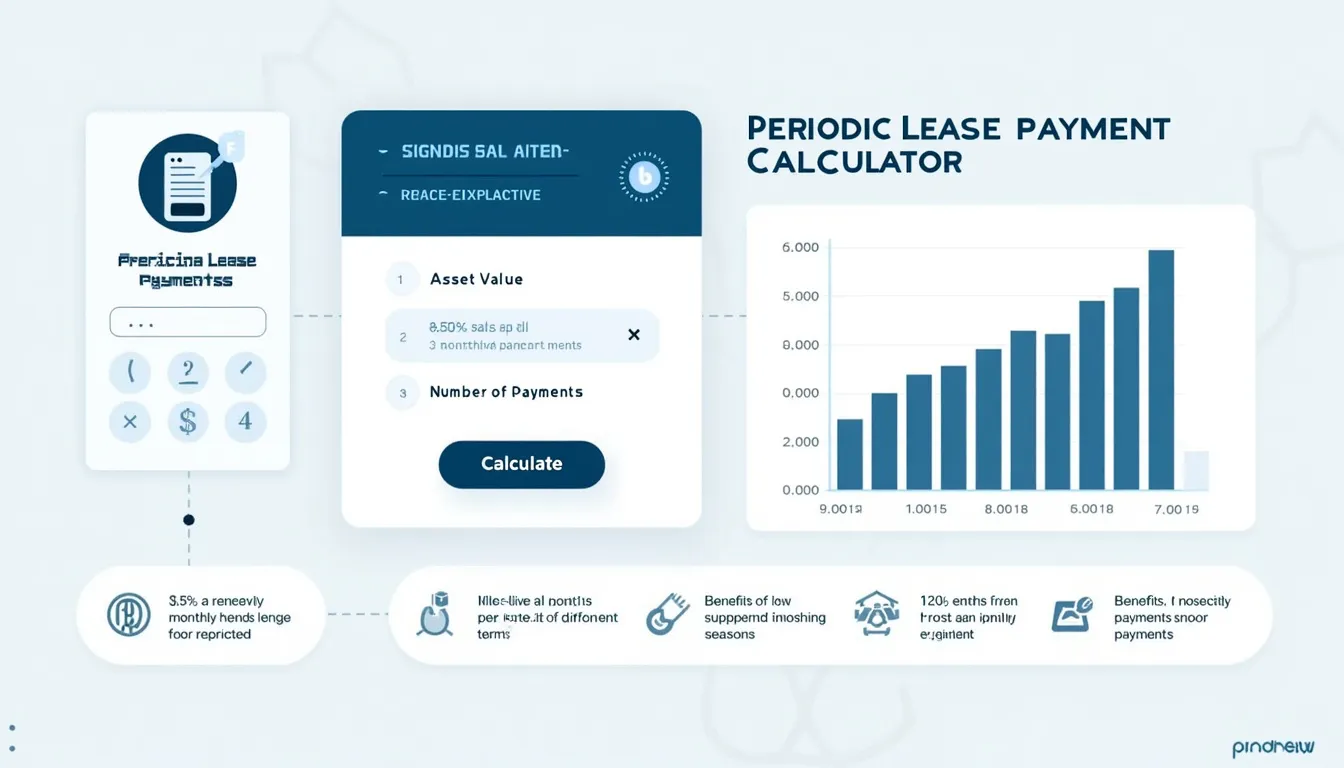

Periodic Lease Payment Calculator

Is this tool helpful?

How to Use the Periodic Lease Payment Calculator Effectively

Our Periodic Lease Payment Calculator is designed to help you quickly and accurately determine your regular lease payments. Here’s a step-by-step guide on how to use this tool effectively:

- Enter the Asset Value: Input the total value of the leased asset in USD. This is typically the market price of the item you’re leasing.

- Input the Monthly Lease Interest Rate: Enter the monthly interest rate as a percentage. If you have an annual rate, divide it by 12 to get the monthly rate.

- Specify the Number of Lease Payments: Enter the total number of payments you’ll make over the lease term.

- Click “Calculate”: Once you’ve entered all the required information, click the calculate button to get your periodic lease payment amount.

- Review the Results: The calculator will display your periodic lease payment in USD.

Remember, all fields must be filled with valid, positive numbers for the calculator to work correctly.

Understanding Periodic Lease Payments: An Introduction

A periodic lease payment is the regular amount a lessee pays to a lessor for the use of an asset over a specified period. This financial arrangement is common in various industries, from automotive to real estate and equipment leasing.

The Periodic Lease Payment Calculator is a powerful tool designed to help individuals and businesses quickly determine the regular payment amount for a lease agreement. By considering factors such as the asset value, interest rate, and number of payments, this calculator provides an accurate estimate of your financial commitment.

The Mathematics Behind Periodic Lease Payments

The calculation of periodic lease payments is based on the following formula:

$$ P = \frac{A \times r}{1 – (1 + r)^{-n}} $$Where:

- P = Periodic Lease Payment

- A = Asset Value

- r = Monthly Lease Interest Rate

- n = Number of Lease Payments

This formula takes into account the time value of money, ensuring that the total of all payments covers the asset’s value plus interest over the lease term.

Benefits of Using the Periodic Lease Payment Calculator

Utilizing our Periodic Lease Payment Calculator offers numerous advantages:

- Time-Saving: Quickly determine lease payments without complex manual calculations.

- Accuracy: Minimize human error and ensure precise results.

- Financial Planning: Easily forecast your lease expenses for budgeting purposes.

- Comparison Tool: Compare different lease terms and interest rates to find the best option.

- Negotiation Aid: Use the results to negotiate better lease terms with lessors.

- Educational Resource: Understand how different factors affect your lease payments.

- Accessibility: Available 24/7, allowing you to calculate payments at your convenience.

- No Cost: Free to use, saving you money on financial advisory services.

Addressing User Needs and Solving Specific Problems

The Periodic Lease Payment Calculator addresses several key user needs and solves specific problems related to leasing:

1. Financial Clarity

Many lessees struggle to understand the true cost of their lease agreements. This calculator provides clarity by breaking down the payment structure, helping users avoid unexpected financial burdens.

2. Decision Making Support

When considering multiple lease options, it can be challenging to compare them effectively. Our calculator allows users to input different scenarios, making it easier to choose the most financially advantageous option.

3. Budgeting Assistance

For businesses and individuals alike, accurate budgeting is crucial. By providing precise payment amounts, this tool aids in creating realistic financial plans and cash flow projections.

4. Negotiation Leverage

Armed with accurate payment calculations, lessees can enter negotiations with confidence. This knowledge can lead to more favorable lease terms and potentially significant savings over the lease period.

5. Time Efficiency

Manual calculations of lease payments can be time-consuming and prone to errors. Our calculator streamlines this process, allowing users to obtain results quickly and reliably.

6. Financial Education

By interacting with the calculator and seeing how different inputs affect the payment amount, users can gain a better understanding of lease finance principles.

Practical Applications and Use Cases

The Periodic Lease Payment Calculator has a wide range of practical applications across various industries and scenarios. Here are some examples:

1. Automotive Leasing

Consider a car dealership offering a lease on a new vehicle valued at $30,000. With a monthly interest rate of 0.5% and a 36-month lease term, the calculator would determine the monthly payment as follows:

- Asset Value: $30,000

- Monthly Interest Rate: 0.5%

- Number of Payments: 36

- Calculated Monthly Payment: $872.44

This information helps both the dealership in setting competitive rates and the customer in understanding their financial commitment.

2. Equipment Leasing for Small Businesses

A small manufacturing company is considering leasing industrial equipment worth $100,000. The leasing company offers a 48-month term with a monthly interest rate of 0.4%. Using our calculator:

- Asset Value: $100,000

- Monthly Interest Rate: 0.4%

- Number of Payments: 48

- Calculated Monthly Payment: $2,505.45

This calculation allows the business to assess if the lease payments fit within their budget and compare it with other financing options.

3. Commercial Real Estate Leasing

A retail business is exploring a 5-year lease on a commercial property valued at $500,000. The property management company offers a monthly interest rate of 0.3%. Using the calculator:

- Asset Value: $500,000

- Monthly Interest Rate: 0.3%

- Number of Payments: 60

- Calculated Monthly Payment: $9,455.01

This information helps the retail business understand their long-term financial commitment and negotiate terms if necessary.

4. Technology Leasing for Educational Institutions

A school district plans to lease computers worth $200,000 for their classrooms. They’re offered a 24-month lease with a monthly interest rate of 0.25%. The calculator shows:

- Asset Value: $200,000

- Monthly Interest Rate: 0.25%

- Number of Payments: 24

- Calculated Monthly Payment: $8,602.83

This calculation helps the school district budget accurately and ensure they can meet the financial obligations of upgrading their technology.

Frequently Asked Questions (FAQ)

1. What is a periodic lease payment?

A periodic lease payment is the regular amount paid by a lessee to a lessor for the use of an asset over a specified period. This payment typically includes both the principal (a portion of the asset’s value) and interest.

2. How accurate is this Periodic Lease Payment Calculator?

Our calculator uses a standard financial formula to provide accurate results based on the information you input. However, the accuracy of the output depends on the accuracy of the information you provide.

3. Can I use this calculator for any type of lease?

Yes, this calculator can be used for various types of leases, including vehicle leases, equipment leases, and property leases. The principles of calculation remain the same across different lease types.

4. What if I don’t know the monthly interest rate?

If you only have the annual interest rate, divide it by 12 to get the monthly rate. For example, if the annual rate is 6%, the monthly rate would be 0.5% (6% ÷ 12).

5. Does this calculator account for residual value?

No, this basic version of the calculator doesn’t account for residual value. It assumes the entire asset value is being financed over the lease term.

6. Can I use this calculator to compare different lease offers?

Absolutely! By inputting different values for asset price, interest rate, and lease term, you can compare the periodic payments for various lease offers.

7. Is the calculated payment the only cost I should consider when leasing?

While the periodic payment is a significant part of leasing costs, you should also consider other factors such as down payments, maintenance costs, insurance, and any end-of-lease fees.

8. How does changing the lease term affect my payments?

Generally, a longer lease term will result in lower periodic payments but may lead to paying more in total interest over the life of the lease.

9. Can this calculator be used for balloon payment leases?

This basic calculator doesn’t account for balloon payments. For leases with balloon payments, you would need a more advanced calculator.

10. Is leasing always better than buying?

The choice between leasing and buying depends on various factors including your financial situation, tax implications, and long-term plans. This calculator can help you understand the costs of leasing, but you should consider all aspects before making a decision.

Please note that while we strive for accuracy, we cannot guarantee that the webtool or results from our webtool are always correct, complete, or reliable. Our content and tools might have mistakes, biases, or inconsistencies. Always consult with a financial professional for important decisions.

Conclusion: Empowering Your Leasing Decisions

The Periodic Lease Payment Calculator is an invaluable tool for anyone considering a lease agreement. By providing quick, accurate calculations of your regular lease payments, it empowers you to make informed financial decisions.

Key benefits of using this calculator include:

- Time and effort savings in complex calculations

- Improved accuracy in financial planning

- Better understanding of lease terms and their impact

- Enhanced ability to compare different lease options

- Increased confidence in lease negotiations

Whether you’re an individual looking to lease a car, a business owner considering equipment leasing, or a financial professional advising clients, this calculator provides the insights you need to navigate the leasing process effectively.

Remember, while this tool provides valuable information, it’s always advisable to consult with a financial professional for personalized advice tailored to your specific situation. Leasing decisions can have long-term financial implications, and it’s important to consider all aspects before committing.

Take control of your leasing decisions today. Use our Periodic Lease Payment Calculator to gain clarity on your potential financial commitments and make choices that align with your financial goals. Your path to smarter leasing starts here!

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.