Hourly Salary Calculator

Is this tool helpful?

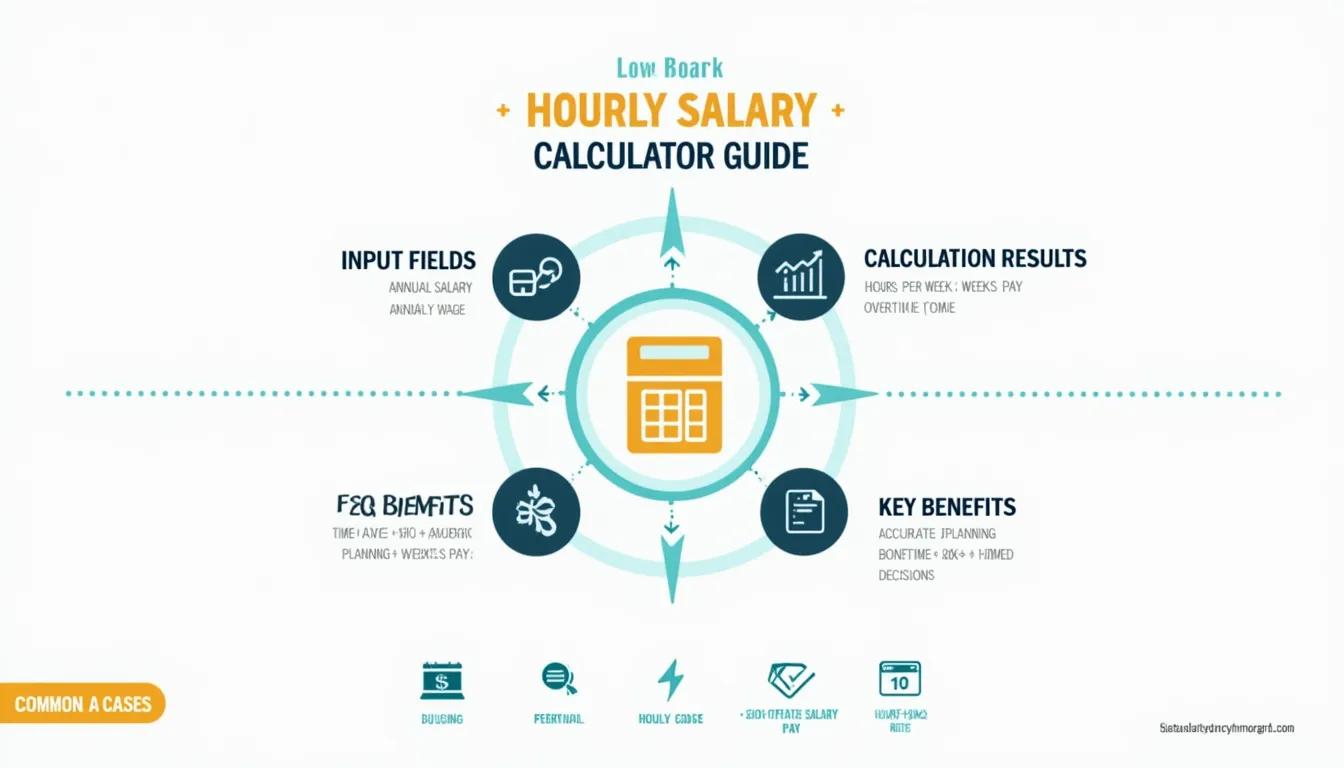

How to use the tool

1. Enter pay information

- Annual salary: type a yearly figure, e.g., $78 500 or $112 000.

- Hourly wage: or supply an hourly rate such as $32.50 or $47.80.

2. Define your schedule

- Hours per week: typical values include 37.5 or 42.

- Weeks per year: adjust for leave—50 or 48 are common.

3. Add overtime (optional)

- Overtime hours: e.g., 4 or 6.5 per week.

- Overtime rate: choose 1.5× (time-and-a-half) or 2× (double-time).

4. Review the formulas

The calculator applies:

$$\text{Hourly Wage}= rac{\text{Annual Salary}}{\text{Hours per Week}\times\text{Weeks per Year}}$$

$$\text{Annual Salary}= \text{Hourly Wage}\times\text{Hours per Week}\times\text{Weeks per Year}$$

$$\text{Weekly Pay}= (\text{Hourly Wage}\times\text{Hours per Week}) + (\text{Hourly Wage}\times\text{Overtime Rate}\times\text{Overtime Hours})$$

$$\text{Monthly Pay}= rac{\text{Annual Salary}}{12}$$

5. Example calculations

Example A — Salary to hourly

- Annual salary: $80 000

- Hours/week: 37.5

- Weeks/year: 50

$$\text{Hourly Wage}= rac{80000}{37.5\times50}=42.67$$

Monthly pay = $80 000 / 12 = $6 666.67

Example B — Hourly with overtime

- Hourly wage: $33

- Hours/week: 42

- Overtime: 6 h at 1.5×

- Weeks/year: 48

Regular weekly pay = 33 × 42 = $1 386

Overtime weekly pay = 33 × 1.5 × 6 = $297

Total annual salary = (1 386 + 297) × 48 = $80 784

Quick-Facts

- Full-time U.S. employees typically work 1 820 hours yearly (40 h × 52 w) (U.S. DOL, 2023).

- Federal law requires overtime pay of at least 1.5× after 40 hours (29 CFR §778.107, 2023).

- Private-sector workers average 11 paid vacation days, roughly two weeks (BLS “Employee Benefits”, 2023).

- Median U.S. hourly wage reached $23.13 in 2023 (BLS Occupational Employment, 2024).

FAQ

What formula converts annual salary to hourly wage?

Divide annual salary by the product of weekly hours and working weeks. $$\text{Hourly}= rac{\text{Annual}}{\text{Hours}×\text{Weeks}}$$ This keeps overtime and vacation adjustments explicit (IRS Publication 15, 2024).

How does overtime affect weekly pay?

Weekly pay rises by the overtime premium: base rate × overtime factor × extra hours. FLSA mandates at least 1.5×, boosting take-home by 50 % for every overtime hour (U.S. DOL, 2023).

Why adjust weeks per year instead of assuming 52?

Subtracting unpaid leave, holidays, or contract gaps yields a realistic earnings picture. “Accurate labor-cost models exclude non-billable weeks” (Project Management Institute, 2022).

Can freelancers use the calculator?

Yes. Input desired annual income and expected billable hours to reveal a sustainable hourly rate, helping you meet profit goals while covering overhead (Freelancers Union Report, 2023).

What is a competitive hourly wage in the U.S.?

Any figure above the median $23.13/h outranks half of U.S. jobs (BLS, 2024). Adjust upward for region and skill demand using local OES data.

How can the results guide salary negotiations?

Convert offers to hourly values, compare against industry medians, and present factual gaps. Negotiators who cite data secure 8-12 % higher raises on average (Payscale Salary Negotiation Guide, 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.