Is this tool helpful?

How to Use the Portfolio Diversification Strategy Generator Effectively

This tool helps you create a personalized investment diversification strategy based on your current portfolio and financial goals. Follow these steps to get the most out of the generator:

- Current Industry Focus: Enter the main industry your portfolio currently targets. Examples include “Consumer Electronics” or “Green Energy Technologies”. This helps the tool understand your existing exposure.

- Investor’s Financial Goals and Risk Tolerance: Describe your investment objectives and how much risk you can handle. Sample inputs are “Seeking steady income with low volatility” or “Targeting aggressive growth over 8 years, comfortable with high risk.”

- Preferred Investment Time Horizon: Select your investment duration. Options could be “Short-term (1-3 years)” or “Medium-term (4-6 years)”. This lets the tool align your strategy with your timeline.

- Approximate Size of Current Investment Portfolio (USD): Enter the estimated dollar value of your portfolio, such as “250000” or “2000000”. This helps tailor strategy recommendations to your portfolio scale.

- Generate Diversification Strategy: Click the button to receive a customized diversification plan. The tool will analyze your inputs and produce recommendations designed for your unique investment profile.

Introduction: What the Portfolio Diversification Strategy Generator Does and Its Benefits

The Portfolio Diversification Strategy Generator is a practical online tool designed to help investors build balanced portfolios by recommending asset allocation methods tailored to your current holdings and goals. By considering your industry focus, financial objectives, risk tolerance, investment horizon, and portfolio size, the generator creates a strategy that spreads risk and maximizes potential returns.

Diversifying your portfolio reduces exposure to any single sector or asset class, helping protect against volatility and economic shifts. This tool applies expert insights to provide clear, actionable guidance that matches your individual circumstances.

Key benefits include personalized recommendations, risk management support, time savings in portfolio planning, and strategies adaptable to evolving market conditions. You’ll get clear suggestions that aim to balance growth potential with risk control, making your investment approach more resilient.

Practical Use Cases for the Portfolio Diversification Strategy Generator

This tool is versatile and fits a variety of investment needs. Here are some common scenarios where it adds value:

1. Portfolio Rebalancing

Use the generator periodically to check if your asset allocation still fits your goals. For example, if your portfolio drifted toward excessive tech stocks after market gains, the tool suggests adjustments to maintain your target balance.

2. Exploring New Investment Sectors

If your portfolio is heavily concentrated in one industry, you can use the tool to discover sectors to diversify into, such as moving from automotive to healthcare or sustainable energy.

3. Planning for Life Events

As your investment horizon changes due to milestones like retirement or education funding, the generator helps you adjust your strategy toward more conservative or growth-focused allocations accordingly.

4. Adapting to Market Trends

This tool provides timely recommendations that reflect current economic cycles, suggesting rotations to defensive sectors during downturns or increasing exposure to growth sectors in expansions.

5. Managing Portfolio Scale

The tool considers your portfolio size, recommending investments suitable for both smaller portfolios—like diversified ETFs—and larger portfolios involving individual asset selections or alternative investments.

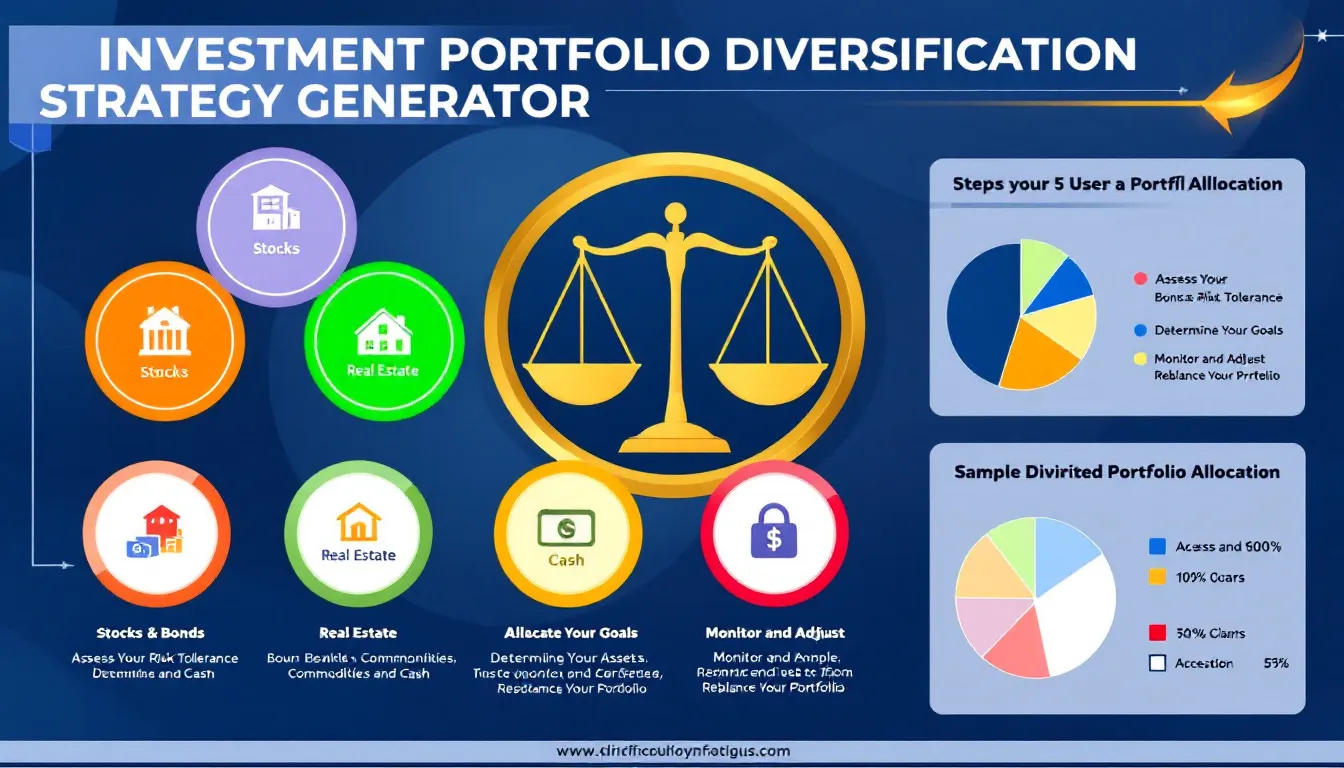

Understanding Portfolio Diversification and Its Importance

Portfolio diversification is the practice of spreading your investments across different asset classes and industries to reduce risk. Instead of relying heavily on one sector, diversification balances potential losses against gains in others.

Why Diversification Matters

- Reduces risk: Limits the negative impact from poor-performing assets.

- Enhances returns: Broad exposure can capture growth opportunities across sectors.

- Cushions volatility: Smooths the effects of market fluctuations on your portfolio.

- Supports stable growth: Helps maintain consistent returns over time.

Core Components of a Diversified Portfolio

- Equities (stocks) across multiple industries

- Fixed income (bonds) of varying maturities and issuers

- Real estate investments like REITs

- Commodities (gold, oil, agricultural products)

- Cash or cash equivalents for liquidity

- Alternative assets such as private equity or hedge funds

Addressing Common Investment Challenges with This Tool

Overconcentration Risk

If your portfolio is overly focused on one industry, the tool suggests diversification into complementary sectors to lower concentration risk.

Example: An investor heavily invested in energy stocks might receive advice to diversify into utilities and consumer goods.

Balancing Risk and Reward

The generator aligns asset allocation with your risk tolerance, ensuring your portfolio’s growth potential matches your comfort with volatility.

Example: For moderate risk tolerance and stable growth goals, the tool might recommend 50% stocks, 40% bonds, and 10% alternatives.

Finding New Opportunities

Break out of your existing investment patterns by exploring sectors and asset classes highlighted by the tool.

Example: Investors focused only on domestic stocks could gain exposure to emerging markets or innovative industries.

Adapting to Market Conditions

The tool adjusts recommendations based on current economic trends, helping you navigate through different market cycles effectively.

Example: Increasing defensive sector allocations during a recession or boosting growth sectors during expansions.

Portfolio Size Considerations

Whether your portfolio is small or large, the tool provides scalable diversification strategies suitable for your investment capacity.

Example: For smaller portfolios, focusing on diversified mutual funds; for larger portfolios, investing across specific stocks and alternatives.

Frequently Asked Questions about the Portfolio Diversification Strategy Generator

Q1: How often should I update my diversification strategy using this tool?

Review your portfolio and use the tool at least once every 6 to 12 months. Update more often if your financial goals or market environments change significantly.

Q2: Is this tool suitable for beginner investors?

Yes. While the tool includes insights from decades of investment experience, it adapts recommendations for various risk levels and portfolio sizes, making it useful for both beginners and experienced investors.

Q3: How does the tool decide which sectors to recommend?

It analyzes your current portfolio focus, financial goals, risk tolerance, investment time horizon, and the broader market to suggest a diversified allocation tailored to your inputs.

Q4: Can I use the generated strategy to select specific funds or stocks?

The tool provides asset class and sector-level recommendations rather than specific products. Use its guidance to select suitable mutual funds, ETFs, or individual investments that fit the suggested allocation.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.