Is this tool helpful?

How to Use the Forex Margin Requirement Calculator Effectively

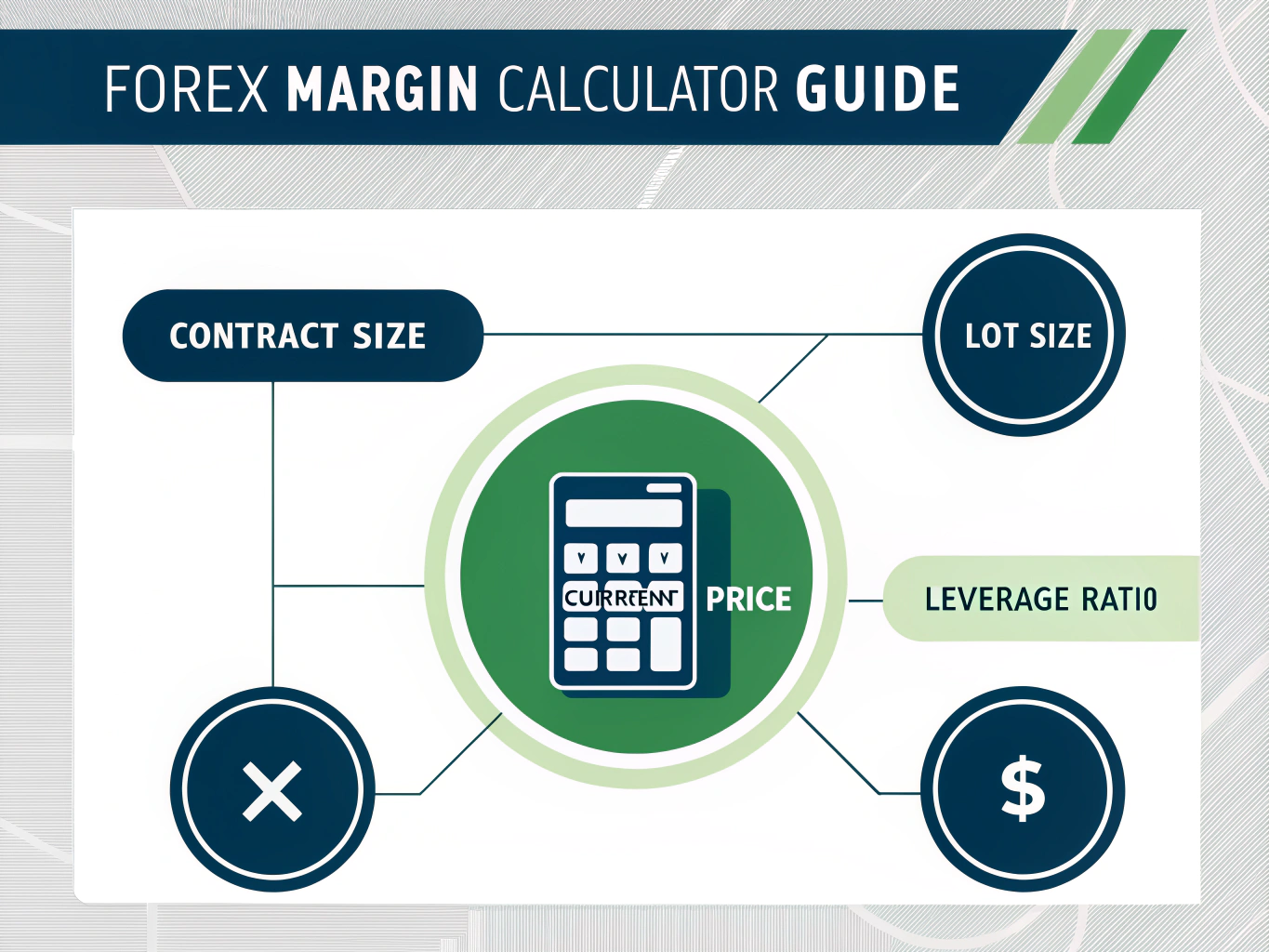

This comprehensive forex margin calculator helps traders determine the required margin for their forex positions. Here’s a detailed guide on using each field:

Input Fields Guide

- Contract Size: Enter the standard contract size for your currency pair. For example, enter 100,000 for a standard lot in EUR/USD, or 10,000 for a mini contract in GBP/JPY.

- Lot Size: Input your desired trading volume in lots. For instance, 0.5 for a half-lot position or 2.5 for multiple standard lots.

- Current Price: Enter the current exchange rate for your currency pair. For example, 1.3524 for EUR/USD or 151.75 for USD/JPY.

- Leverage Ratio: Select your broker’s offered leverage from the dropdown menu, ranging from 50:1 to 500:1.

Understanding Forex Margin Requirements

The forex margin requirement calculator is an essential tool for forex traders to determine the amount of capital needed to open and maintain trading positions. It helps traders manage risk effectively by calculating the required margin based on position size, leverage, and current market prices.

The calculation follows this formula:

Why Margin Calculation Matters

Accurate margin calculation is crucial for:

- Proper position sizing

- Risk management

- Account balance optimization

- Prevention of margin calls

- Trading strategy development

Benefits of Using the Forex Margin Calculator

1. Precise Position Planning

Traders can accurately determine the required capital for various position sizes, enabling better trading decisions and risk management.

2. Risk Management Enhancement

Understanding margin requirements helps traders avoid overexposure and maintain appropriate leverage levels for their trading strategy.

3. Account Optimization

Traders can efficiently allocate their capital across multiple positions by knowing exact margin requirements for each trade.

4. Professional Trading Approach

Using the calculator promotes a more systematic and professional approach to forex trading.

Practical Applications and Examples

Example 1: Standard Lot Trading

Consider trading EUR/USD:

- Contract Size: 100,000

- Lot Size: 1.0

- Current Price: 1.3524

- Leverage: 100:1

- Required Margin: $1,352.40

Example 2: Mini Lot Trading

For a GBP/JPY trade:

- Contract Size: 10,000

- Lot Size: 0.5

- Current Price: 151.75

- Leverage: 200:1

- Required Margin: $379.38

Advanced Usage Strategies

Multiple Position Management

Use the calculator to plan multiple positions across different currency pairs while maintaining proper risk management:

- Calculate total margin requirements for portfolio positions

- Determine available margin for additional trades

- Balance leverage across different currency pairs

Risk-Based Position Sizing

Incorporate the margin calculator into your risk management strategy:

- Determine maximum position sizes based on account equity

- Calculate optimal lot sizes for risk percentage targets

- Adjust positions based on volatility and market conditions

Frequently Asked Questions

What is forex margin?

Forex margin is the collateral required to open and maintain a leveraged trading position. It represents a percentage of the total position size and varies based on the leverage ratio offered by your broker.

How does leverage affect margin requirements?

Higher leverage ratios reduce the required margin. For example, 50:1 leverage requires 2% margin, while 500:1 leverage requires only 0.2% margin of the total position size.

What is the difference between margin and leverage?

Margin is the actual capital required to open a position, while leverage is the multiplier that determines how much larger your trading position can be compared to your margin.

How do I calculate pip value using margin?

Pip value calculation relates to your position size and can be determined once you know your margin and leverage. For standard lots, each pip typically represents $10 in EUR/USD trading.

Should I always use maximum available leverage?

Using maximum leverage increases both potential profits and risks. It’s recommended to use leverage conservatively based on your risk tolerance and trading strategy.

How often should I calculate margin requirements?

Calculate margin requirements before opening any new position and when adjusting existing positions to ensure proper risk management.

Common Trading Scenarios

Scalping Strategy

Short-term traders often use higher leverage and need to calculate margins frequently for multiple quick trades:

- Multiple small positions throughout the day

- Quick position sizing calculations

- Frequent margin requirement updates

Swing Trading Approach

Longer-term traders typically use lower leverage and focus on larger position sizes:

- Careful margin calculation for extended positions

- Conservative leverage utilization

- Strategic position sizing based on technical levels

Best Practices for Margin Calculation

Follow these guidelines for effective margin management:

- Always calculate margin before entering trades

- Maintain adequate free margin for market fluctuations

- Consider currency pair volatility when determining position sizes

- Use appropriate leverage based on your trading style

- Regular monitoring of margin levels during active trades

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.