Real Estate Market Analysis

Generating analysis...

Is this tool helpful?

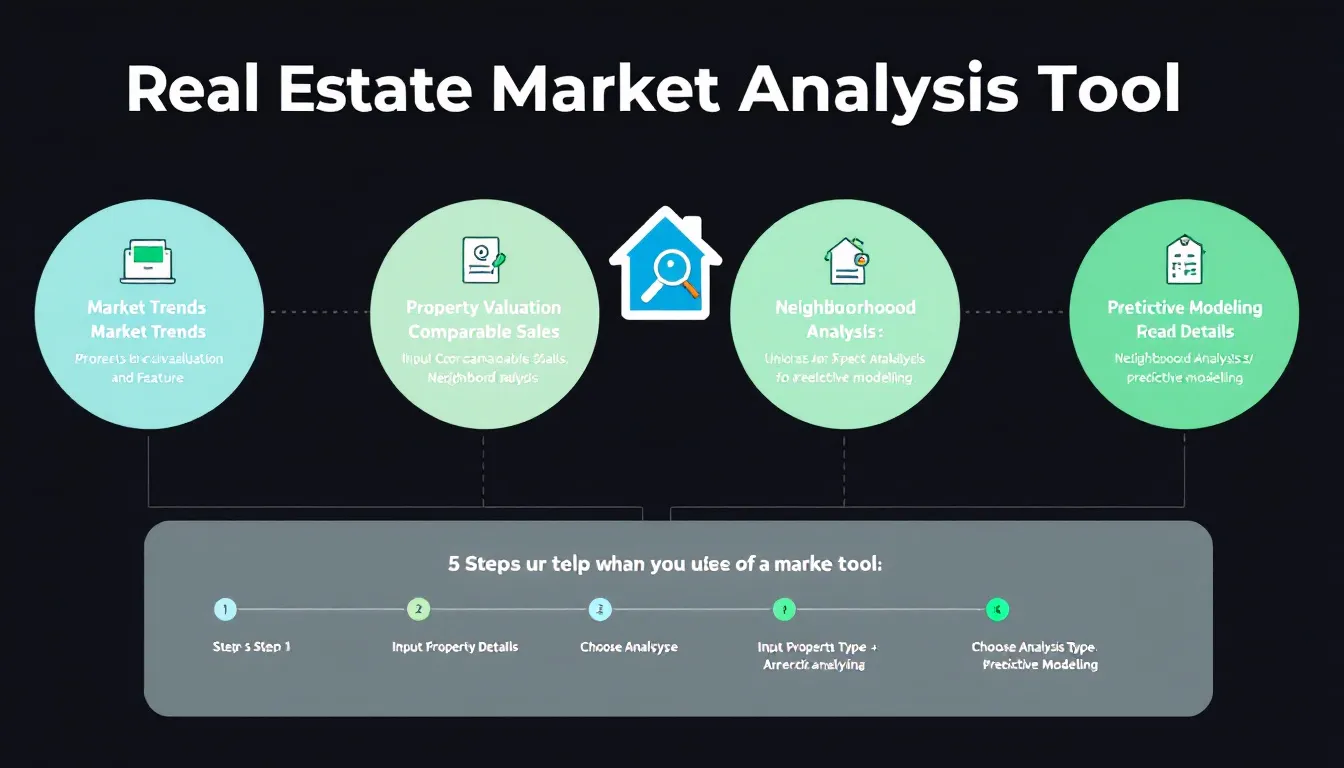

How to Use the Real Estate Market Analysis Tool Effectively

Follow these steps to get precise and actionable insights from the Real Estate Market Analysis Tool:

- Enter the Property Type: Specify the kind of property you’re interested in analyzing. For example, you can enter “townhouses with modern amenities” or “vacation cabins near lakes”.

- Define the Area: Input the exact location or neighborhood for your market research. Try entries like “Silicon Valley, CA” or “Greenwich Village, New York”.

- Set the Time Frame (Optional): Focus your analysis on a particular period by entering terms such as “past 12 months” or “Q1 2023”.

- Add Additional Factors (Optional): Include any special considerations affecting the market, like “near public parks” or “close to major transit hubs”.

- Generate the Analysis: Click the “Generate Real Estate Market Analysis” button to receive detailed insights tailored to your inputs.

After generating the report, you can review key market trends, pricing data, and other relevant factors. The tool also lets you copy the full report text for easy sharing or further evaluation.

What Is the Real Estate Market Analysis Tool and Why Use It?

The Real Estate Market Analysis Tool helps you compare sales prices and identify market trends by analyzing recent property data specific to your selected property types and areas. It supports buyers, sellers, investors, and professionals by providing data-driven insights that improve decision-making in real estate transactions.

This tool harnesses current market data to deliver assessments on sales prices, market demand, and property value influencers. By considering variables such as location, time frame, and additional market factors, it offers a clear picture of market dynamics, helping you respond swiftly and strategically.

Main Benefits of Using This Real Estate Market Analysis Tool

- Customized Property Insights: Tailor your report based on specific property types and targeted locations.

- Flexible Time Frame Selection: Analyze market changes over short or long periods for timely decisions.

- Inclusion of Additional Market Factors: Assess how local amenities or neighborhood characteristics affect property values.

- Clear Market Trend Indicators: Understand price movements, average days on market, and buyer preferences.

- Convenient Report Sharing: Easily copy and save comprehensive analysis for reference or professional use.

Practical Applications and Use Cases

This tool serves various real estate stakeholders by addressing specific needs in market research and property evaluation. Here are some common scenarios where this market analysis tool proves valuable:

For Homebuyers

- Verify fair market prices for properties matching your criteria.

- Discover trends in how long homes stay on the market in your desired area.

- Understand seasonal price fluctuations to time your purchase optimally.

- Compare neighborhoods based on local amenities or school quality.

For Sellers and Real Estate Agents

- Set competitive pricing based on comparative market analysis.

- Identify features that impact sale prices in your target area.

- Assess when market demand peaks to list properties strategically.

- Evaluate the influence of local factors like proximity to transport or shopping centers.

For Real Estate Investors

- Track price trends across neighborhoods to identify appreciation opportunities.

- Compare rental yields among different property types and locations.

- Spot emerging markets with growing demand for investment properties.

- Analyze how economic factors influence property values locally.

For Developers and Financial Institutions

- Support development planning by assessing market demand for various property types.

- Assist mortgage lenders in property appraisal with recent sales comparisons.

- Help REITs optimize portfolios by comparing market performance across regions.

- Provide investment entry analysis for international investors exploring new markets.

For Home Flippers

- Estimate the return on investment (ROI) for renovation projects.

- Compare sales prices of renovated versus non-renovated properties to forecast profits.

- Determine the optimal level of investment for improvements based on market trends.

Understanding Market Trends and Insights from the Tool

By analyzing the data generated from your inputs, the tool reveals important real estate market patterns, such as:

- Average Sales Price Calculation: Analyze the typical sale price for the selected property type in your target location.

- Price Per Square Foot Analysis: Evaluate how property size influences pricing within the specific market.

- Trend Identification: Detect whether prices are rising, stable, or declining over the chosen time frame.

- Days on Market Statistics: Understand how quickly properties sell and what that implies for pricing strategies.

Example Insight from Market Data

Suppose you analyze 2-bedroom condos in Austin, Texas for the last 9 months and find:

- Average sales price: $280,000

- Average price per square foot: $175

- Prices have increased by approximately 6% compared to the previous period

- Average days on market: 30 days

This snapshot helps you understand current demand and guide buying or selling decisions for condos in Austin.

Frequently Asked Questions

How often is the data updated?

The tool sources the most recent available sales and market data. While update frequency depends on local data providers, the tool ensures analysis reflects current market conditions.

Can I analyze commercial properties?

Yes, simply specify the commercial property type such as “industrial warehouses” or “retail storefronts” in the property type input to generate reports for commercial real estate markets.

Is this tool suitable for international real estate markets?

The tool is designed to analyze real estate markets worldwide, allowing for location-specific insights across many countries, subject to available local sales data.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.