Debt to Income Ratio Calculator

Is this tool helpful?

How to use the tool

- Type your annual gross income. Example inputs: $72,500 or $138,250.

- Add your total monthly debt payments. Include loans, credit-card minimums, etc. Example inputs: $1,450 or $3,200.

- Press “Calculate”. The script instantly returns your DTI ratio and a plain-language interpretation.

Formula used

The calculator follows the industry standard:

$$ \text{DTI (\%)} = rac{\text{Total Monthly Debt}}{\text{Annual Income} / 12}\times100 $$

Example calculation

- Annual income: $90,000 ⇒ monthly income = $7,500

- Monthly debt: $2,250

- DTI: $$ rac{2,250}{7,500}\times100 = 30.00\%$$

At 30 %, you meet the <36 % benchmark many lenders prefer (CFPB, 2023).

Quick-Facts

- DTI < 36 % is viewed as “low risk” by the CFPB (Consumer Financial Protection Bureau, https://www.consumerfinance.gov).

- FHA mortgages permit DTIs up to 50 % with strong credit (HUD Handbook 4000.1 II-A-5, 2023).

- Average U.S. household DTI was 31 % in 2022 (Federal Reserve “Survey of Consumer Finances” 2023).

- Lenders calculate DTI using gross income, not take-home pay (Fannie Mae Selling Guide B3-6-03, 2023).

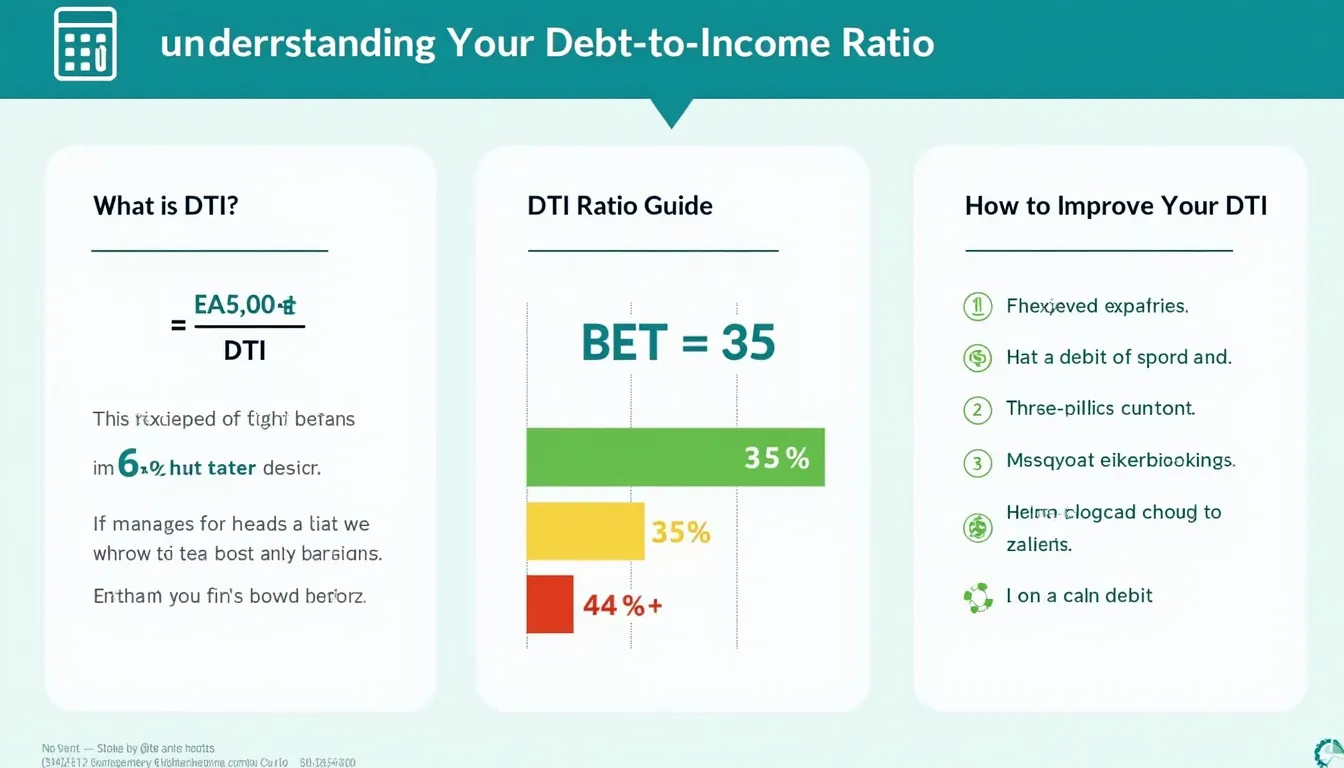

What is the debt-to-income ratio?

DTI is the percentage of your gross monthly income committed to debt payments. It gauges repayment capacity and shapes underwriting decisions (CFPB, 2023).

How do lenders use DTI?

Underwriters compare your DTI to program limits; a lower ratio signals lower default risk and can unlock better rates (Freddie Mac Single-Family Seller/Servicer Guide 5501.2, 2023).

Which debts count?

Include mortgages, rent, auto, student and personal loans, credit-card minimums, alimony, and child support; exclude utilities and groceries (CFPB, 2023).

Does DTI affect my credit score?

Credit scores ignore DTI, but high debt can raise credit-utilization ratios, lowering scores indirectly (FICO “Understanding Scores”, 2023).

What DTI do I need for a mortgage?

Conventional loans cap DTI at 45 % while FHA allows 50 % if compensating factors exist (HUD 4000.1, 2023). “Ratios above 50 % require manual underwriting” (HUD quote).

How can I lower DTI quickly?

Pay down revolving balances, refinance high-interest loans, or boost income with overtime or side work; each action lowers the numerator or raises the denominator (NerdWallet, 2023).

Should I use gross or net income?

Use gross income; lending rules specify it for consistency across applicants (Fannie Mae Guide B3-6-03, 2023).

How often should I recalculate DTI?

Check each time your debt or income changes, and at least annually, to spot problems early (CFPB “Managing Debt”, 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.