Forex Profit/Loss Calculator

Is this tool helpful?

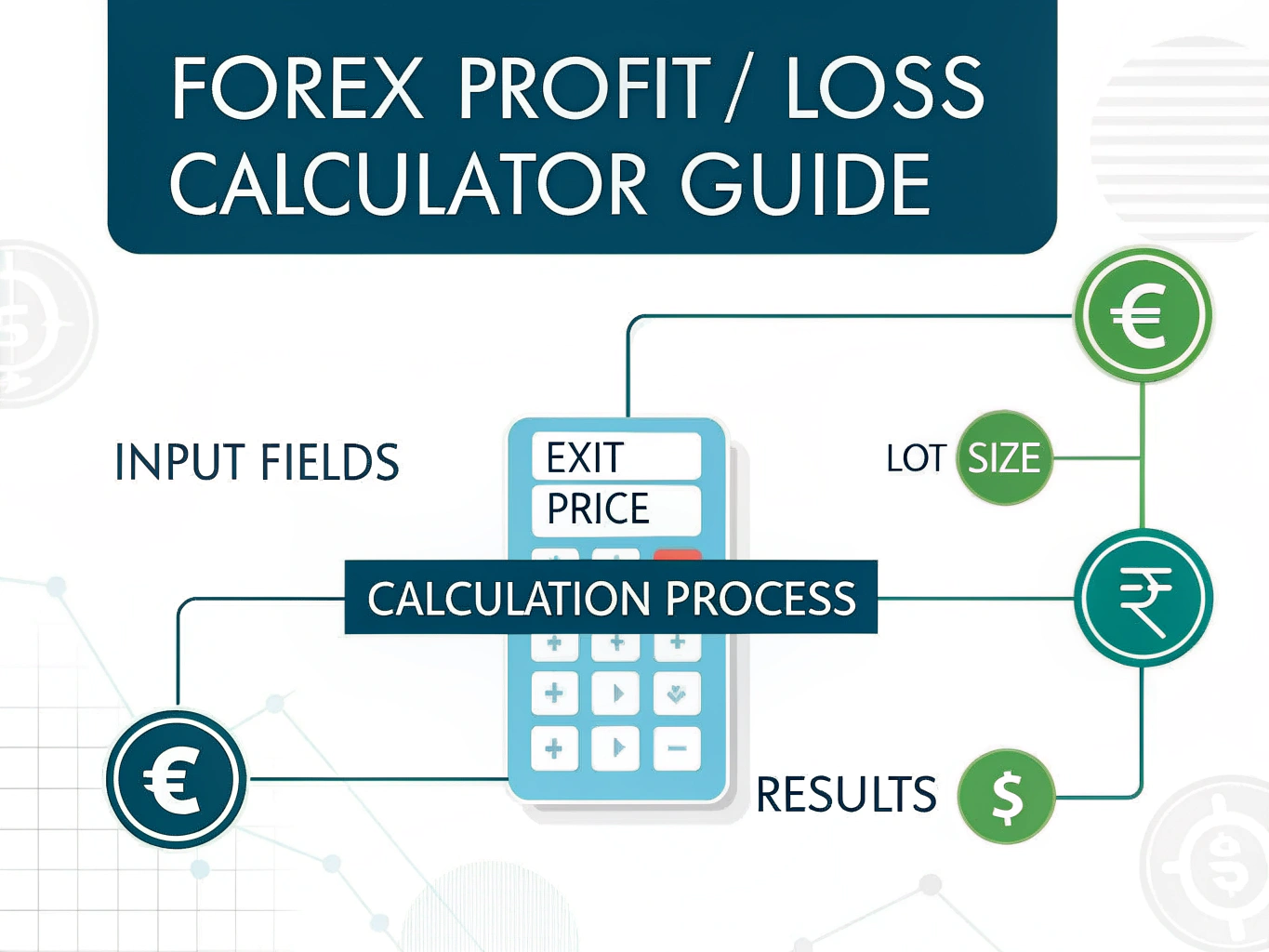

How to Use the Forex Profit/Loss Calculator Effectively

To calculate your forex trading profit or loss, follow these simple steps:

- Entry Price: Input your position’s opening price (e.g., 1.22450 for EUR/USD)

- Exit Price: Enter your position’s closing price (e.g., 1.22650 for EUR/USD)

- Lot Size: Specify your trading volume (e.g., 0.5 lots or 2.5 lots)

Click the “Calculate” button to instantly see your profit/loss and the total pip movement.

Understanding Forex Profit/Loss Calculations

The Forex Profit/Loss Calculator is an essential tool for currency traders to accurately determine their potential gains or losses before entering a trade. It uses the following formula to calculate the profit or loss:

$$ \text{Profit/Loss} = (\text{Exit Price} – \text{Entry Price}) \times \text{Lot Size} \times \text{Pip Value} $$Core Components of the Calculator

- Price Movement: The difference between exit and entry prices

- Lot Size: The trading volume, where 1 standard lot equals 100,000 units

- Pip Value: The monetary value of a single pip movement ($10 per pip for EUR/USD)

Benefits of Using the Forex Profit/Loss Calculator

- Precise risk management through accurate position sizing

- Quick assessment of potential trade outcomes

- Better trading decisions based on calculated risk-reward ratios

- Enhanced money management strategies

- Prevention of overleveraging by understanding position impacts

Practical Applications and Examples

Example 1: Long Position

Consider a long EUR/USD position:

- Entry Price: 1.18250

- Exit Price: 1.18450

- Lot Size: 1.5

- Calculation: (1.18450 – 1.18250) × 10000 × 1.5 × $10 = $300 profit

Example 2: Short Position

For a short EUR/USD position:

- Entry Price: 1.19800

- Exit Price: 1.19600

- Lot Size: 0.75

- Calculation: (1.19600 – 1.19800) × 10000 × 0.75 × $10 = $150 profit

Advanced Trading Strategies Using the Calculator

Risk-Reward Ratio Assessment

Use the calculator to determine optimal position sizes based on your risk tolerance:

- Set maximum risk per trade (e.g., 2% of account balance)

- Calculate required lot size for stop-loss placement

- Determine potential profit at target price levels

Position Scaling

Plan multiple entry and exit points:

- Calculate partial profit-taking levels

- Determine position add-on sizes

- Evaluate overall position performance

Trading Scenarios and Applications

Day Trading

Short-term traders benefit from quick calculations:

- Multiple trade sizing throughout the day

- Quick profit target assessments

- Rapid position adjustments

Swing Trading

Longer-term position management:

- Weekly profit/loss projections

- Position size optimization

- Multiple time frame analysis

Frequently Asked Questions

What is a pip in forex trading?

A pip is the smallest price move in forex trading, typically the fourth decimal place for most currency pairs (0.0001). For EUR/USD, each pip movement equals $10 per standard lot.

How do lot sizes affect profit and loss?

Lot sizes directly multiply your potential profit or loss. A larger lot size means higher potential returns but also increased risk. Standard lot (1.0) = 100,000 units, Mini lot (0.1) = 10,000 units, Micro lot (0.01) = 1,000 units.

Can I use this calculator for other currency pairs?

This calculator is specifically designed for EUR/USD with a $10 pip value. Different currency pairs have different pip values based on their exchange rates and base currencies.

Why do I need to calculate profit/loss before trading?

Pre-trade calculations help you:

- Determine appropriate position sizes

- Set realistic profit targets

- Manage risk effectively

- Maintain proper account management

How do I use this calculator for risk management?

Follow these steps:

- Determine your maximum acceptable loss per trade

- Input your intended entry price and stop-loss level

- Adjust lot size until the calculated loss matches your risk tolerance

- Set profit targets based on your preferred risk-reward ratio

What’s the difference between profit calculation for long and short positions?

The formula remains the same, but:

- Long positions profit when exit price > entry price

- Short positions profit when exit price < entry price

- The calculation automatically handles the direction

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.