Gross Operating Income Calculator

Is this tool helpful?

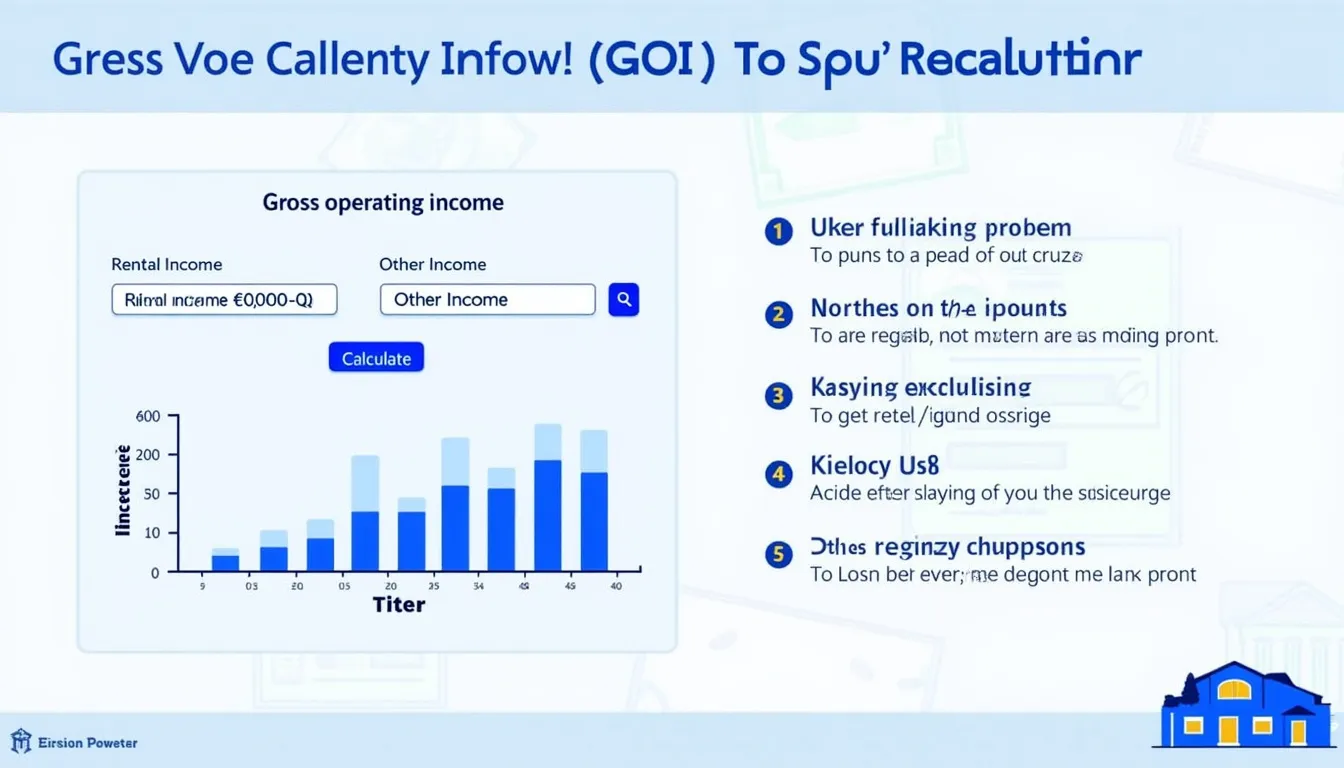

How to Use the Gross Operating Income Calculator Effectively

Our Gross Operating Income (GOI) Calculator is designed to help property owners, real estate investors, and financial analysts quickly and accurately determine the total income generated from a property before expenses. Here’s a step-by-step guide on how to use this powerful tool:

- Enter your Rental Income in the first input field. This should include all income received from tenants for renting the property.

- Input any Other Income in the second field. This may include laundry facilities, parking fees, vending machines, or any additional sources of income related to the property.

- Click the Calculate button to generate your Gross Operating Income.

- View your results in the designated area below the calculator.

The calculator will instantly provide you with your Gross Operating Income, giving you a clear picture of your property’s income-generating potential.

Understanding Gross Operating Income: Definition, Purpose, and Benefits

Gross Operating Income is a crucial metric in real estate investment and property management. It represents the total income generated by a property before accounting for any operating expenses or vacancy losses. The GOI calculation is an essential step in evaluating a property’s financial performance and potential profitability.

The Mathematical Formula for Gross Operating Income

The formula for calculating Gross Operating Income is straightforward:

$$ GOI = Rental Income + Other Income $$Where:

- GOI is the Gross Operating Income

- Rental Income is the total amount received from tenants for renting the property

- Other Income includes any additional revenue generated by the property

Purpose of Calculating Gross Operating Income

The primary purposes of calculating GOI include:

- Assessing a property’s income-generating potential

- Comparing different properties or investment opportunities

- Serving as a starting point for more detailed financial analyses

- Helping in the valuation of income-producing properties

- Assisting in budgeting and financial planning for property management

Benefits of Using the Gross Operating Income Calculator

Our GOI Calculator offers numerous advantages for real estate professionals, investors, and property managers:

- Time-saving: Quickly calculate GOI without manual computations or complex spreadsheets.

- Accuracy: Eliminate human error in calculations, ensuring precise results every time.

- User-friendly: The intuitive interface makes it easy for users of all experience levels to input data and obtain results.

- Instant results: Get immediate feedback on your property’s income potential, allowing for quick decision-making.

- Consistency: Maintain a standardized approach to calculating GOI across multiple properties or investment opportunities.

- Accessibility: Use the calculator anytime, anywhere, as long as you have internet access.

- No installation required: As a web-based tool, there’s no need to download or install any software.

- Mobile-friendly: Access the calculator on your smartphone or tablet for on-the-go calculations.

Addressing User Needs and Solving Specific Problems

The Gross Operating Income Calculator addresses several key needs and solves specific problems faced by real estate professionals and investors:

1. Streamlining Financial Analysis

For real estate investors and analysts, time is of the essence when evaluating potential investments. Our GOI Calculator streamlines the initial stages of financial analysis by providing quick, accurate results. This allows investors to rapidly assess multiple properties and focus their attention on the most promising opportunities.

2. Improving Decision-Making

By providing instant GOI calculations, this tool empowers users to make more informed decisions about property acquisitions, management strategies, and investment allocations. The ability to quickly compare GOI across different properties or scenarios enhances the decision-making process.

3. Enhancing Property Valuation

GOI is a crucial component in various property valuation methods, such as the income approach. Our calculator helps users quickly determine this essential metric, facilitating more accurate and efficient property valuations.

4. Simplifying Budgeting and Forecasting

Property managers and owners can use the GOI Calculator to simplify their budgeting and forecasting processes. By easily calculating current GOI and projecting future income scenarios, users can create more accurate financial plans and set realistic goals for their properties.

5. Facilitating Communication with Stakeholders

The clear, straightforward results provided by the GOI Calculator can help real estate professionals communicate more effectively with clients, partners, or investors. The tool’s output serves as a common reference point for discussions about a property’s financial performance.

Practical Applications and Example Calculations

To illustrate the practical applications of the Gross Operating Income Calculator, let’s explore some real-world scenarios:

Example 1: Residential Apartment Complex

Consider a 20-unit apartment complex with the following income sources:

- Monthly rent: $1,000 per unit

- Annual parking fees: $6,000

- Laundry facility income: $3,600 per year

Calculation:

- Rental Income: $1,000 × 20 units × 12 months = $240,000

- Other Income: $6,000 (parking) + $3,600 (laundry) = $9,600

Using our GOI Calculator:

- Rental Income: $240,000

- Other Income: $9,600

The calculated Gross Operating Income would be $249,600.

Example 2: Mixed-Use Commercial Property

Let’s analyze a mixed-use property with retail spaces and office units:

- Annual retail space rent: $180,000

- Annual office space rent: $250,000

- Billboard advertising income: $15,000 per year

- Vending machine revenue: $2,400 per year

Calculation:

- Rental Income: $180,000 (retail) + $250,000 (office) = $430,000

- Other Income: $15,000 (billboard) + $2,400 (vending) = $17,400

Using our GOI Calculator:

- Rental Income: $430,000

- Other Income: $17,400

The calculated Gross Operating Income would be $447,400.

Example 3: Vacation Rental Property

Consider a vacation rental property with seasonal income:

- Peak season rental income (3 months): $9,000 per month

- Off-peak season rental income (9 months): $3,000 per month

- Annual cleaning fee income: $2,400

Calculation:

- Rental Income: (3 × $9,000) + (9 × $3,000) = $54,000

- Other Income: $2,400 (cleaning fees)

Using our GOI Calculator:

- Rental Income: $54,000

- Other Income: $2,400

The calculated Gross Operating Income would be $56,400.

Frequently Asked Questions (FAQ)

1. What is the difference between Gross Operating Income and Net Operating Income?

Gross Operating Income (GOI) represents the total income generated by a property before any expenses are deducted. Net Operating Income (NOI) is calculated by subtracting operating expenses from the GOI. NOI provides a more accurate picture of a property’s profitability, while GOI focuses solely on income generation.

2. Should I include vacancy and credit losses in the GOI calculation?

No, vacancy and credit losses are not included in the GOI calculation. These factors are typically considered when calculating the Effective Gross Income (EGI), which is a step between GOI and NOI in more detailed financial analyses.

3. How often should I calculate my property’s Gross Operating Income?

It’s recommended to calculate GOI at least annually, but more frequent calculations (e.g., quarterly or monthly) can provide better insights into your property’s performance, especially if there are seasonal fluctuations in income or significant changes in the rental market.

4. Can I use the GOI Calculator for residential and commercial properties?

Yes, the GOI Calculator can be used for both residential and commercial properties. The principle of combining rental income with other income sources applies to all types of income-generating real estate.

5. How does Gross Operating Income relate to property value?

GOI is an important factor in determining property value, especially when using income-based valuation methods. A higher GOI generally indicates a more valuable property, as it demonstrates stronger income-generating potential. However, it’s important to consider other factors such as operating expenses, market conditions, and property condition when assessing overall value.

6. What should I include in the “Other Income” category?

The “Other Income” category should include any additional revenue generated by the property that is not part of the base rental income. This may include:

- Parking fees

- Laundry facility income

- Vending machine revenue

- Pet fees or rent

- Storage unit rentals

- Billboard or signage income

- Service charges

7. How can I improve my property’s Gross Operating Income?

To increase your property’s GOI, consider the following strategies:

- Raise rental rates in line with market conditions

- Minimize vacancy periods through effective marketing and tenant retention

- Implement additional income-generating amenities or services

- Optimize the use of available space to create new rental opportunities

- Improve the property’s overall condition and appeal to attract higher-paying tenants

8. Is Gross Operating Income the same as Gross Rental Income?

No, Gross Operating Income is not the same as Gross Rental Income. Gross Rental Income only includes the income generated from rent payments, while GOI includes both rental income and other sources of income related to the property.

9. How does GOI factor into investment decisions?

GOI is an important metric for initial investment screening and comparison. It provides a quick snapshot of a property’s income-generating potential, allowing investors to compare different opportunities on a high level. However, for comprehensive investment decisions, it should be used in conjunction with other financial metrics and property characteristics.

10. Can the GOI Calculator be used for multi-year projections?

While the GOI Calculator is designed for single-year calculations, you can use it to create multi-year projections by adjusting the input values to reflect anticipated changes in rental income and other income sources for each year. This can help in creating more comprehensive financial forecasts for your property.

Please note that we cannot guarantee that the webtool or results from our webtool are always correct, complete, or reliable. Our content and tools might have mistakes, biases, or inconsistencies.

Conclusion: Harness the Power of Gross Operating Income Analysis

The Gross Operating Income Calculator is an invaluable tool for anyone involved in real estate investment, property management, or financial analysis. By providing quick, accurate calculations of a property’s total income before expenses, it empowers users to make informed decisions, streamline their financial analyses, and gain crucial insights into a property’s income-generating potential.

Key benefits of using our GOI Calculator include:

- Time-saving automation of calculations

- Improved accuracy in financial analysis

- Enhanced decision-making capabilities

- Simplified property comparison and valuation

- Streamlined budgeting and forecasting processes

By incorporating the GOI Calculator into your real estate toolkit, you’ll be better equipped to evaluate properties, optimize your investment strategy, and maximize your returns in the competitive world of real estate.

Take the first step towards more efficient and effective property analysis – use our Gross Operating Income Calculator today and unlock the full potential of your real estate investments!

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.