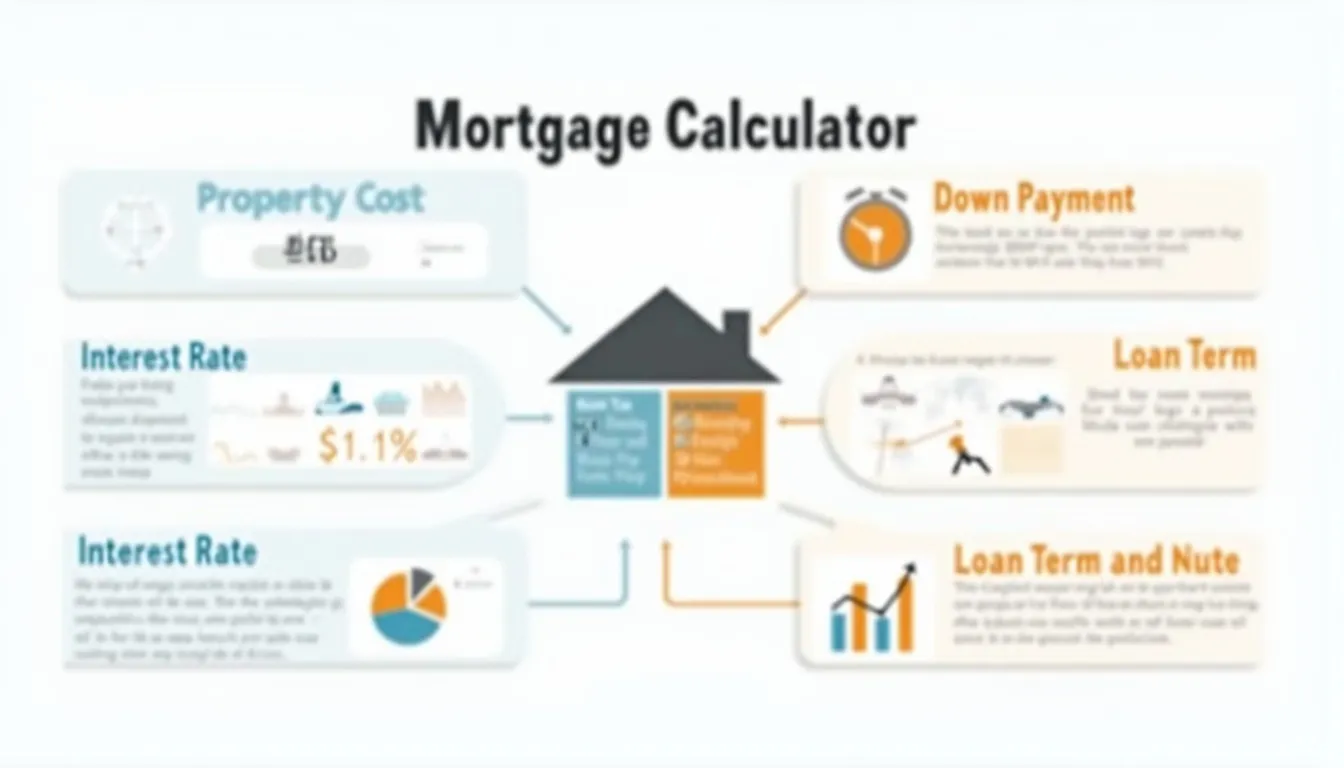

Mortgage Calculator

Is this tool helpful?

How to use the tool

- Property Cost – type the purchase price, e.g., $350 000 or $600 000.

- Down-Payment % – enter the upfront share, such as 12 % or 25 %.

- Mortgage Term (Years) – choose length, e.g., 20 or 30.

- Interest Rate % – input the annual rate, e.g., 3.25 % or 5.1 %.

- Calculate – the tool shows monthly payment, total interest, and a full amortization schedule.

Formula used

Monthly payment $$M = P \times rac{r(1+r)^n}{(1+r)^n – 1}$$ where P=loan amount, r=monthly rate (annual ÷ 12), n=total months (Consumer Finance Protection Bureau, 2022).

Example A

- Price: $350 000 | Down: 20 % | Loan: $280 000

- Term: 30 years (360 months) | Rate: 3.5 % (0.002916 monthly)

- $$M ≈ \$1 258$$ per month; total paid ≈ $452 880; interest ≈ $172 880.

Example B

- Price: $600 000 | Down: 10 % | Loan: $540 000

- Term: 25 years (300 months) | Rate: 5 % (0.004167 monthly)

- $$M ≈ \$3 157$$ per month; total paid ≈ $947 100; interest ≈ $407 100.

Quick-Facts

- Median first-time buyer down payment: 13 % (NAR Profile of Home Buyers 2023).

- Common loan term cap: 30 years for conforming loans (FHFA Seller/Servicer Guide 2024).

- Average 30-year fixed rate 2023: 6.54 % (Freddie Mac PMMS 2024).

- “Borrowers pay $2 in interest for every $1 of principal on a 30-year 6 % loan” (Federal Reserve Education Publication 2022).

FAQ

What is a mortgage calculator?

A mortgage calculator is an online tool that estimates monthly payments and total loan cost from four inputs—price, down %, term, and rate—using the standard amortization formula (CFPB, 2022).

How does the tool compute my payment?

It converts the annual rate to a monthly rate, plugs it with loan amount and total months into $$M = P \times rac{r(1+r)^n}{(1+r)^n-1}$$ then outputs payment, interest, and balance trajectory (Investopedia, “Mortgage Calculator”).

How can you lower monthly payments?

Increase down payment, extend term, improve credit to qualify for a lower interest rate, or shop loan products with lower APRs (Fannie Mae Homebuyer Guide 2023).

What does the amortization table show?

It details each month’s split between principal and interest and tracks remaining balance—“a clear roadmap of debt reduction” (Freddie Mac Consumer Education 2023).

Are online calculators accurate?

They are accurate for fixed-rate loans but ignore taxes, insurance, and HOA fees; always verify with your lender’s Loan Estimate (CFPB TILA-RESPA Guide 2022).

When should you refinance?

Refinance when the new rate is at least 1 percentage point lower and you plan to stay long enough to recoup closing costs (Mortgage Bankers Association Refinance Report 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.