Liabilities Calculator

Is this tool helpful?

How to Use the Liabilities Calculator Effectively

The Liabilities Calculator is designed to help individuals and businesses quickly determine their total financial liabilities based on their assets and equity. Follow these simple steps to get accurate results:

- Access the Calculator: Locate the Liabilities Calculator tool on the webpage.

- Enter Assets ($): Input the total value of your assets. This includes cash, real estate, stocks, bonds, vehicles, and other valuable items. For example, you might enter assets = 350,000 or assets = 125,500.

- Enter Equity ($): Provide the total equity value. For companies, this may be shareholder’s equity; for individuals, owner’s equity. Sample inputs could be equity = 200,000 or equity = 100,000.

- Calculate Liabilities: Click the “Calculate Liabilities” button to process your inputs.

- View Results: The calculator will instantly display your total liabilities based on your entries.

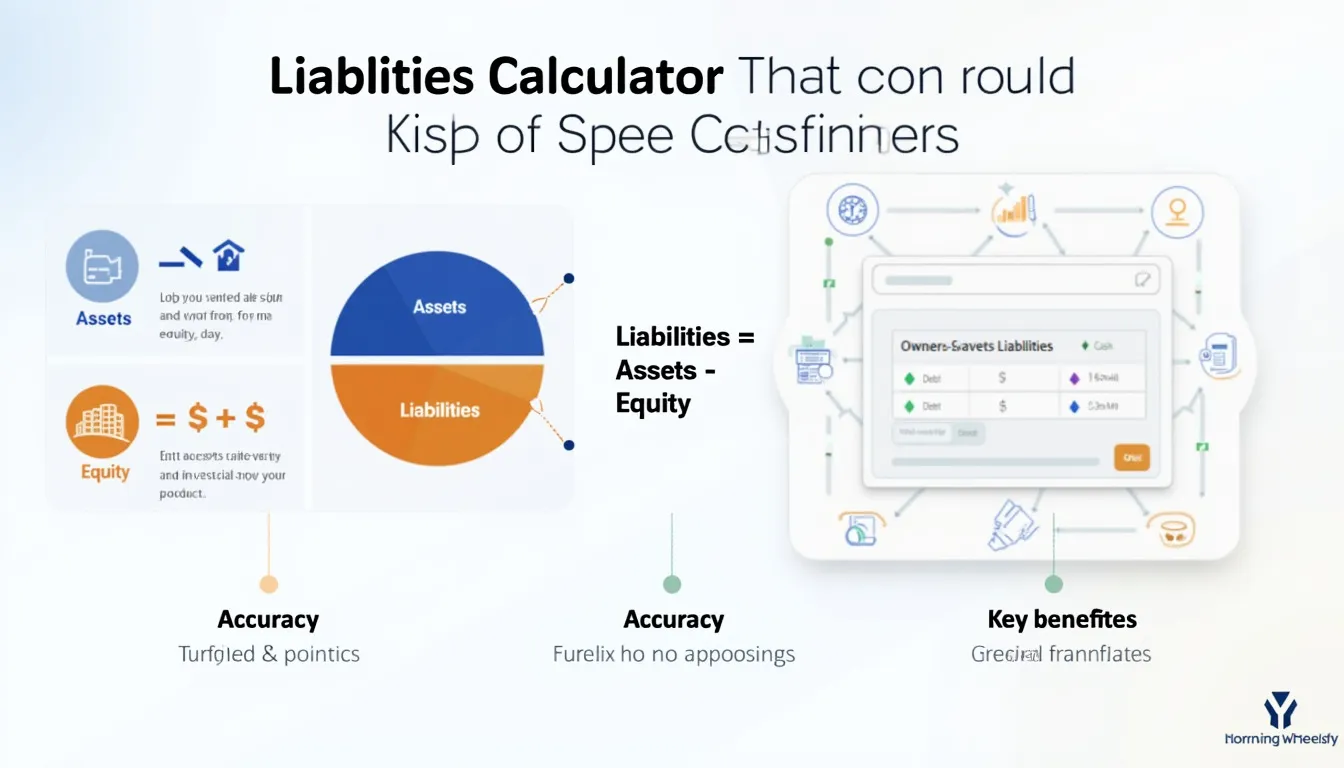

Introducing the Liabilities Calculator: Purpose, Definition, and Key Benefits

What is the Liabilities Calculator? This financial tool automates the computation of liabilities by using your provided asset and equity figures. It simplifies the complex accounting calculations to give you immediate insight into your financial obligations.

Why use this tool? The Liabilities Calculator helps users achieve:

- Accurate financial liability calculations, removing errors common in manual methods.

- Instant results, saving valuable time over traditional spreadsheet methods.

- Convenient, online access anytime, anywhere, with an intuitive user interface.

- Clear financial insights to better understand your current financial obligations.

- Improved financial literacy by reinforcing the fundamental accounting principles.

Understanding the Liabilities Calculation and Example Scenarios

The Liabilities Calculator is based on the fundamental accounting equation:

$$ \text{Liabilities} = \text{Assets} – \text{Equity} $$

This equation represents the foundation for assessing your financial position by identifying the amount owed (liabilities) after considering what you own (assets) and the value retained by owners (equity).

Example Calculations to Illustrate Usage

-

Scenario 1 – Individual Financial Assessment:

Suppose you have assets totaling $400,000 (including savings and property) and equity of $300,000. Your liabilities would be calculated as:

Liabilities = $400,000 – $300,000 = $100,000

This tells you have $100,000 in outstanding obligations such as loans or mortgages. -

Scenario 2 – Small Business Financial Review:

A small business possesses assets worth $800,000 (inventory, equipment, cash) and equity of $500,000. Applying the equation:

Liabilities = $800,000 – $500,000 = $300,000

This amount reflects the debts or payables the business currently owes.

Benefits of Using the Liabilities Calculator for Financial Management

1. Enhanced Financial Decision Making

Access to accurate liability data enables users to:

- Assess borrowing capacities responsibly

- Evaluate debt levels before financial commitments

- Optimize investment strategies with clear financial status

2. Streamlined Financial Planning

This calculator helps set the foundation for:

- Creating accurate budgets aligned with liabilities

- Planning debt-reduction strategies and payment schedules

- Forecasting future financial scenarios with liability insights

3. Risk Identification and Management

By understanding liabilities, users can:

- Detect potential over-leveraging situations

- Maintain favorable debt-to-equity ratios

- Avoid financial pitfalls caused by unmonitored debts

4. Time and Resource Savings

Manual accounting can be laborious. Using this tool offers:

- Instantaneous calculations to reduce delays

- Elimination of spreadsheet errors

- Flexibility to test multiple financial scenarios quickly

5. Increased Financial Literacy

Regular use promotes:

- Better comprehension of accounting fundamentals

- Ongoing awareness of financial health

- Motivation to maintain balanced assets and liabilities

Practical Applications: Real-Life Use Cases of the Liabilities Calculator

Personal Financial Management

Individuals can use the calculator to assess debt levels and make confident borrowing or saving decisions. For instance, a recent graduate evaluating student loans and savings can quickly identify their liabilities and create a repayment plan.

Small Business Financial Evaluation

Business owners can monitor liabilities relative to assets and equity, helping prepare for growth or managing cash flow. This tool supports monthly financial reviews to maintain business health.

Investment and Startup Analysis

Startups and investors can use the calculator to showcase financial stability through transparent liability reporting, aiding in funding decisions and negotiations.

Debt Reduction Monitoring

Individuals aiming to reduce debt can track the effectiveness of their strategies over time by comparing liabilities month-to-month, adjusting financial plans accordingly.

Frequently Asked Questions About the Liabilities Calculator

Q1: How reliable is the Liabilities Calculator?

The calculator provides precise results when accurate asset and equity inputs are entered, relying on the core accounting equation for financial liabilities.

Q2: Can this tool be used for both personal and business finances?

Absolutely. Whether managing household budgets or business accounts, the calculator adapts to your financial context.

Q3: How frequently should I use the calculator?

It’s best to use the calculator monthly or anytime significant changes in assets or equity occur, ensuring up-to-date financial insights.

Q4: What if my liabilities calculation is negative?

A negative result indicates your equity exceeds your assets, which may signify input errors or unusual financial circumstances requiring review.

Q5: Does this tool affect my credit score?

While the calculator itself does not impact your credit, understanding liabilities helps you make better financial choices that can indirectly improve your credit profile.

Conclusion: Take Control with the Liabilities Calculator

The Liabilities Calculator is an essential online tool that simplifies understanding financial obligations by providing immediate, accurate liability results. With its user-friendly interface and rooted in fundamental accounting principles, it facilitates better financial management for individuals and businesses alike.

- Gain clear financial clarity and insight

- Support smarter financial planning and risk mitigation

- Save time on complex and error-prone manual calculations

- Improve financial literacy and confidence over time

Start using the Liabilities Calculator today to fully understand and manage your financial liabilities—your first step toward long-term financial success and stability.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.