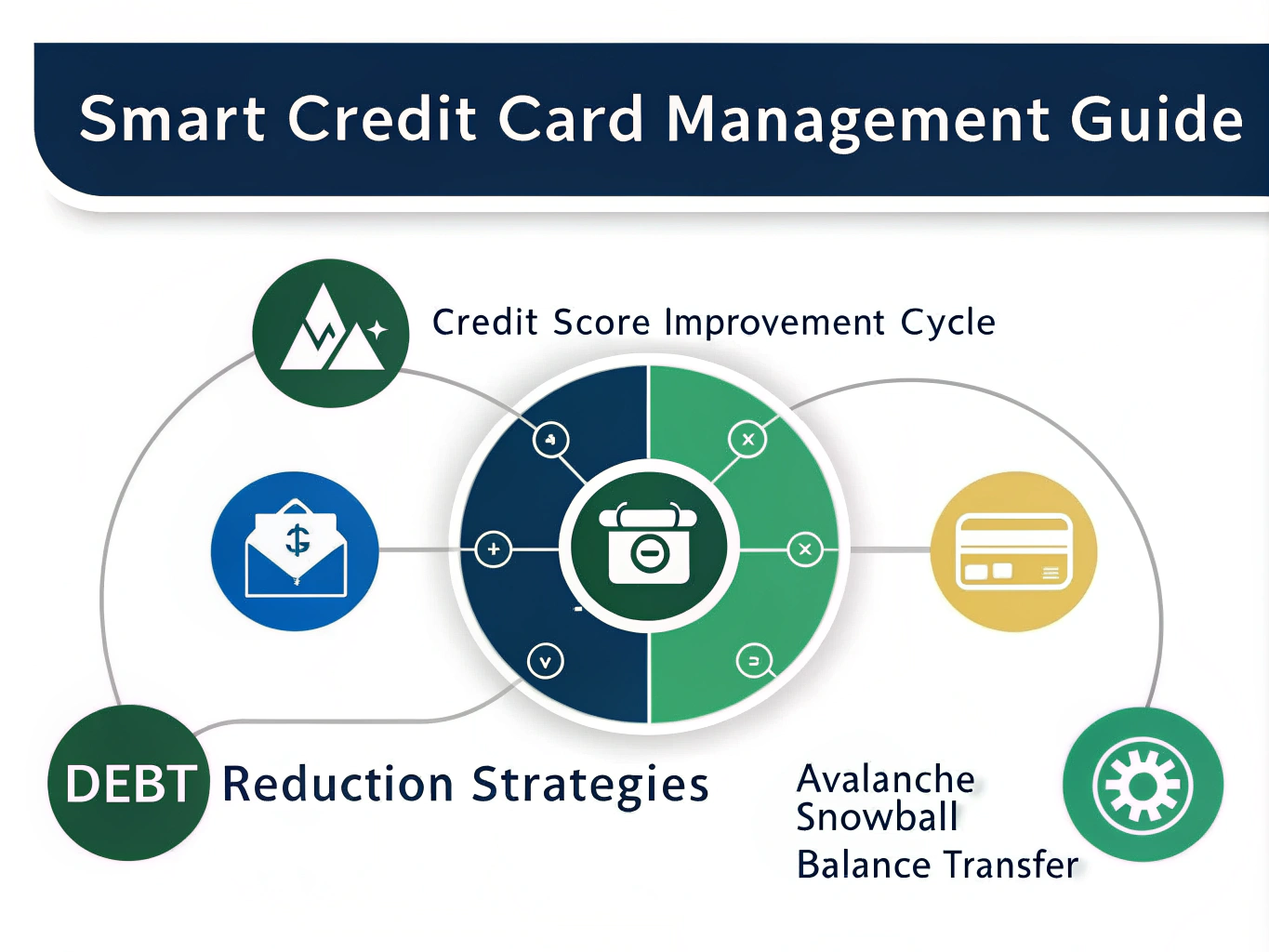

1. Customized Debt Reduction Strategies

One of the most significant advantages of using our tool is the personalized debt reduction strategies it provides. Based on your current debt level and financial goals, the tool can suggest effective methods to pay down your credit card balances faster. These strategies may include:

- The debt avalanche method (focusing on high-interest cards first)

- The debt snowball method (paying off smaller balances first for psychological wins)

- Balance transfer options to consolidate debt at lower interest rates

- Recommendations for negotiating with creditors for lower interest rates

2. Improved Financial Literacy

Our tool not only provides advice but also educates users about credit card management principles. This increased financial literacy can lead to better decision-making in the long run, helping users avoid common pitfalls and make more informed choices about their credit card usage.

3. Credit Score Improvement Guidance

Understanding the factors that influence your credit score is crucial for financial health. Our tool offers tailored advice on how to improve your credit score through responsible credit card usage, including:

- Optimal credit utilization ratios

- The importance of on-time payments

- Strategies for maintaining a diverse credit mix

- The impact of credit inquiries on your score

4. Personalized Card Recommendations

Based on your financial situation and goals, our tool can provide insights into the types of credit cards that might be most beneficial for you. This could include recommendations for:

- Low-interest cards for balance transfers

- Rewards cards aligned with your spending habits

- Secured credit cards for building credit

- Cash-back cards for maximizing returns on everyday purchases

5. Fraud Prevention Strategies

Protecting your financial information is paramount. Our tool offers advice on monitoring your credit card accounts effectively to detect and prevent fraudulent activity, helping you safeguard your financial well-being.

6. Budgeting Integration

Incorporating credit card usage into a comprehensive budget is essential for maintaining financial health. Our tool provides guidance on creating a budget that accounts for credit card payments and helps you align your spending with your financial goals.

Addressing User Needs and Solving Specific Problems

Tackling High-Interest Debt

For users struggling with high-interest credit card debt, our tool offers strategic advice on how to minimize interest payments and pay down balances more efficiently. For example, consider a user with $10,000 in credit card debt spread across three cards with interest rates of 22%, 18%, and 15%. Our tool might recommend the following strategy:

- Focus on paying off the 22% interest card first while making minimum payments on the others.

- Calculate the amount needed to pay off the highest-interest card within 12 months.

- Explore balance transfer options to consolidate debt at a lower interest rate.

Let’s break down the potential savings:

$$ \text{Interest Saved} = \text{Original Interest} – \text{Interest After Strategy} $$Assuming the user can pay $1,000 per month towards their debt:

- Original interest paid (minimum payments only): $2,200 in the first year

- Interest paid with the recommended strategy: $1,500 in the first year

- Potential savings: $700 in the first year alone

Improving Credit Scores

For users looking to boost their credit scores, our tool provides tailored advice based on their current score and financial situation. For instance, if a user reports a credit score of 650 and wants to improve it, the tool might suggest:

- Reducing credit utilization to below 30% on all cards

- Setting up automatic payments to ensure on-time payments

- Avoiding applying for new credit in the short term

- Keeping old credit accounts open to maintain a longer credit history

By following these strategies, users could potentially see a 50-100 point improvement in their credit score over 6-12 months, depending on their specific circumstances.

Selecting the Right Credit Card

Our tool helps users navigate the complex world of credit card offers by providing personalized recommendations. For example, if a user indicates they frequently travel for business, the tool might suggest a travel rewards card that offers:

- 3x points on travel and dining purchases

- An annual travel credit of $300

- No foreign transaction fees

- Travel insurance benefits

The tool would then calculate the potential value of these benefits based on the user’s spending habits, helping them make an informed decision about which card to apply for.

Practical Applications and Use Cases

Case Study 1: The Recent Graduate

Sarah, a recent college graduate, has just started her first job and is looking to build her credit responsibly. She uses our Credit Card Management Advice Tool with the following inputs:

- Current financial situation: “I have a stable job with a $45,000 annual salary, no credit card debt, and limited credit history.”

- Credit card debt: $0

- Credit score: 680

- Financial goals: “I want to build my credit score and start earning rewards on my everyday purchases.”

Based on this information, our tool might provide the following advice:

- Apply for a starter rewards credit card with no annual fee.

- Use the card for regular expenses like groceries and gas, but pay the balance in full each month.

- Keep credit utilization below 30% to positively impact credit score.

- Set up automatic payments to ensure on-time payments.

- Consider becoming an authorized user on a parent’s credit card to boost credit history length.

By following this advice, Sarah could potentially increase her credit score to over 700 within a year while earning rewards on her everyday spending.

Case Study 2: The Debt-Burdened Professional

John, a mid-career professional, is struggling with credit card debt accumulated over several years. He uses our tool with the following inputs:

- Current financial situation: “I have $15,000 in credit card debt spread across four cards with interest rates ranging from 18% to 24%. I’m making minimum payments but not making progress on reducing the debt.”

- Credit card debt: $15,000

- Credit score: 620

- Financial goals: “I want to pay off my credit card debt within two years and improve my credit score.”

Our tool might provide John with the following strategy:

- Consolidate debt using a balance transfer credit card with a 0% introductory APR for 18 months.

- Create a budget to allocate $750 per month towards debt repayment.

- Use the debt avalanche method to tackle remaining high-interest debt.

- Negotiate with creditors for lower interest rates on any remaining balances.

- Avoid using credit cards for new purchases until the debt is paid off.

By implementing this plan, John could potentially save over $3,000 in interest charges and be debt-free within two years, while also seeing a significant improvement in his credit score.

Case Study 3: The Rewards Maximizer

Emily, a frequent traveler, wants to maximize her credit card rewards. She uses our tool with these inputs:

- Current financial situation: “I travel frequently for work and personal reasons. I spend about $30,000 annually on credit cards and always pay my balance in full.”

- Credit card debt: $0

- Credit score: 780

- Financial goals: “I want to maximize travel rewards and perks from my credit card spending.”

Our tool might recommend the following strategy for Emily:

- Apply for a premium travel rewards card with a high sign-up bonus and strong ongoing rewards rate.

- Utilize category bonuses by using different cards for various spending categories (e.g., dining, travel, groceries).

- Take advantage of card perks like airport lounge access, travel credits, and hotel status upgrades.

- Consider adding a business credit card if she has any self-employment income to access additional rewards opportunities.

- Set up automatic payments to ensure on-time payments and maintain her excellent credit score.

By following this advice, Emily could potentially earn enough points or miles for multiple free flights or hotel stays each year, significantly reducing her travel expenses.

Frequently Asked Questions (FAQ)

Q1: How often should I check my credit score?

A1: It’s a good practice to check your credit score at least once every 3-4 months. Many credit card issuers now offer free credit score monitoring, which can make this process easier. Regular monitoring allows you to track your progress and quickly identify any potential issues or fraudulent activity.

Q2: Is it better to close unused credit cards or keep them open?

A2: In most cases, it’s better to keep unused credit cards open, especially if they don’t have an annual fee. Open accounts contribute to your credit utilization ratio and the length of your credit history, both of which are factors in calculating your credit score. However, if a card has a high annual fee and you’re not using its benefits, it might be worth closing.

Q3: How many credit cards should I have?

A3: There’s no one-size-fits-all answer to this question. The ideal number of credit cards depends on your financial situation, spending habits, and ability to manage multiple accounts responsibly. For many people, 2-3 credit cards is a good balance, allowing for a mix of rewards and benefits while remaining manageable. The key is to only have as many cards as you can responsibly handle.

Q4: What’s the fastest way to improve my credit score?

A4: The fastest way to improve your credit score often involves addressing the factors that have the most immediate impact:

- Pay down credit card balances to reduce your credit utilization ratio

- Ensure all payments are made on time

- Dispute any errors on your credit report

- Become an authorized user on a family member’s card with a good payment history

Keep in mind that significant improvements to your credit score typically take time, often several months to a year.

Q5: How does a balance transfer affect my credit score?

A5: A balance transfer can affect your credit score in several ways:

- Short-term negative impact: The new credit inquiry and account may temporarily lower your score.

- Potential positive impact: If the transfer significantly lowers your credit utilization ratio, it could improve your score.

- Long-term impact: If you use the balance transfer to pay off debt more quickly, it can lead to a higher credit score over time.

The overall impact depends on your specific credit profile and how you manage the balance transfer.

Q6: What should I do if I can’t make a credit card payment?

A6: If you’re unable to make a credit card payment, take these steps:

- Contact your credit card issuer immediately to explain your situation.

- Ask about hardship programs or payment deferral options.

- Try to negotiate a lower interest rate or minimum payment.

- Consider seeking help from a non-profit credit counseling agency.

- As a last resort, look into debt consolidation or balance transfer options.

Remember, it’s always better to communicate with your creditor than to miss a payment without explanation.

Q7: How do rewards credit cards work?

A7: Rewards credit cards offer incentives for using the card, typically in the form of:

- Cash back: A percentage of your purchases is returned to you as cash.

- Points: You earn points for purchases, which can be redeemed for travel, merchandise, or statement credits.

- Miles: Similar to points, but typically used for travel-related redemptions.

The value of rewards varies by card and redemption method. It’s important to choose a rewards card that aligns with your spending habits and preferences.

Q8: What’s the difference between a secured and unsecured credit card?

A8: The main differences are:

- Secured cards require a cash deposit that typically equals your credit limit. This deposit acts as collateral.

- Unsecured cards don’t require a deposit but usually need a higher credit score to qualify.

- Secured cards are often easier to get and are used to build or rebuild credit.

- Unsecured cards generally offer better rewards and perks.

Both types of cards can help build credit if used responsibly and payments are reported to credit bureaus.

Q9: How does credit card interest work?

A9: Credit card interest is typically calculated using an Annual Percentage Rate (APR). Here’s a simplified explanation:

- The APR is divided by 365 to get a daily rate.

- This daily rate is applied to your average daily balance.

- The resulting interest is added to your balance at the end of each billing cycle.

For example, if your APR is 18% and your average daily balance is $1,000, your monthly interest would be approximately:

$$ \text{Monthly Interest} = \frac{18\%}{365} \times 1000 \times 30 \text{ days} \approx $14.79 $$To avoid paying interest, pay your full statement balance by the due date each month.

Q10: What should I consider when choosing a new credit card?

A10: When selecting a new credit card, consider the following factors:

- Your credit score and likelihood of approval

- Annual fees and whether the card’s benefits justify the cost

- Rewards programs and how well they align with your spending habits

- Interest rates, especially if you might carry a balance

- Sign-up bonuses and their requirements

- Additional perks like travel insurance, purchase protection, or extended warranties

- Foreign transaction fees if you travel internationally

Prioritize these factors based on your financial situation and goals to find the card that best suits your needs.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.