Personal Finance Plan Generator

Is this tool helpful?

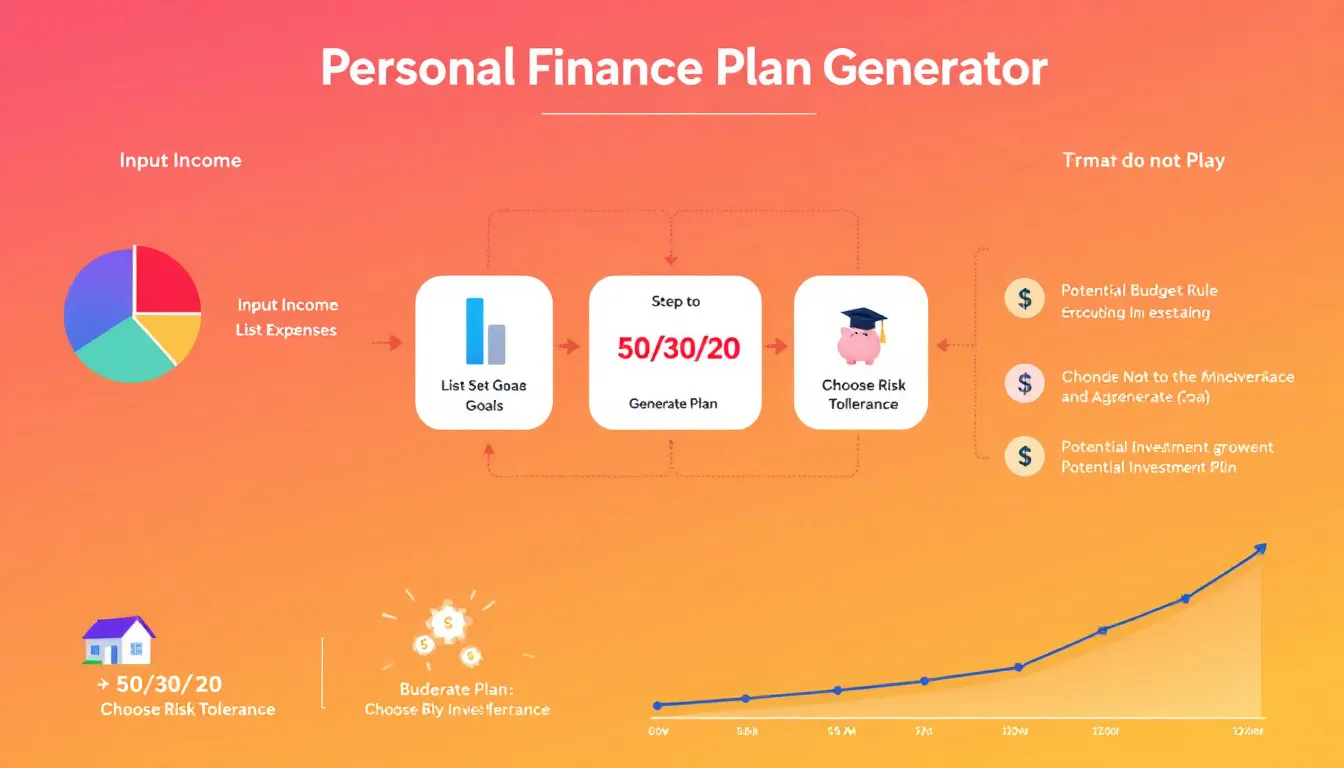

How to Use the Personal Finance Plan Generator Effectively

Follow these simple steps to create a tailored personal finance plan that aligns with your unique financial situation and goals:

- Enter Your Monthly Income: Provide your total monthly income in USD. For example, you might enter “4200” for a freelancer earning variable income or “6500” for a salaried position.

- List Your Major Monthly Expenses: Detail your primary monthly expenses using the text area. Sample entries can be:

- Mortgage: $1,200

- Internet & Phone: $100

- Childcare: $600

- Car Payment: $320

- Specify Your Financial Goals: Describe your financial objectives with realistic timeframes. For instance:

- Build a $15,000 emergency fund within 18 months

- Save $25,000 for a car upgrade in 4 years

- Select Your Investment Risk Tolerance: Choose your comfort level for investment risk from the dropdown options: Low, Medium, or High.

- Provide Debt Information (Optional): Enter any outstanding debts with details such as:

- Home equity loan: $15,000 at 4.5% APR

- Auto loan: $8,000 at 6% APR

- Generate Your Personal Finance Plan: After completing the inputs, submit the form to receive a customized plan based on your data.

- Review and Save Your Plan: Examine your personalized budget, investment suggestions, debt repayment strategies, and goal timelines.

Unlocking Financial Success with the Personal Finance Plan Generator

The Personal Finance Plan Generator is a powerful online tool designed to create a customized financial roadmap tailored to your income, expenses, debts, financial goals, and risk tolerance. It combines key components of budgeting, investing, debt management, and goal-setting to help you take control of your financial future.

What is a Personal Finance Plan Generator?

This innovative tool provides a step-by-step guide for managing your finances by analyzing your unique monetary information. It offers actionable advice to optimize spending, saving, investing, and debt repayment in one comprehensive plan.

Purpose and Benefits of Using This Financial Planning Tool

- Customized Budgeting: Provides spending and saving recommendations tailored to your specific financial data.

- Goal-Oriented Planning: Aligns financial decisions with your short-term and long-term objectives.

- Investment Guidance: Suggests investment strategies based on your risk appetite and target goals.

- Effective Debt Management: Recommends structured debt repayment methods to reduce interest costs efficiently.

- Income Growth Ideas: Shares suggestions to increase earnings based on your skills and opportunities.

- Financial Literacy Boost: Helps improve your understanding of personal finance concepts through practical insights.

Practical Use Cases of the Personal Finance Plan Generator

Use Case 1: The Freelancer Navigating Variable Income

Alex, a graphic designer with fluctuating monthly earnings, uses the tool to average his income over recent months and create a plan that balances irregular earnings with consistent expenses. The plan includes:

- Flexible budgeting strategies accommodating income variability

- Clear debt repayment schedules for a credit card balance

- Investment advice matching moderate risk tolerance

Use Case 2: Planning for Homeownership

Maria, aspiring to buy a home in 3 years, enters her monthly income and detailed expenses to receive a savings and investment plan. The generator outlines:

- Monthly savings targets dedicated to the down payment

- Debt payoff recommendations for her student loan

- Conservative investment portfolios appropriate for her timeline and risk tolerance

Use Case 3: Mid-Career Retirement Planning

James, preparing for retirement in 15 years, inputs his steady salary, debts, and varied financial goals. The tool guides him through:

- Comprehensive budget to optimize savings and debt repayments

- Asset allocation recommendations balancing growth and security

- Goal sequencing to prioritize retirement savings alongside education funding for children

Example Financial Calculations and Recommendations

The generator often uses proven budgeting frameworks like the 50/30/20 rule to allocate your income:

- Needs (50%): Essential expenses like housing, utilities, and groceries

- Wants (30%): Discretionary spending such as dining out and entertainment

- Savings & Debt Repayment (20%): Allocations toward savings accounts, investments, and paying down debts

For investment growth projections, it calculates compound interest based on your principal, rate, and time horizon, following the formula:

$$A = P \left(1 + \frac{r}{n}\right)^{nt}$$Where:

- A = Final amount

- P = Initial principal investment

- r = Annual interest rate (decimal)

- n = Number of compounding periods per year

- t = Number of years

The tool tailors investment recommendations based on your risk tolerance using diversified asset allocations. Example for medium risk:

- 60% stocks (index funds or ETFs)

- 30% bonds

- 10% cash or equivalents

Why Choose the Personal Finance Plan Generator?

- Comprehensive Financial Planning: Integrates budgeting, debt management, and investing into one easy-to-use platform.

- Accessible and Affordable: Delivers expert financial advice without expensive consultations.

- Personalized Recommendations: Adapts to your specific financial circumstances, making plans attainable and realistic.

- Time-Saving Automation: Quickly generates detailed plans, saving you hours of manual calculations.

- Continuous Learning: Enhances your financial knowledge as you engage with the tool’s insights.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.