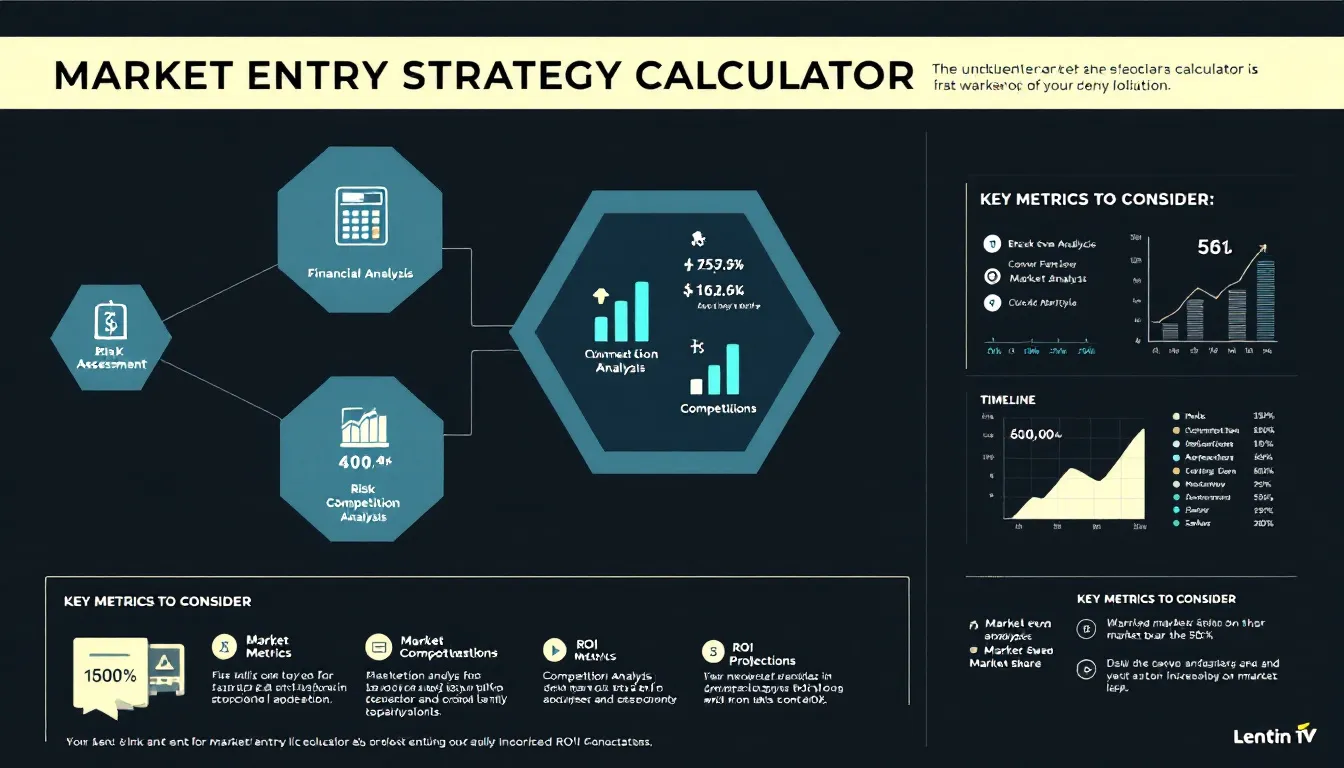

Market Entry Strategy Calculator

Is this tool helpful?

How to Use the Market Entry Strategy Calculator Effectively

This Market Entry Strategy Calculator helps you evaluate the financial viability and risks of entering a new market. To get the most accurate insights, carefully input relevant data in each field. Here’s a step-by-step guide with sample inputs to guide you:

-

Enter Market Information:

- Market Size ($): Add the total value of your target market. For example, 750,000,000 for the electric vehicle market in a region or 1,200,000,000 for cloud computing services globally.

- Market Growth Rate (%): Input the expected annual growth rate of the market. For example, 8.2 for a fast-growing renewable energy sector or 3.5 for a mature consumer goods segment.

- Expected Market Share (%): Enter the percentage of market sales you aim to capture. For instance, 4.5 for a niche software product or 12 for a new health supplement brand.

-

Input Financial Data:

- Initial Investment ($): Provide your upfront market entry costs. Examples: 1,800,000 for opening distribution channels or 900,000 for developing infrastructure.

- Fixed Operating Costs ($/year): Enter annual fixed expenses such as rent, salaries, and utilities. For example, 400,000 for a regional office or 1,200,000 for manufacturing facility overheads.

- Variable Cost per Unit ($): Input the cost to produce one unit of your product. Sample inputs: 80 for cosmetic items or 350 for electric gadgets.

- Selling Price per Unit ($): Enter the price you plan to sell one unit for. Examples: 150 for a wearable device or 600 for professional equipment.

- Projected Sales Volume (units/year): Provide your yearly expected units sold. For example, 20,000 units if you target moderate growth or 50,000 for aggressive sales goals.

- Marketing and Advertising Expenses ($/year): Add your annual promotional budget. Examples: 100,000 for initial brand awareness or 450,000 for sustained marketing campaigns.

-

Add Optional Financial Parameters:

- Discount Rate (%): Use this rate for net present value (NPV) calculations. For example, 9 for low-risk investments or 15 for riskier ventures.

- Projection Period (years): Set the number of years for your financial forecast. Commonly 3 for short-term or 7 for extended outlooks.

- Tax Rate (%): Enter your applicable corporate tax rate. For example, 18 for tax-friendly jurisdictions or 28 for higher-tax regions.

-

Assess Market Conditions:

- Barrier to Entry Level: Choose Low, Medium, or High to reflect obstacles such as regulations, capital requirements, or brand loyalty.

- Number of Competitors: Input the total competitors in your target market. For example, 12 for a saturated retail market or 3 for emerging tech niches.

-

Consider International Factors (if applicable):

- Exchange Rate: Add the currency conversion rate for cross-border transactions. For instance, 0.85 if converting USD to GBP or 110 for USD to JPY.

- Tariffs and Import Duties (%): Include additional costs for importing products. Examples: 12 for electronics or 5 for textiles.

- Calculate and Analyze Results: Click “Calculate” to generate financial metrics like revenue, costs, net profit, ROI, NPV, and payback period. The tool also provides risk assessments and competitive intensity scores to guide your market entry strategy.

Understanding the Market Entry Strategy Calculator: Definition, Purpose, and Benefits

What Is the Market Entry Strategy Calculator?

The Market Entry Strategy Calculator is an interactive financial tool that helps businesses quantify the profitability and risks of launching in new markets. By inputting marketplace data, cost structures, and sales projections, you can quickly see how viable your market entry plan is before making major investments.

Purpose of the Calculator

This calculator transforms complex financial and market variables into clear, actionable insights. It supports decision-making by uncovering key metrics such as net present value (NPV), return on investment (ROI), break-even points, and payback periods. Additionally, it evaluates barriers to entry and competitive intensity, helping you understand challenges unique to your target market.

Key Benefits You Gain

- Comprehensive Financial Overview: Visualize revenue forecasts, cost breakdowns, and profitability at a glance.

- Risk Identification: Evaluate market risks by considering entry barriers and competitor density.

- Strategic Planning Support: Use the calculated figures to plan investment sizes and pricing strategies confidently.

- Time-Saving Analysis: Streamline market evaluation without needing complex spreadsheets or external consultants.

- Scenario Testing: Adjust key inputs instantly to model different business circumstances and strategies.

Example Calculations to Illustrate the Tool’s Use

Scenario 1: Launching a Boutique Coffee Brand

- Market Size: $2,000,000

- Market Growth Rate: 6%

- Expected Market Share: 7%

- Initial Investment: $300,000

- Fixed Operating Costs: $80,000/year

- Variable Cost per Unit: $5

- Selling Price per Unit: $12

- Projected Sales Volume: 40,000 units/year

- Marketing Expenses: $50,000/year

With these inputs, the calculator estimates:

- Total Revenue: $480,000

- Total Costs: $330,000

- Net Profit: Approximately $120,000 (after tax)

- Break-even Point: Roughly 12,000 units

- ROI: 40%

- Payback Period: 2.5 years

Scenario 2: Expanding a Software SaaS Product

- Market Size: $35,000,000

- Market Growth Rate: 10%

- Expected Market Share: 5%

- Initial Investment: $1,250,000

- Fixed Operating Costs: $450,000/year

- Variable Cost per Unit: $15

- Selling Price per Unit: $120

- Projected Sales Volume: 25,000 subscriptions/year

- Marketing Expenses: $200,000/year

Here, the results might show:

- Total Revenue: $3,000,000

- Total Costs: $1,125,000

- Net Profit: Approximately $1,350,000 (after tax)

- Break-even Point: About 5,000 subscriptions

- ROI: 108%

- Payback Period: Less than 1 year

These example calculations show how adjusting your inputs shapes your financial outlook and highlights key considerations for your market entry plan.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.