Is this tool helpful?

How to use the tool

1. Fill in the fields

- Principal ($): the starting amount. Examples: 7 000 or 22 500.

- Future Value ($): amount after interest. Examples: 8 750 or 31 400.

- Time (Years): investment or loan duration. Examples: 2.5 or 5.75.

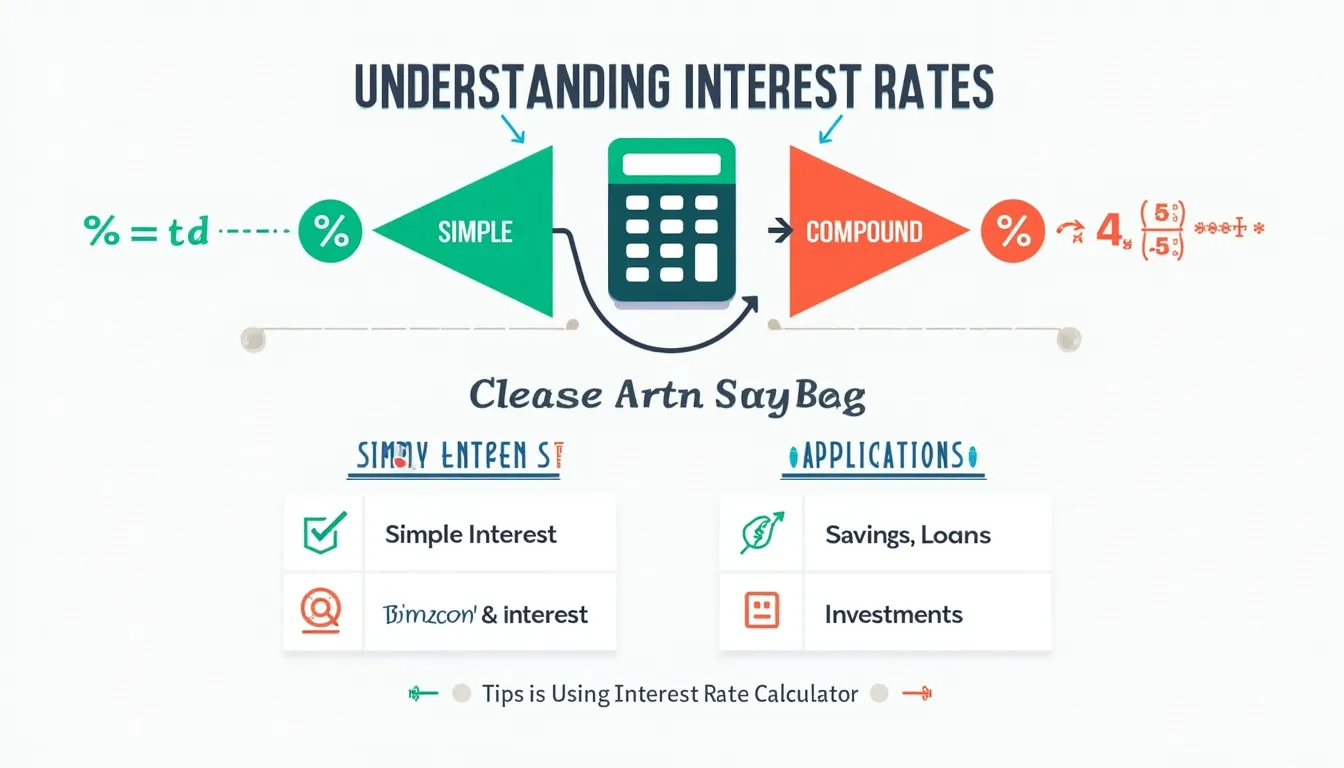

- Interest Type: select Simple or Compound.

- Compounding Frequency: if compound, pick 1, 2, 4, 12, or 365 times per year.

2. Apply the formulas

Simple interest rate

$$r_{annual}= rac{FV-P}{P\times t}$$

Compound interest rate (nominal annual)

$$r_{annual}=n\left(\left( rac{FV}{P}\right)^{ rac1{n t}}-1\right)$$

3. Check two worked examples

Example A — Simple interest

- P = 7 000

- FV = 8 750

- t = 2.5 years

Rate: (8 750−7 000)/(7 000×2.5)=0.10 ⇒ 10 % per year.

Example B — Compound interest

- P = 4 000

- FV = 6 500

- t = 4 years

- n = 12 (monthly)

Rate: 12×((6 500/4 000)^{1/(12×4)}−1)=0.122 ⇒ 12.2 % per year.

Quick-Facts

- U.S. prime rate averaged 8.50 % in 2023 (Federal Reserve, 2023).

- Daily compounding can raise the effective rate by ≈0.3 % vs. monthly at the same nominal rate (CFI, 2022).

- Simple-interest car loans rarely exceed 72 months under U.S. lending rules (Consumer Financial Protection Bureau, 2021).

- FINRA suggests keeping loan APR below your projected investment return “to avoid negative carry” (FINRA, 2023).

FAQ

What is simple interest?

Simple interest accrues only on the original principal, producing linear growth (Investopedia, https://www.investopedia.com).

How does compound interest grow faster?

Each period adds interest on both principal and prior interest, creating exponential growth (Khan Academy, https://www.khanacademy.org).

What is an effective annual rate (EAR)?

EAR equals $$(1+ rac{r_{nom}}{n})^{n}-1$$ and shows true yearly cost or return (Corporate Finance Institute, 2023).

Which compounding frequency do banks use?

Most U.S. savings accounts compound daily but pay monthly (FDIC “Money Smart” Guide, 2022).

Can I enter decimals for years?

Yes. Enter 1.75 for 1 year 9 months; the formula handles fractional periods accurately.

Does the calculator work for negative rates?

It accepts negative future values, reflecting deflationary scenarios tracked in some European bonds (ECB Statistical Data Warehouse, 2021).

Why is my calculated rate higher than the APR a lender quotes?

Lenders often include fees in APR, whereas this tool uses pure interest; add fees to FV for a closer match (Consumer Financial Protection Bureau, 2022).

How can I lower borrowing costs?

Shorten the term or negotiate a lower nominal rate—each 0.5 % cut on a 30-year $300 k mortgage saves ≈$31 k interest (Freddie Mac Mortgage Calculator, 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.