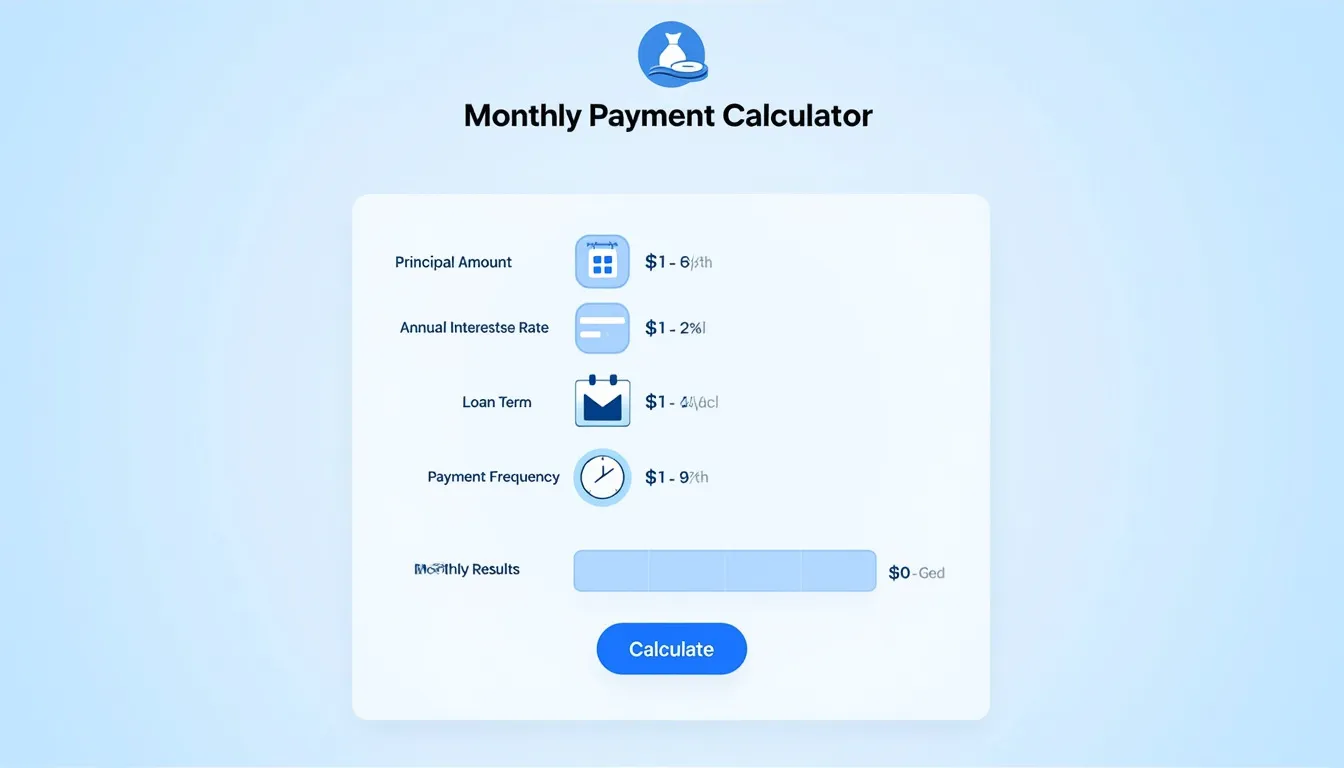

Monthly Payment Calculator

Is this tool helpful?

How to Use the Monthly Payment Calculator Effectively

Our intuitive Monthly Payment Calculator helps you easily estimate your loan installments, empowering you to plan your finances with confidence. Here’s how to get accurate results by entering the necessary details:

- Enter the Principal Amount: Provide the total loan amount in dollars. For example, try $150,000 or $45,500 to see different monthly payment scenarios.

- Specify the Annual Interest Rate: Input the yearly interest rate as a percentage. Examples include 4.75% or 7.2%.

- Set the Loan Term: Enter the number of years over which you’ll repay the loan. You can use values like 15 years or 8 years depending on your financial plan.

- Choose the Payment Frequency: Select your preferred payment schedule from options such as monthly, quarterly, semi-annually, or annually to reflect your budgeting needs.

- Calculate Your Payment: After entering all inputs, click the “Calculate” button to instantly view your estimated monthly payment amount.

By experimenting with different input values, you can explore how changes in loan size, interest rate, or term affect your payment obligations.

What Is the Monthly Payment Calculator and Why Use It?

The Monthly Payment Calculator is a robust financial tool designed to help individuals estimate their recurring loan payments with precision. Whether you’re preparing to purchase a home, finance a vehicle, consolidate debt, or secure a business loan, this tool provides clarity on what your monthly financial commitment will be.

Key benefits include:

- Clear Financial Forecasting: Accurately predict your monthly loan payments to manage your budget effectively.

- Loan Comparison: Quickly assess multiple loan offers by adjusting parameters to find the most favorable terms.

- Time Efficient: Save time by automating complex payment calculations that otherwise require detailed manual work.

- Better Decision-Making: Gain insights to support borrowing decisions aligned with your financial goals.

- Long-Term Planning: Understand how payment schedules and loan durations impact your overall financial outlook.

Example Calculations Using Our JavaScript Loan Payment Estimator

Our calculator uses a standard amortization formula that incorporates the principal, interest rate, loan term, and payment frequency to provide precise monthly payment estimates. The formula applied is:

Where:

- M = Monthly payment

- P = Principal loan amount

- r = Periodic interest rate (annual rate divided by number of payments per year)

- n = Total number of payments (payments/year × loan term in years)

Example 1: A loan of $150,000 with an annual interest rate of 4.75%, over 15 years, with monthly payments.

- Principal (P): $150,000

- Annual Interest Rate: 4.75%

- Loan Term: 15 years

- Payments Per Year: 12 (monthly)

Estimated monthly payment: approximately $1,162.95

Example 2: A $45,500 loan at 7.2% annual interest over 8 years with quarterly payments.

- Principal (P): $45,500

- Annual Interest Rate: 7.2%

- Loan Term: 8 years

- Payments Per Year: 4 (quarterly)

Estimated quarterly payment: approximately $1,599.74

These examples demonstrate how varying inputs affect your periodic loan obligations, enabling you to tailor decisions to your financial capacity.

Maximizing the Benefits of the Monthly Payment Calculator for Financial Planning

To get the most from this powerful loan calculator, consider the following tips:

- Compare Multiple Loan Scenarios: Adjust loan amounts, interest rates, and terms to discover the options that best suit your budget and goals.

- Analyze Payment Frequencies: Explore how monthly, quarterly, semi-annual, or annual payments impact your cash flow and total interest paid.

- Consider Total Loan Cost: Look beyond monthly payments to understand cumulative interest and overall repayment amounts.

- Include Additional Expenses: Remember that taxes, insurance, and fees may not be included in the calculated payment, so budget accordingly.

- Regularly Review Loans: Use the calculator to reassess your loan options over time, especially if refinancing becomes an option.

Practical Uses and Real-World Applications

Our Monthly Payment Calculator is suited for a variety of loan types and financial planning scenarios, including:

Mortgage Planning

Prospective homebuyers can evaluate affordability by inputting different home prices, interest rates, and loan durations. For instance, estimating payments on a $250,000 home loan at a 3.8% fixed rate over 25 years helps decision-making around mortgage affordability.

Auto Loan Comparison

Compare car loan options that vary in interest rates and terms. A $20,000 loan at 5.5% for 6 years versus a $20,000 loan at 4.9% for 4 years will have distinctly different monthly payments and total costs outlined clearly through this tool.

Personal Loan Management

Whether consolidating debts or financing major expenses, you can predict monthly payments on varied loan terms. A $12,000 personal loan at 9% over 3 years is quickly assessed to determine budget compatibility.

Small Business Financing

Business owners can assess payment obligations for equipment loans or expansion funding, helping with cash flow and financial forecasting. A $75,000 business loan at 6.5% over 5 years can be broken down into manageable monthly installments.

Understanding Important Considerations and Limitations

- Fixed Interest Rate Assumption: The calculation assumes that the interest rate remains constant throughout the loan term.

- No Adjustment for Variable Rates: Adjustable-rate loans or loans with changing rates are not accounted for.

- Excludes Additional Fees: The tool doesn’t include extra charges such as loan origination fees, taxes, or insurance premiums.

- Estimate Only: Use results as guidance; actual loan terms might vary depending on lender policies.

Frequently Asked Questions About Loan Payment Calculations

Q1: How precise is the Monthly Payment Calculator?

Our calculator provides highly accurate estimates based on standard amortization formulas, but exact payments may differ slightly due to lender-specific factors and rounding.

Q2: Can I use this calculator for any type of loan?

Yes, it works well for mortgages, auto loans, personal loans, business financing, and more, assuming fixed interest rates.

Q3: Why do my payments change when I switch payment frequencies?

Payment frequency alters how often interest accrues and payments apply, which affects the amount due each period.

Q4: Does this calculator include taxes or insurance?

No, it only calculates principal and interest payments. Taxes, insurance, and other costs should be added separately to your budgeting.

Q5: How can I reduce my monthly loan payments?

Increasing the loan term, lowering the interest rate, or decreasing the loan amount are primary ways to reduce monthly installments.

Q6: Is it better to choose a longer loan term with lower payments or a shorter term with higher payments?

Longer terms lower monthly payments but increase total interest paid; shorter terms raise monthly payments while reducing interest. Your choice depends on your financial goals.

Q7: Can this tool assist in refinancing decisions?

Absolutely, by comparing current loan parameters with potential new terms, you can assess potential savings and payment changes.

Empower Your Financial Decisions with Our Easy Loan Payment Calculator

Making smart borrowing decisions starts with clear knowledge of your payment obligations. Our Monthly Payment Calculator offers a fast, accurate way to estimate your loan payments and compare different financing options. Whether you’re buying a home, financing a vehicle, or managing personal debt, this tool is an essential companion in your journey to financial wellness.

Take control of your budget, anticipate future expenses, and plan confidently with this straightforward, user-friendly loan calculator — your partner in smarter financial planning and responsible borrowing.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.