Cryptocurrency Tax Calculator

Is this tool helpful?

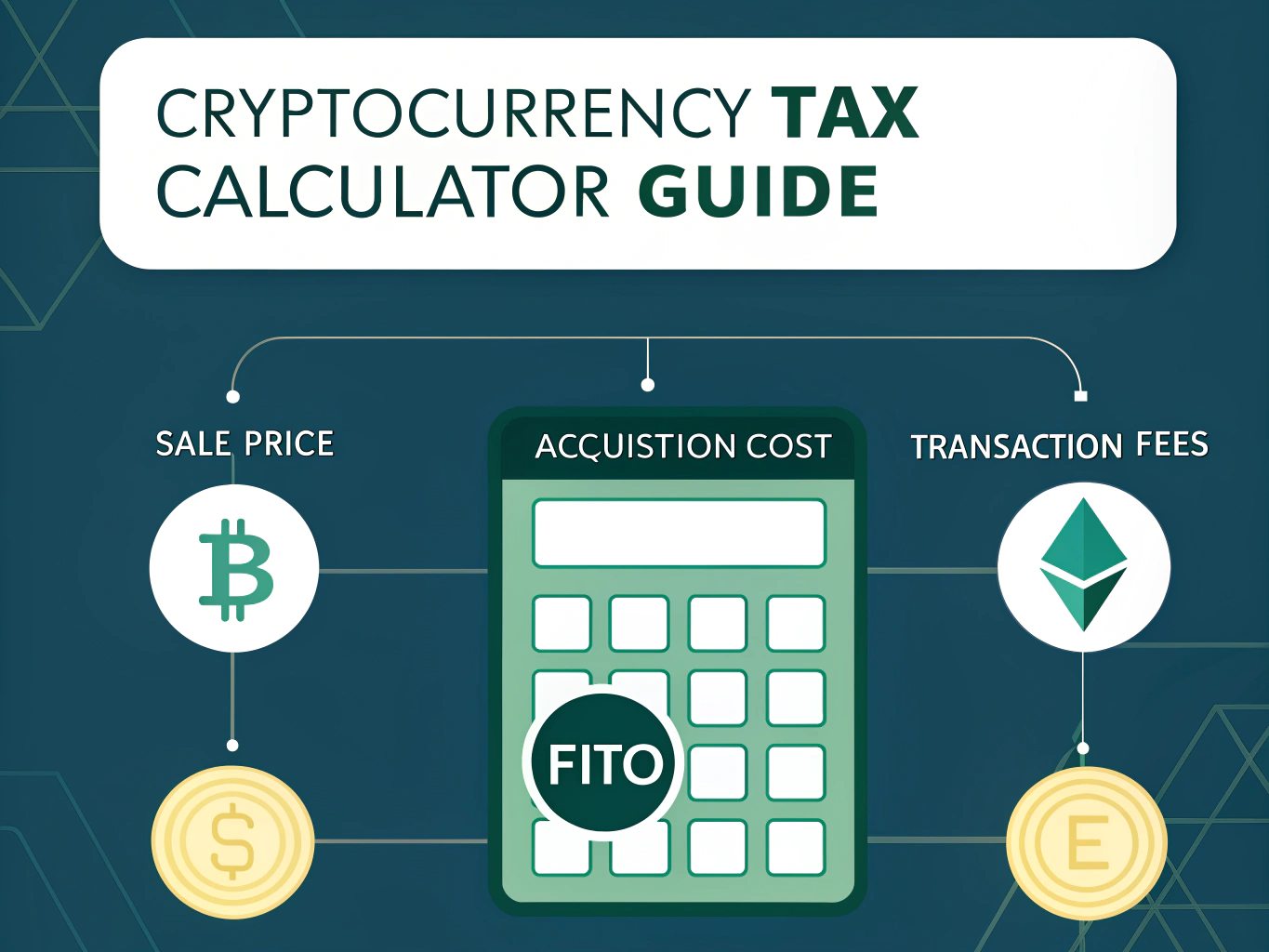

How to Use the Cryptocurrency Tax Liability Calculator Effectively- Enter Sale Price (USD): Input the total amount received from selling your cryptocurrency. For example, if you sold 2 BTC at $45,000 each, enter 90,000.00

- Input Acquisition Cost (USD): Enter the original purchase price of the cryptocurrency. For instance, if you bought 2 BTC at $30,000 each, enter 60,000.00

- Add Transaction Fees (USD): Include all associated transaction fees, such as exchange fees, network fees, or broker commissions. For example, if your total fees were $250, enter 250.00

The calculator will instantly display your net gain or loss and classify it as either a capital gain or capital loss.

Understanding Cryptocurrency Tax Calculations

The Cryptocurrency Tax Liability Calculator employs the First-In-First-Out (FIFO) method to determine taxable gains or losses from cryptocurrency transactions. The fundamental calculation follows this formula:

$$ \text{Net Gain/Loss} = \text{Sale Price} – \text{Acquisition Cost} – \text{Transaction Fees} $$The Role of FIFO in Cryptocurrency Taxation

FIFO accounting assumes that the first cryptocurrency units you purchased are the first ones you sell. This method is widely accepted by tax authorities and provides a consistent approach to calculating crypto gains and losses.

Benefits of Using the Cryptocurrency Tax Calculator

- Accuracy in Tax Reporting: Ensures precise calculation of capital gains or losses according to IRS guidelines

- Time Efficiency: Eliminates manual calculations and reduces the risk of mathematical errors

- Compliance: Adheres to IRS Notice 2014-21 requirements for virtual currency transactions

- Documentation: Helps maintain clear records of cryptocurrency transactions for tax purposes

- Planning: Assists in tax planning and portfolio management decisions

Addressing Tax Compliance Requirements

This calculator helps cryptocurrency investors meet their tax obligations by:

- Determining the correct taxable amount from crypto transactions

- Classifying gains or losses appropriately

- Supporting proper tax documentation

- Facilitating year-end tax reporting

Practical Applications and Examples

Example 1: Short-term Cryptocurrency Trade

Consider a trader who:

- Purchased 0.5 ETH at $3,000 ($1,500 total)

- Sold at $4,000 ($2,000 total)

- Paid $50 in transaction fees

Calculator results would show:

- Net Gain = $2,000 – $1,500 – $50 = $450 (Capital Gain)

Example 2: Multiple Transaction Scenario

For an investor who:

- Bought 1 BTC at $35,000

- Sold 0.5 BTC at $55,000 ($27,500)

- Incurred $150 in fees

Calculator results would show:

- Net Gain = $27,500 – ($35,000/2) – $150 = $9,850 (Capital Gain)

Common Use Cases

- Year-end Tax Preparation: Calculate total gains/losses for tax filing

- Portfolio Management: Track performance of crypto investments

- Tax Loss Harvesting: Identify opportunities to offset gains

- Investment Planning: Evaluate potential tax implications before trades

Frequently Asked Questions

What is FIFO calculation method?

FIFO (First-In-First-Out) assumes that the first cryptocurrencies you purchased are the first ones you sell. This method helps maintain consistent cost basis calculations for tax purposes.

Are cryptocurrency transactions taxable?

Yes, the IRS treats cryptocurrency as property, and transactions are subject to capital gains tax rules. Every sale, trade, or exchange may have tax implications.

What types of fees can I include in the calculation?

You can include exchange fees, network transaction fees, broker commissions, and other direct costs associated with buying and selling cryptocurrency.

How do I report cryptocurrency taxes?

Cryptocurrency gains and losses should be reported on Form 8949 and Schedule D of your tax return. Use this calculator to determine the amounts to report.

Can I use this calculator for multiple cryptocurrencies?

Yes, you can use this calculator for any cryptocurrency transaction. Simply enter the values in USD for your specific cryptocurrency trade.

What is the difference between capital gains and losses?

A capital gain occurs when your net calculation is positive (sold for more than purchase price plus fees). A capital loss occurs when the net calculation is negative (sold for less than purchase price plus fees).

Do I need to calculate taxes for each transaction?

Yes, each cryptocurrency transaction that results in a sale or exchange needs to be calculated separately for tax purposes. This calculator helps you determine the gain or loss for each transaction.

Tax Planning Strategies Using the Calculator

Strategic Tax Loss Harvesting

Use the calculator to identify positions with unrealized losses that could be used to offset gains in your portfolio. This strategy can help optimize your tax situation while maintaining your desired cryptocurrency exposure.

Cost Basis Tracking

Maintain accurate records of your cryptocurrency purchases and sales using the calculator. This helps ensure proper tax reporting and can save time during tax season.

Portfolio Optimization

Regular use of the calculator can help you understand the tax implications of your trading strategies and make more informed decisions about when to buy or sell cryptocurrencies.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.