Leverage Ratio Calculator

Is this tool helpful?

How to use the tool

- Total Liabilities: Type every balance-sheet obligation—e.g., 125,500 or 310,200.

- Total Debts: Add loans and credit cards—e.g., 38,800 or 96,000.

- Total Income: Enter annual income from all sources—e.g., 92,000 or 450,000.

- Hit “Calculate”. The result appears instantly.

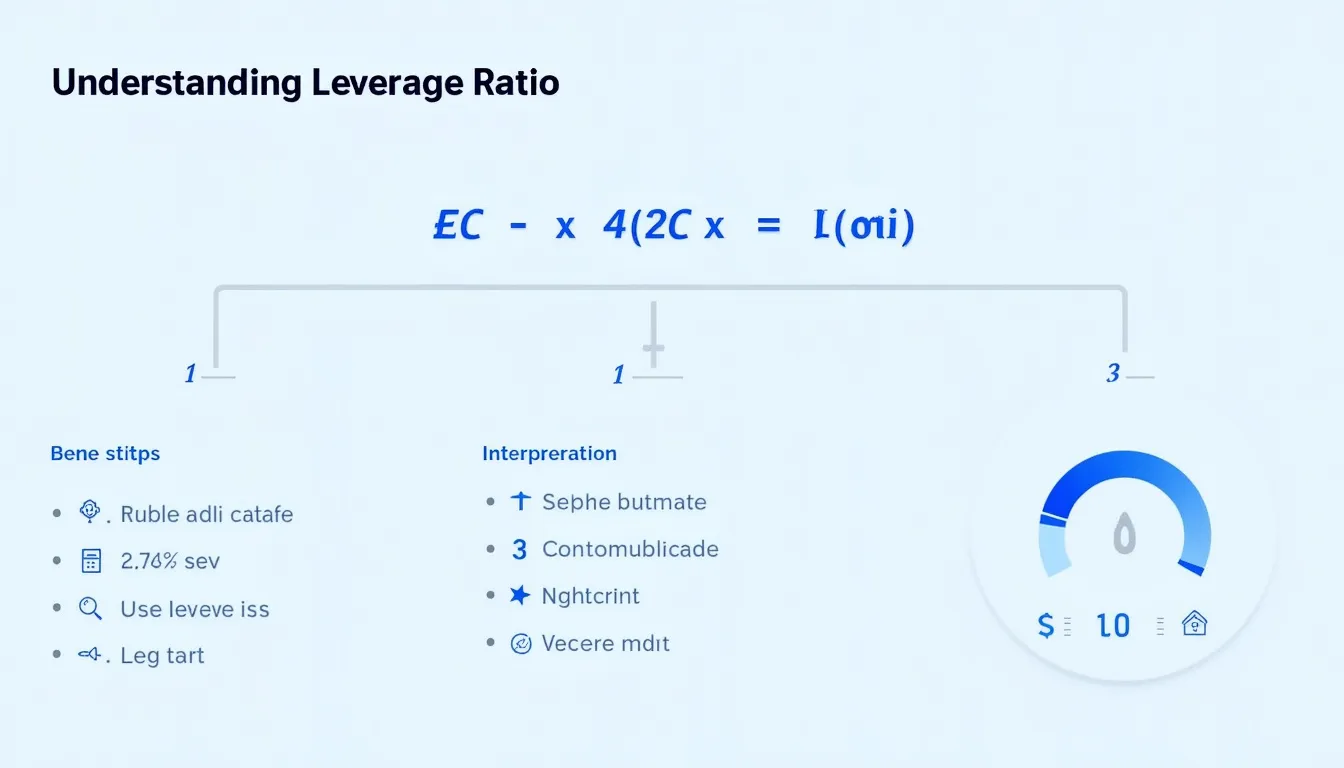

Formula

$$\text{Leverage Ratio}= rac{\text{Total Liabilities}+\text{Total Debts}}{\text{Total Income}}$$

Example A

- Liabilities: 120 000 $

- Debts: 45 000 $

- Income: 95 000 $

$$ rac{120\,000+45\,000}{95\,000}=1.74$$

Example B

- Liabilities: 400 000 $

- Debts: 150 000 $

- Income: 900 000 $

$$ rac{400\,000+150\,000}{900\,000}=0.61$$

Quick-Facts

- Household leverage under 2.0 is generally considered safe (Federal Reserve FSR 2023).

- Average corporate leverage ratio: 0.55 in 2023 (OECD Corporate Finance Statistics).

- Basel III sets a 3 % minimum leverage ratio for banks (BIS Basel III, 2014).

- US household debt-service ratio sat at 9.8 % in Q4 2023 (Federal Reserve 2024).

FAQ

What is a leverage ratio?

Your leverage ratio shows how many dollars of liabilities and debts you carry for each income dollar earned. It highlights borrowing intensity and risk (Investor.gov).

Why does leverage matter?

Higher leverage magnifies both gains and losses. Excess debt strains cash flow and credit access (Federal Reserve FSR 2023).

What counts as a “good” leverage ratio?

Analysts like ratios below 1.0 for most non-financial entities; banks obey Basel III’s 3 % Tier 1 leverage rule (BIS Basel III, 2014).

How often should I recalculate?

Recompute quarterly for businesses and annually—or before major loans—for households (CFPB budgeting guide).

How can I lower a high ratio?

Pay down high-interest debt, raise income, or refinance to longer terms, reducing numerator or boosting denominator (FINRA, 2023).

Does industry affect interpretation?

Yes. Capital-intensive sectors tolerate higher leverage than service firms. Energy firms averaged 1.2 in 2023, tech 0.3 (S&P Global 2024).

Can leverage predict distress?

Leverage ratios above peer averages raise default probability, but add liquidity and profitability metrics for a full picture (Moody’s Credit Handbook 2023).

Is the calculator secure?

The form runs locally; no data leave your browser. No personal information stores on our servers.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.