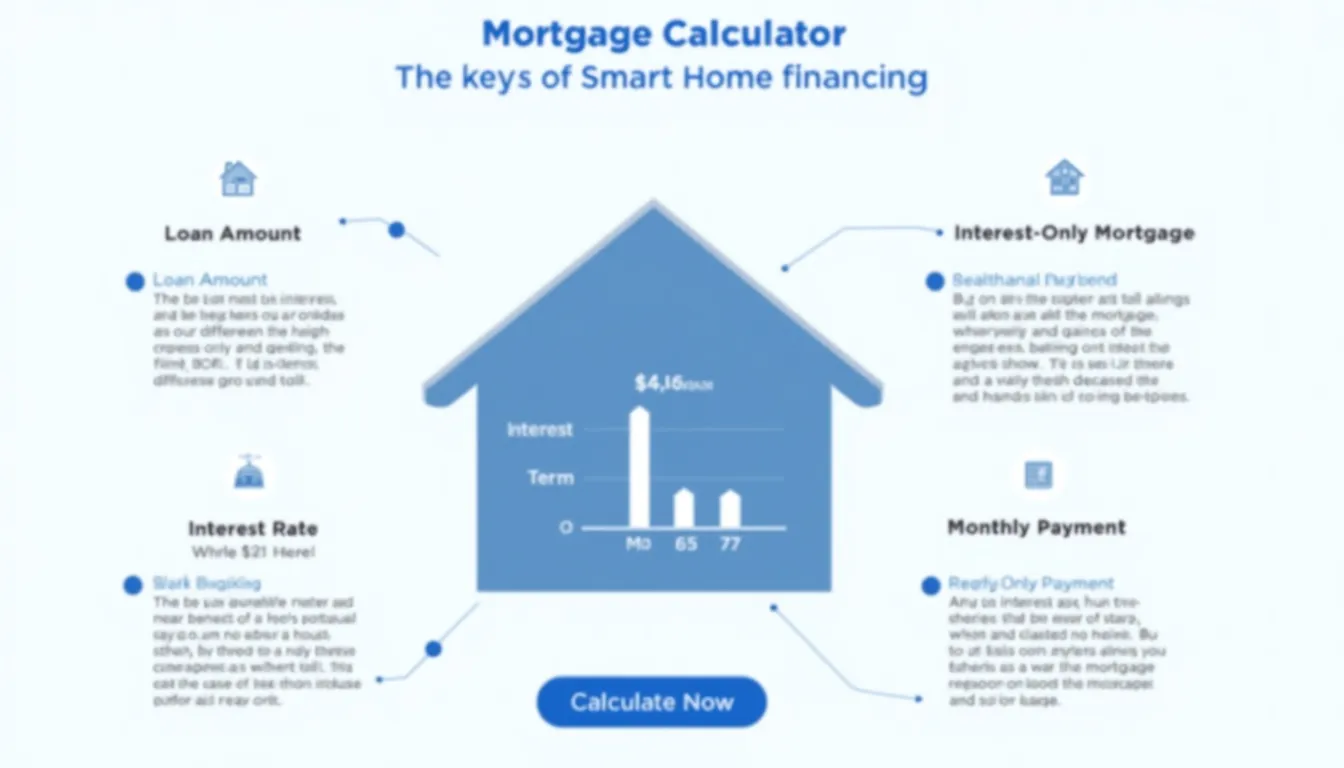

Mortgage Calculator

Is this tool helpful?

How to Use the Mortgage Calculator Effectively

This intuitive mortgage calculator helps you estimate your monthly payments quickly and accurately. Follow these simple steps to get started:

- Enter the Loan Amount ($): Input the total loan amount you intend to borrow. For example, you could enter 350000 or 450000. Please input the number without any commas or currency symbols.

- Input the Interest Rate (%): Provide the annual interest rate as a percentage. For instance, you might enter 4.25 or 5.1 to reflect your lender’s rate.

- Specify the Loan Term (years): Enter the duration of your mortgage in years. Common terms are 10, 20, or 25 years — for example, 20 or 25.

- Select the Mortgage Type: Choose between Repayment (where both principal and interest are paid monthly) or Interest Only (paying interest monthly without reducing the principal).

- Click Calculate: After filling in all fields, click the calculate button to instantly see your estimated monthly mortgage payment.

The tool will then display your monthly payment, helping you understand your financial commitment before moving forward.

Mortgage Calculator: Definition, Purpose, and Key Benefits

A mortgage calculator is a valuable financial tool designed to estimate your monthly mortgage payments based on the loan amount, interest rate, loan term, and mortgage type. This calculator is perfect for prospective homebuyers, refinancers, or anyone seeking to understand potential home financing costs.

The purpose of this calculator is to empower users to:

- Quickly estimate monthly mortgage payments without needing complex financial knowledge.

- Compare different loan scenarios by adjusting key inputs to see how changes affect payments.

- Understand the impact of mortgage types such as repayment versus interest-only options.

- Plan and budget accordingly to ensure home affordability fits your financial goals.

- Make informed decisions when negotiating mortgage terms or considering refinancing strategies.

By integrating these benefits, the mortgage calculator helps simplify one of the most important financial steps in your home ownership journey.

Example Calculations and How This JavaScript Mortgage Calculator Works

This JavaScript-powered mortgage calculator uses well-established financial formulas to determine your monthly payments based on the provided inputs:

1. Repayment Mortgage Monthly Payment Formula

For traditional repayment mortgages (principal + interest), the monthly payment P is calculated using the formula:

$$ P = L \times \frac{r(1+r)^n}{(1+r)^n – 1} $$Where:

- P = Monthly payment

- L = Loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in months)

2. Interest-Only Mortgage Monthly Payment Formula

For interest-only loans (paying only interest each month), the formula simplifies to:

$$ P = L \times \frac{r}{12} $$Where:

- P = Monthly payment

- L = Loan amount

- r = Annual interest rate (expressed as a decimal)

Sample Calculation 1: Repayment Mortgage

Consider a loan amount of $400,000, interest rate of 3.75% annually, and a loan term of 25 years. Using the repayment formula:

- Monthly interest rate = 3.75% ÷ 12 = 0.003125

- Number of payments = 25 × 12 = 300 months

Plugging these values into the formula calculates your estimated monthly payment, which will provide a close approximation to the actual amount you’ll owe monthly.

Sample Calculation 2: Interest-Only Mortgage

For a loan amount of $500,000 with an annual interest rate of 4.2%, the monthly payment on an interest-only mortgage would be calculated as follows:

- Monthly interest rate = 4.2% ÷ 12 = 0.0035

- Monthly payment = $500,000 × 0.0035 = $1,750

This calculation shows that you would pay $1,750 per month in interest only, with the principal balance remaining unchanged during the interest-only period.

Additional Benefits of This Advanced Mortgage Calculator

In addition to providing accurate monthly payment estimates, this calculator delivers several advantages:

- Responsive and user-friendly interface enhanced with Tailwind CSS styling for intuitive interaction.

- Real-time validation and error handling to ensure your inputs are accurate and meaningful.

- Mortgage type flexibility allowing easy switching between repayment and interest-only options.

- Local storage feature which saves your latest entries, enabling continuity when you return to the calculator.

- Clear display of results with formatted currency values tailored to US dollar standards.

Why Use a Mortgage Calculator for Smarter Home Financing?

Understanding your prospective mortgage payments before committing to a loan is pivotal in successful home financing. This mortgage calculator:

- Helps manage expectations by presenting realistic monthly payment obligations.

- Enables budget planning by integrating mortgage estimates into your overall monthly expenses.

- Supports strategic decision-making whether you’re purchasing your first home, refinancing, or investing in property.

- Facilitates informed discussions with lenders and financial advisors, using accurate payment figures.

- Empowers you to compare multiple mortgage options quickly and confidently.

Use this tool as a stepping stone toward securing the perfect mortgage tailored to your individual financial situation and homeownership goals.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.