Net Interest Margin Calculator

Is this tool helpful?

How to use the tool

- Enter Net Interest Income—the interest earned minus interest paid. Try 920 000 or 1 480 000.

- Enter Average Earning Assets—the mean value of loans and securities generating interest. Test 11 200 000 or 17 500 000.

- Click “Calculate” to display your margin as a percentage.

- Interpret the result: higher percentages generally signal more profitable asset-liability management.

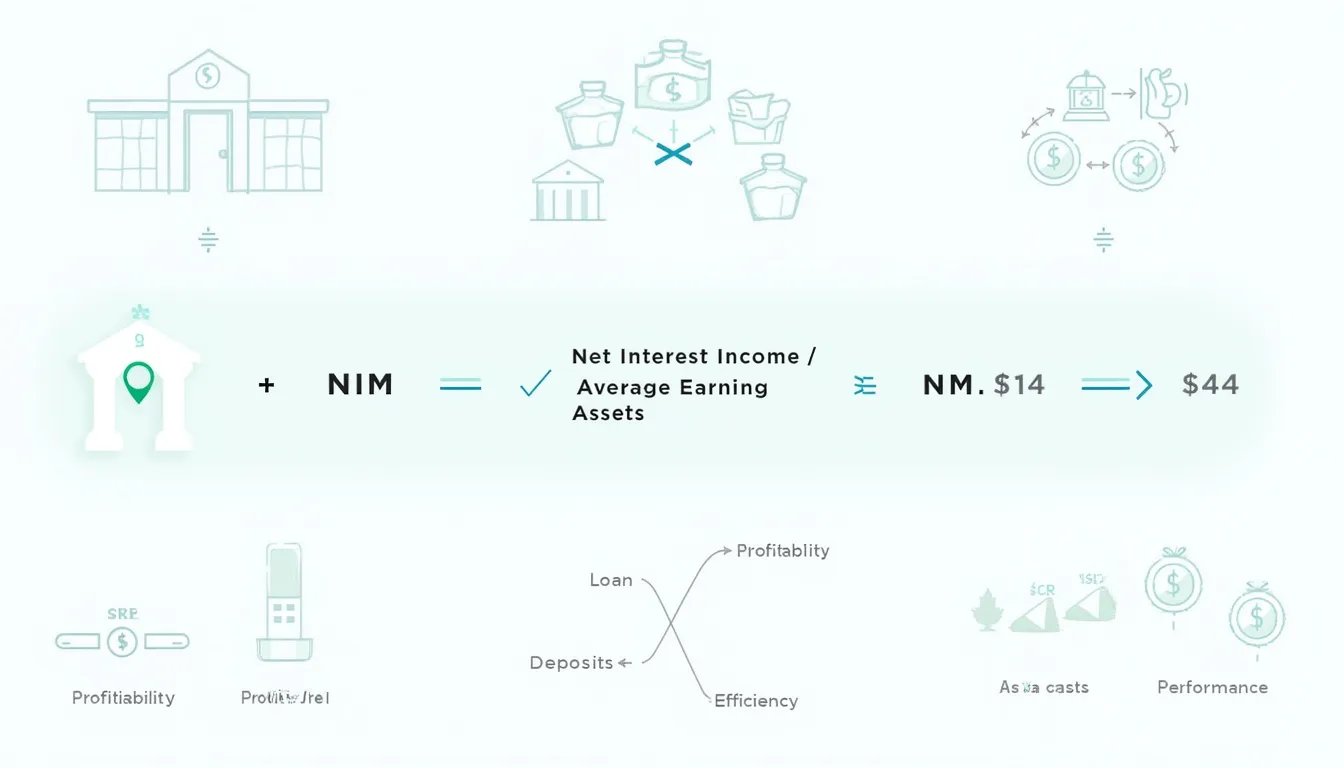

Formula used

$$\text{Net Interest Margin} = rac{\text{Net Interest Income}}{\text{Average Earning Assets}} \times 100\%$$

Example calculations

- Example A: 920 000 ÷ 11 200 000 = 0.0821 ⇒ 8.21 %.

- Example B: 1 480 000 ÷ 17 500 000 = 0.0846 ⇒ 8.46 %.

Quick-Facts

- U.S. bank average NIM: 3.28 % in 2022 (FDIC Quarterly Banking Profile, 2023).

- EU bank average NIM: 1.32 % in 2022 (ECB Statistical Data Warehouse, 2023).

- Analysts view ≥3 % NIM as healthy (Investopedia, https://www.investopedia.com).

- Negative NIM signals paying more interest than earned (OCC Bank Supervision Handbook, 2020).

Frequently Asked Questions

What does the calculator measure?

It measures how efficiently your bank earns net interest on assets, echoing “a key profitability metric” (FDIC Quarterly Banking Profile, 2023).

Why is Net Interest Margin important?

NIM links pricing, funding costs, and risk, guiding strategy and valuation (OCC Bank Management Guide, 2020).

What is a good Net Interest Margin?

Margins above 3 % beat the U.S. long-term median of 2.97 % (St. Louis Fed FRED, 2023).

Can Net Interest Margin be negative?

Yes—paying more on deposits than earning on loans drives a negative ratio, flagging distress (Basel Committee Report, 2022).

How often should banks track NIM?

Regulators review it quarterly; many institutions monitor monthly for faster course correction (FDIC Call Report Instructions, 2023).

How do interest rates affect NIM?

Rising rates boost asset yields faster than deposit costs 60 % of the time (S&P Global Market Intelligence, 2023).

Does a higher NIM always mean better performance?

No; unusually high margins can hide credit-risk exposure or limited competition (IMF Financial Soundness Indicators, 2021).

How accurate is the calculator?

It applies the standard formula precisely; accuracy depends on entering audited income and asset figures (AICPA Audit Guide, 2022).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.