GST Calculator

Is this tool helpful?

How to use the tool

- Original Price (USD): type the untaxed amount—e.g., 200.50 or 75.20.

- GST Rate (%): enter the applicable percentage—e.g., 15 or 8.

- Press Calculate GST. The display shows three lines: Original Price, GST Amount, and Total Price.

- To adjust, overwrite either field; results update each time you rerun the calculation.

Formulas used

- GST Amount: $$\text{GST}=P rac{R}{100}$$

- Total Price: $$\text{Total}=P+ \text{GST}=P\left(1+ rac{R}{100}\right)$$

Example calculations

- Price 200.50, Rate 15 % ⇒ GST $30.08, Total $230.58.

- Price 75.20, Rate 8 % ⇒ GST $6.02, Total $81.22.

Quick-Facts

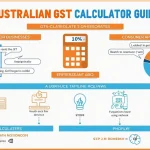

- Australia’s standard GST rate is 10 % (ATO GST Overview, https://www.ato.gov.au).

- Canada levies a 5 % federal GST, with provinces adding up to 10 % more (Government of Canada, 2023).

- India applies four GST slabs: 5 %, 12 %, 18 %, 28 % (GST Council FAQ, https://gstcouncil.gov.in).

- New Zealand collected NZ$27 billion in GST during 2022-23 (NZ Treasury, 2023 Budget).

What is GST?

GST is a consumption tax added at each value-addition stage; input credits prevent cascading tax (OECD Consumption Tax Trends 2022).

How does the calculator find GST?

It multiplies the untaxed price by the rate fraction, then rounds to two decimals for currency display.

Can I reverse-calculate pre-tax price?

Yes. Rearrange the formula: $$P=\frac{\text{Total}}{1+R/100}$$ and enter your inclusive amount and rate.

Which currencies work?

The math is currency-agnostic; substitute your local symbol when interpreting results.

What rounding rule is used?

Values round half-up to two decimal places, matching ISO 4217 minor-unit practice (ISO 4217:2015).

Is GST the same as VAT?

Both tax final consumption; GST is the term in Australia, India, etc., while VAT is Europe’s equivalent (European Commission VAT Guide 2023).

Why is input validation important?

Positive-number and range checks stop errors that can distort invoices or tax filings (NIST Secure Coding 2019).

How often do GST rates change?

Major economies revise rates roughly every 5-10 years, usually after parliamentary review (PwC Worldwide Tax Summaries 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.