Inheritance Tax Calculator

Is this tool helpful?

How to Use the Inheritance Tax Liability Estimator Effectively

To calculate your potential inheritance tax liability using this tool, follow these simple steps:

- Enter Estate Value: Input the total value of the estate in US dollars. For example, if the estate is worth $15,500,000 or $8,750,000.

- Select State: Choose your state from the dropdown menu. The tool includes specific tax rates for states like New York, Washington, Illinois, and others.

- Click Calculate: Press the “Calculate Tax Liability” button to see your detailed tax breakdown.

The results will display:

- Federal Tax Amount

- State Tax Amount (if applicable)

- Total Tax Liability

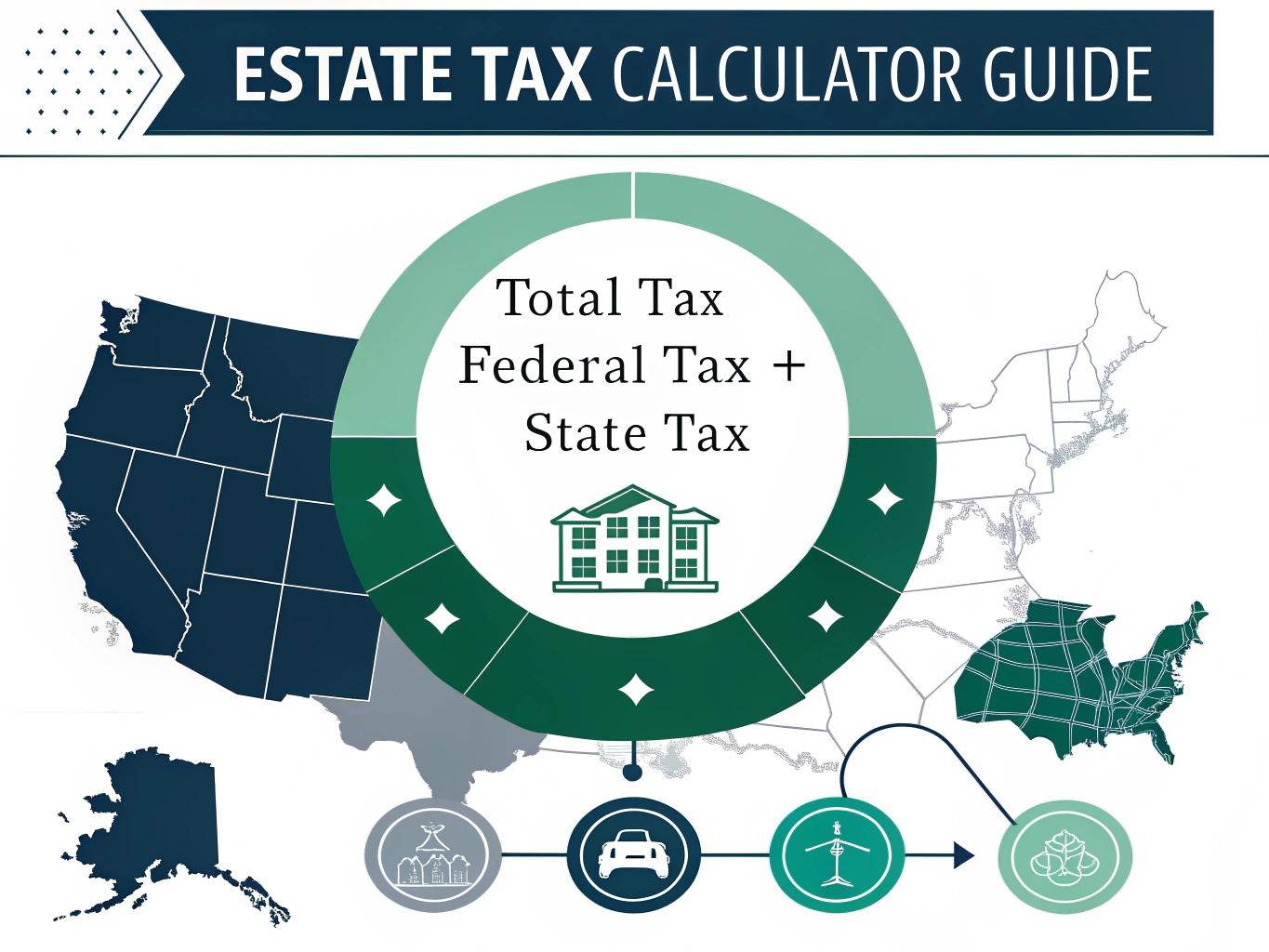

Understanding Inheritance Tax Calculations

The Inheritance Tax Liability Estimator employs a progressive tax calculation system that considers both federal and state-specific tax rates. The fundamental calculation follows this formula:

$$ \text{Total Tax} = \text{Federal Tax} + \text{State Tax} $$$$ \text{Federal Tax} = (\text{Estate Value} – \text{Federal Exemption}) \times 0.40 $$$$ \text{State Tax} = (\text{Estate Value} – \text{State Exemption}) \times \text{State Rate} $$Current Tax Rates and Exemptions

- Federal Estate Tax Rate: 40%

- Federal Estate Tax Exemption: $12,920,000

- State Tax Rates: Vary by state (0% to 20%)

- State Exemption: $5,000,000 (where applicable)

Benefits of Using the Inheritance Tax Calculator

- Instant tax liability estimation

- State-specific calculations

- Comprehensive breakdown of federal and state taxes

- User-friendly interface

- Accurate calculations based on current tax rates

Practical Applications and Examples

Example 1: Large Estate in Washington State

Consider an estate valued at $18,000,000 in Washington:

- Federal Tax: ($18,000,000 – $12,920,000) × 0.40 = $2,032,000

- State Tax: ($18,000,000 – $5,000,000) × 0.20 = $2,600,000

- Total Tax Liability: $4,632,000

Example 2: Medium Estate in New York

For an estate worth $7,500,000 in New York:

- Federal Tax: $0 (below federal exemption)

- State Tax: ($7,500,000 – $5,000,000) × 0.16 = $400,000

- Total Tax Liability: $400,000

State-Specific Considerations

States with Estate Tax

- Washington (20% maximum rate)

- New York (16% maximum rate)

- Illinois (16% maximum rate)

- Massachusetts (16% maximum rate)

- Connecticut (12% maximum rate)

States without Estate Tax

- California

- Texas

- Florida

Planning Strategies and Considerations

Understanding your potential tax liability allows for better estate planning:

- Gift planning during lifetime

- Trust establishment considerations

- State residency planning

- Asset distribution strategies

Frequently Asked Questions

What is included in the estate value?

Estate value includes all assets owned at death: real estate, investments, businesses, personal property, life insurance proceeds, and retirement accounts.

Why do state tax rates vary so significantly?

Each state sets its own estate tax policies based on various factors including local economic conditions, revenue needs, and tax policy objectives.

How often do estate tax rates change?

Federal and state estate tax rates and exemptions are subject to periodic legislative changes. The calculator uses current rates as of the latest tax year.

Can I use this calculator for gift tax planning?

While the calculator focuses on estate tax, the information can help inform lifetime gift planning strategies to reduce overall tax liability.

Do all estates need to pay estate tax?

No, only estates exceeding the federal or state exemption amounts are subject to estate tax. Many estates fall below these thresholds.

Understanding Tax Reduction Strategies

Several strategies can help reduce estate tax liability:

- Annual gift exclusions

- Charitable giving

- Family limited partnerships

- Qualified personal residence trusts

- Irrevocable life insurance trusts

Impact of Location on Estate Planning

Your state of residence significantly impacts estate tax planning:

- Consider state-specific exemptions

- Evaluate multiple state residences

- Review state-specific deductions and credits

- Assess impact of property location

Professional Guidance and Resources

While this calculator provides valuable estimates, complex estates benefit from:

- Estate planning attorney consultation

- Tax professional guidance

- Financial advisor input

- Regular estate plan reviews

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.