ESG Investment Screener

Is this tool helpful?

How to Use the ESG Investment Screening Tool Effectively

To utilize this socially responsible investing screener effectively, follow these steps:

- Enter your specific investment criteria in the text area provided, focusing on requirements beyond ESG factors

- Include details such as market capitalization preferences (e.g., “$5 billion minimum market cap”)

- Specify any sector-specific requirements (e.g., “focus on renewable energy and healthcare sectors”)

- Add financial metric preferences (e.g., “minimum dividend yield of 3% and P/E ratio below 20”)

Sample Investment Criteria Inputs

Example 1:

“Seeking large-cap companies with market capitalization above $10 billion, operating in sustainable technology and clean energy sectors. Prefer companies with dividend yields above 2.5% and debt-to-equity ratios below 0.5. Interested in companies with strong water conservation initiatives.”

Example 2:

“Looking for mid-cap healthcare and biotechnology companies between $2-5 billion market cap. Focus on companies with R&D investment above 15% of revenue and positive revenue growth over the past 3 years. Preference for companies with diverse board composition and strong supply chain ethics.”

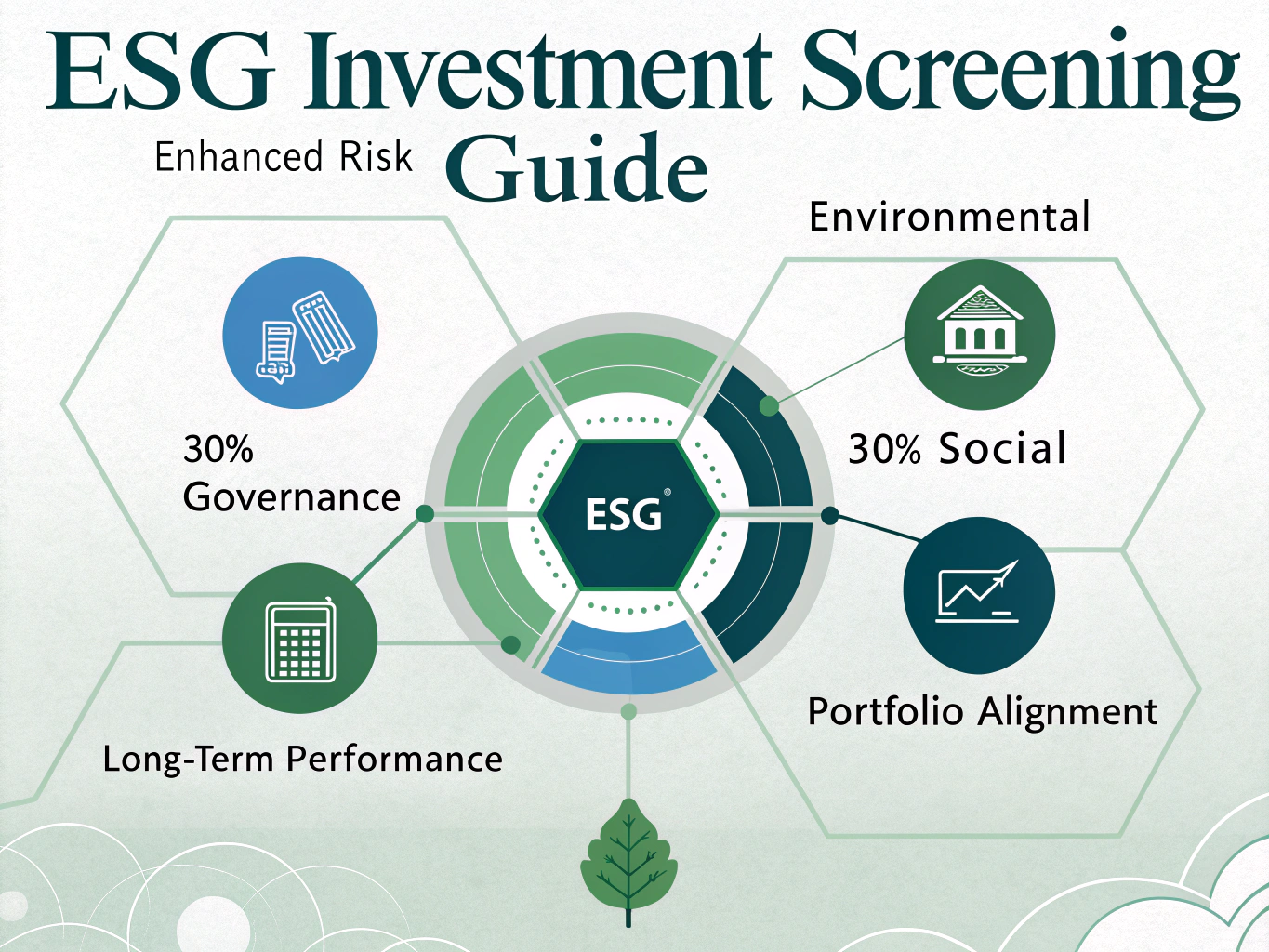

Understanding ESG Investment Screening

The ESG Investment Screening Tool combines environmental, social, and governance factors to evaluate investment opportunities aligned with sustainable and responsible investing principles. The tool applies the following weighted scoring formula:

$$ \text{ESG Score} = 0.4 \times \text{Environmental Score} + 0.3 \times \text{Social Score} + 0.3 \times \text{Governance Score} $$Core Components of ESG Screening

- Environmental (40% weight): Evaluates company’s environmental impact, sustainability initiatives, and climate policies

- Social (30% weight): Assesses workplace practices, community relations, and human rights policies

- Governance (30% weight): Examines corporate behavior, board diversity, and shareholder rights

Benefits of Using the ESG Investment Screening Tool

1. Enhanced Risk Management

- Identifies companies with strong sustainability practices

- Reduces exposure to environmental and social risks

- Screens out companies with poor governance practices

2. Portfolio Alignment with Values

- Ensures investments match personal or institutional ethical standards

- Facilitates impact investing strategies

- Supports sustainable development goals

3. Long-term Performance Potential

- Focuses on companies with sustainable business models

- Identifies forward-thinking management teams

- Targets businesses with strong stakeholder relationships

Practical Applications and Problem-Solving

Sample ESG Score Calculation

Consider a company with the following scores:

- Environmental Score: 85/100

- Social Score: 78/100

- Governance Score: 92/100

Implementation Strategies

- Portfolio Construction: Use scores to weight investment allocations

- Sector Analysis: Compare companies within the same industry

- Risk Assessment: Identify potential sustainability risks

Real-World Applications and Case Studies

Case Study 1: Clean Energy Portfolio

An investment manager using the ESG screener to build a renewable energy portfolio might input:

- Focus on companies with environmental scores above 80

- Minimum market cap of $1 billion

- Required revenue from renewable sources > 50%

Case Study 2: Sustainable Healthcare Investment

A socially conscious investor targeting healthcare might specify:

- Companies with social scores above 75

- Strong workplace safety records

- Significant investment in medical research

Frequently Asked Questions

What are the key ESG factors considered in the screening?

The tool evaluates environmental factors (carbon emissions, resource usage, waste management), social factors (employee relations, community impact, human rights), and governance factors (board composition, shareholder rights, business ethics).

How often should I review my ESG investment criteria?

It’s recommended to review ESG criteria quarterly or semi-annually to ensure alignment with changing sustainability standards and market conditions.

Can I customize the weightings of ESG factors?

The tool uses standardized weightings based on established ESG frameworks, with 40% environmental, 30% social, and 30% governance factors.

What industries are typically excluded from ESG screening?

Following UN PRI guidelines, the screener automatically excludes companies involved in tobacco and weapons manufacturing.

How does ESG screening complement traditional financial analysis?

ESG screening provides additional risk and opportunity insights beyond traditional financial metrics, offering a more comprehensive view of long-term investment potential.

What makes a company score well in ESG criteria?

Companies score well when they demonstrate strong environmental stewardship, positive social impact, and transparent governance practices, such as comprehensive sustainability reporting and diverse board composition.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.