Pension Calculator

Is this tool helpful?

How to Use the Pension Calculator Effectively

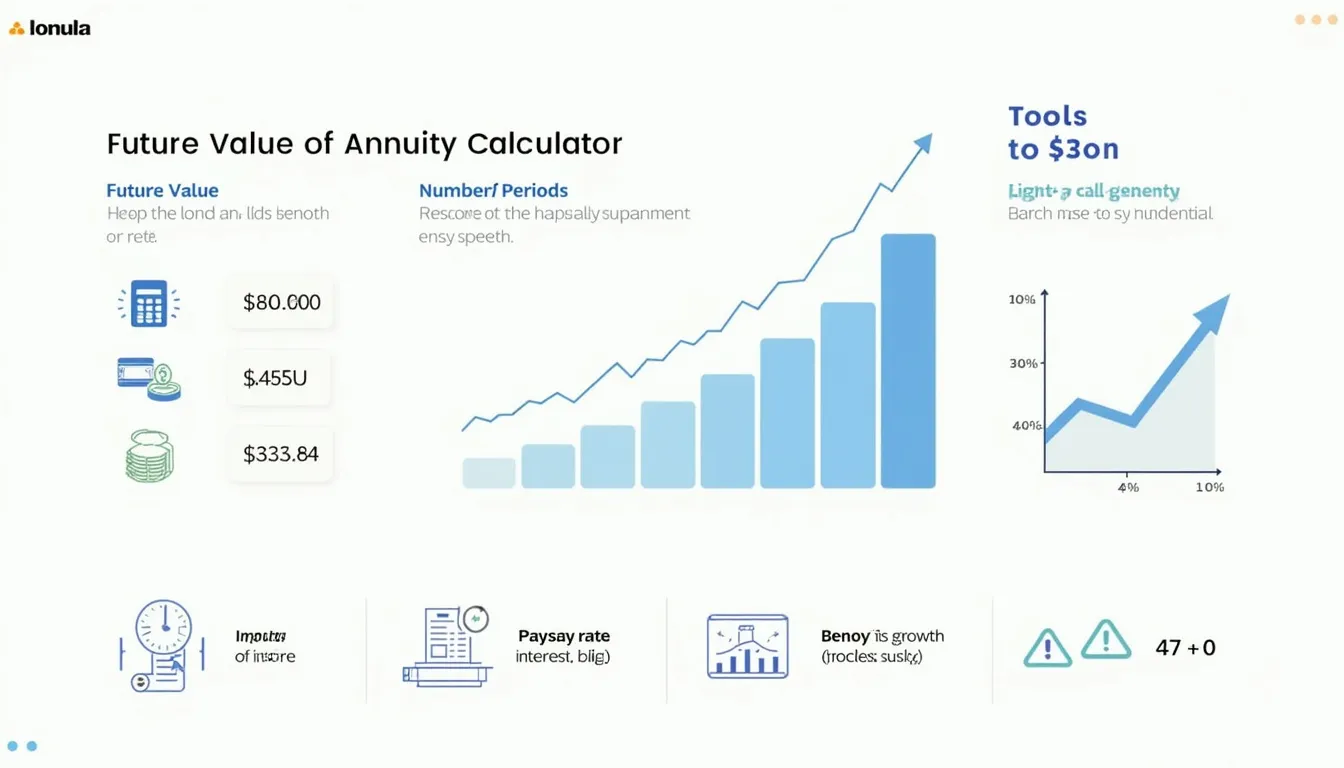

Our Pension Calculator is designed for ease and accuracy, helping you estimate your retirement corpus and income effortlessly. Follow these steps to get meaningful projections tailored to your financial goals:

- Monthly Investment Amount: Enter the sum you intend to invest monthly in USD. For example, try $350 or $750 to see how your savings grow.

- Number of Years: Specify how many years you plan to contribute to your pension. Try inputs like 25 or 35 years for a realistic time horizon.

- Annuity Rates (%): Input the expected annuity rate as a percentage, representing the rate used to convert your corpus into steady income. Possible values could be 4.5% or 6.2%.

- Annuity Purchased (%): Define the percentage of your pension corpus allocated for purchasing an annuity. Try values like 60% or 85% based on your preference for lump sum versus income.

- Yearly Interest Rates (%): Enter the anticipated annual investment return as a percentage. Consider realistic values such as 5% or 7.5% depending on your investment options.

- Once all fields are completed, click “Calculate Pension” to receive your personalized pension projections instantly.

Upon submission, the tool calculates and displays your Total Corpus, Lump Sum Pension, and Monthly Pension based on your inputs, helping you plan your retirement with confidence.

Comprehensive Pension Calculator: Definition, Purpose, and Benefits

A pension calculator is a powerful financial planning tool that estimates your retirement savings and income using your investment inputs and assumptions about interest and annuity rates. Designed for both beginners and seasoned investors, this calculator empowers you to visualize how consistent monthly contributions grow over time, thanks to compound interest and annuity factors.

The primary purpose of this calculator is to help you:

- Identify the potential size of your retirement corpus based on your current savings strategy.

- Understand the impact of variables such as interest rates, investment duration, and annuity options.

- Make informed, data-backed decisions on how to allocate your pension investments between lump sum withdrawals and monthly income.

- Set realistic retirement savings goals and adjust contributions as needed.

Using this tool offers several key benefits:

- Accurate Retirement Projections: Personalized estimates based on your actual investment input help you anticipate future financial needs.

- Financial Confidence: Clear visualization of pension growth reduces uncertainty and offers peace of mind.

- Improved Savings Discipline: Seeing how changes in input variables affect outcomes motivates early and consistent saving.

- Flexible Scenario Analysis: Quickly test different investment amounts, interest rates, and annuity percentages to optimize your retirement plan.

Example Pension Calculations Using the Pension Calculator

Below are sample calculations demonstrating how the pension calculator works with specific inputs to project retirement outcomes:

Example 1: Young Professional Starting Early

- Monthly Investment: $350

- Number of Years: 30

- Annuity Rate: 4.5%

- Annuity Purchased: 70%

- Yearly Interest Rate: 6%

This strategy could lead to a substantial pension corpus accumulated through consistent savings combined with compound interest. Allocating 70% toward an annuity would generate a monthly pension, while the remaining 30% serves as a lump sum for flexibility.

Example 2: Mid-Career Investor Catching Up

- Monthly Investment: $800

- Number of Years: 20

- Annuity Rate: 5.5%

- Annuity Purchased: 80%

- Yearly Interest Rate: 5%

Although starting later than ideal, increasing monthly investment substantially and allocating 80% for an annuity can still provide a meaningful monthly pension income, complemented by a lump sum payout.

Understanding the Mathematics Behind the Pension Calculator

To fully grasp the pension projections, it is helpful to understand the underlying mathematical concepts. The calculations consider compound interest and annuity principles as follows:

1. Total Corpus Calculation

Your total pension corpus is computed by summing your yearly investments compounded annually over the investment period:

$$ TC = \sum_{i=0}^{n} (MI \times 12) \times (1 + r)^i $$- Where:

- TC = Total corpus accumulated

- MI = Monthly investment amount

- n = Number of years investing

- r = Annual interest rate expressed as a decimal (e.g., 6% = 0.06)

2. Annuity Pension Calculation

The portion of your corpus used to purchase an annuity is calculated as:

$$ AP = TC \times AP\% $$- Where:

- AP = Amount allocated for annuity purchase

- AP% = Annuity purchased percentage expressed as a decimal

3. Lump Sum Pension Calculation

The leftover corpus after the annuity purchase represents your lump sum pension:

$$ LSP = TC – AP $$- Where:

- LSP = Lump sum pension amount

4. Monthly Pension Estimation

Your monthly pension income from the annuity is calculated by applying the annuity rate to the purchased amount, spread monthly:

$$ MP = \frac{AP \times AR}{12} $$- Where:

- MP = Monthly pension amount

- AR = Annuity rate expressed as a decimal

Practical Tips for Maximizing Pension Planning with This Calculator

- Start Early: The more years you invest, the greater the benefit from compound interest.

- Adjust Contributions: Use the calculator to experiment with different monthly contributions to meet your retirement goals.

- Monitor Interest Rates: Even small changes in yearly interest rates can significantly affect your total corpus.

- Balance Annuity vs. Lump Sum: Find the right percentage of annuity purchase to suit your need for steady income versus available cash.

- Review Regularly: Life circumstances and market conditions change; revisit the calculator periodically to update your strategy.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.