QBI Deduction Calculator

Is this tool helpful?

How to Use the QBI Deduction Calculator Effectively

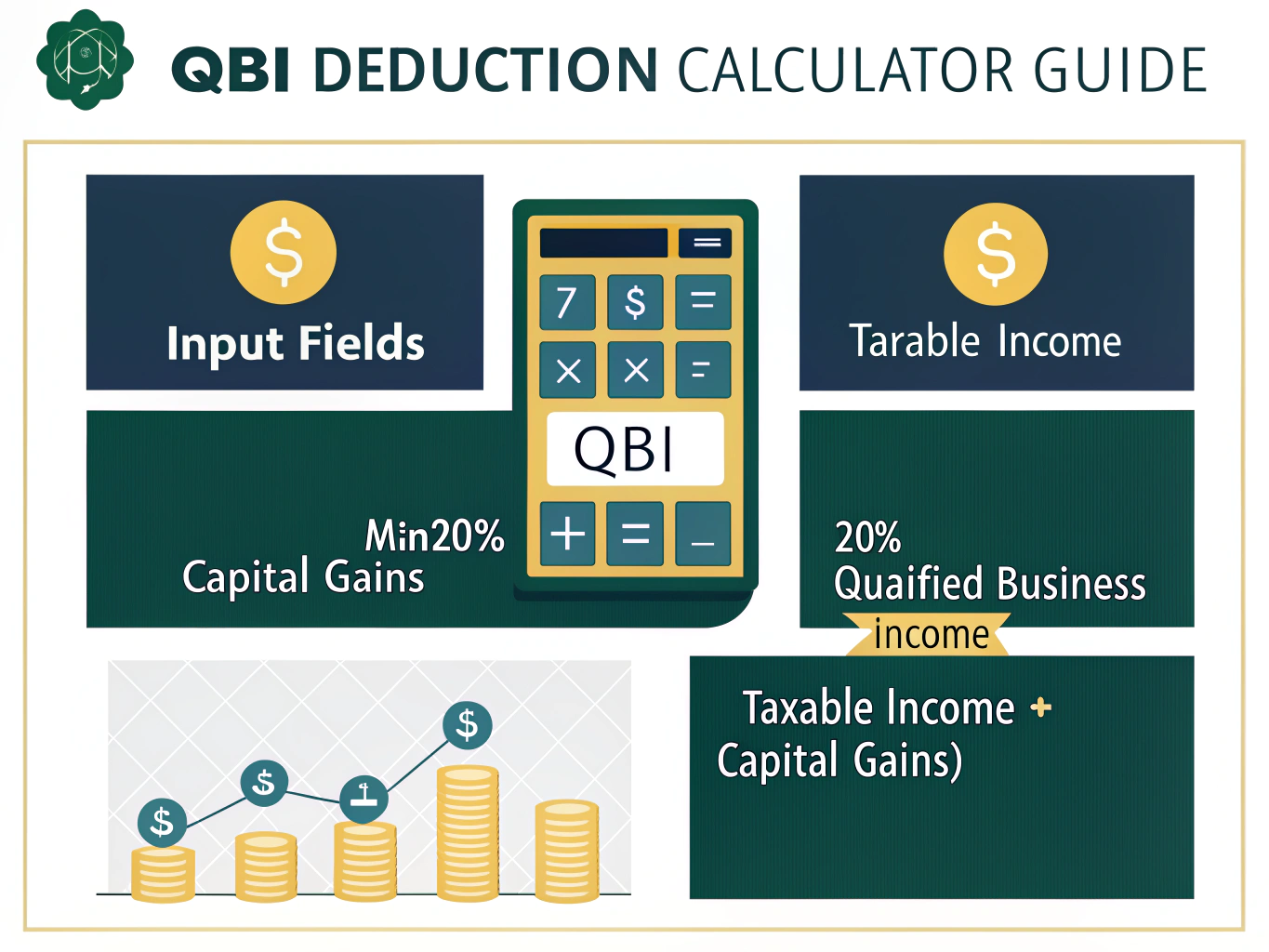

To calculate your Qualified Business Income (QBI) deduction accurately, follow these steps with our calculator:

- Enter Taxable Income: Input your total taxable income for the year. For example, if you earned $145,000 from all sources, enter “145000”.

- Input Capital Gains: Enter your total capital gains for the tax year. If you realized $25,000 in capital gains, enter “25000”.

- Add Qualified Business Income: Input your QBI amount. For instance, if your qualified business earned $95,000, enter “95000”.

- Click “Calculate QBI Deduction” to view your results.

Understanding the QBI Deduction Calculator

The Qualified Business Income Deduction Calculator helps business owners determine their Section 199A deduction, introduced by the Tax Cuts and Jobs Act. This valuable tool simplifies the complex calculation process by automatically computing your maximum allowable deduction.

The calculator uses the following formula to determine your QBI deduction:

$$ \text{QBI Deduction} = \text{Min}(20\% \times \text{QBI}, 20\% \times (\text{Taxable Income} – \text{Capital Gains})) $$Benefits of Using the QBI Deduction Calculator

- Time Efficiency: Eliminates manual calculations and reduces the risk of mathematical errors

- Accuracy: Automatically applies the correct percentage and limitation rules

- Phase-out Awareness: Provides notifications when income falls within the phase-out range

- Financial Planning: Helps forecast tax savings and business decisions

- Immediate Results: Generates instant calculations for quick decision-making

Key Features and Advantages

Our calculator includes several advanced features designed to enhance your tax planning experience:

- Automatic Limitation Application: Compares different limitation scenarios

- Phase-out Range Alert: Notifies users when income falls within critical thresholds

- User-friendly Interface: Clear input fields with helpful descriptions

- Responsive Design: Works seamlessly across all devices

Practical Applications and Problem-Solving

The QBI Deduction Calculator addresses several common challenges faced by business owners:

Example Calculation 1: Service Business Owner

Consider Sarah, who owns a consulting business:

- Qualified Business Income: $130,000

- Taxable Income: $160,000

- Capital Gains: $15,000

The calculator would determine:

- 20% of QBI: $26,000

- 20% of (Taxable Income – Capital Gains): $29,000

- QBI Deduction: $26,000 (lower of the two amounts)

Example Calculation 2: Multiple Income Sources

Consider Michael, who has diverse income streams:

- Qualified Business Income: $85,000

- Taxable Income: $120,000

- Capital Gains: $30,000

The calculator would determine:

- 20% of QBI: $17,000

- 20% of (Taxable Income – Capital Gains): $18,000

- QBI Deduction: $17,000 (lower of the two amounts)

Real-World Applications

Business Planning Scenarios

The calculator proves invaluable in various business situations:

- Annual Tax Planning: Estimating quarterly tax payments

- Business Structure Decisions: Evaluating entity classification impacts

- Investment Strategy: Analyzing the impact of capital gains on QBI deduction

- Income Timing: Planning income recognition for optimal deduction

Strategic Tax Planning

Business owners can use the calculator for:

- Forecasting tax liabilities

- Structuring business transactions

- Timing income recognition

- Planning retirement contributions

Frequently Asked Questions

What is Qualified Business Income?

Qualified Business Income represents the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. It excludes capital gains/losses, interest income, and dividend income.

How does the QBI deduction benefit business owners?

The QBI deduction allows eligible business owners to deduct up to 20% of their qualified business income, effectively reducing their taxable income and overall tax liability.

When should I calculate my QBI deduction?

Calculate your QBI deduction during tax planning sessions, quarterly tax preparation, and year-end tax calculations to optimize your tax position.

Can I use this calculator for multiple businesses?

Yes, you can use the calculator for multiple businesses by combining your total qualified business income from all eligible sources.

How does capital gains income affect the QBI deduction?

Capital gains reduce the taxable income limitation, potentially affecting your maximum allowable QBI deduction. The calculator automatically accounts for this reduction.

Do I need to recalculate my QBI deduction if my income changes?

Yes, any changes to your qualified business income, taxable income, or capital gains can affect your QBI deduction. Use the calculator to update your calculations accordingly.

What business entities qualify for the QBI deduction?

The QBI deduction is available to sole proprietorships, partnerships, S corporations, and some trusts and estates. C corporations are not eligible.

How often should I review my QBI deduction calculation?

Review your QBI deduction calculation quarterly or whenever significant changes occur in your business income or structure to ensure optimal tax planning.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.