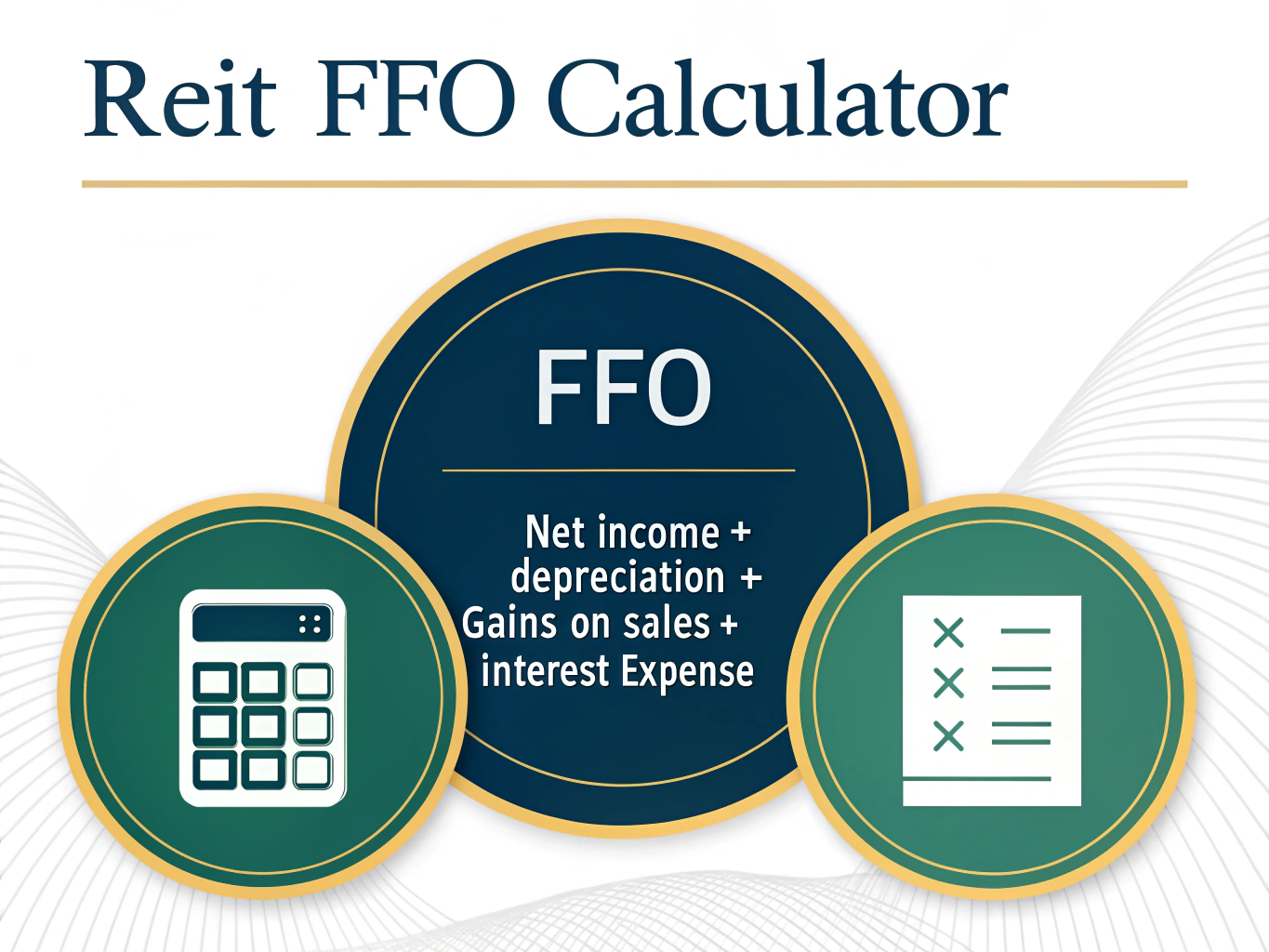

REIT FFO Calculator

Is this tool helpful?

How to Use the REIT FFO Evaluator Tool Effectively

To calculate the Funds From Operations (FFO) for a Real Estate Investment Trust (REIT), follow these steps:

- Net Income: Enter your REIT’s net income for the reporting period. For example, if your REIT generated $5,250,000 in net income, input this value in the first field.

- Depreciation: Input the total depreciation amount. A typical value might be $1,750,000 for a mid-sized REIT portfolio.

- Gains on Sales: Enter any gains realized from property sales during the period. For instance, if properties were sold with a profit of $850,000.

- Interest Expense: Input the total interest expense incurred. A representative value could be $975,000.

Understanding REIT FFO Evaluation

The REIT FFO Evaluator is a specialized financial tool designed to calculate the Funds From Operations, a crucial metric for evaluating Real Estate Investment Trust performance. FFO provides a more accurate measure of a REIT’s operating performance compared to traditional net income by adjusting for specific real estate-related factors.

The fundamental formula for calculating FFO is:

$$ \text{FFO} = \text{Net Income} + \text{Depreciation} – \text{Gains on Sales} + \text{Interest Expense} $$The Significance of FFO in REIT Analysis

FFO has become the industry standard for REIT performance evaluation because it:

- Eliminates the impact of depreciation, which typically doesn’t reflect actual property value changes

- Removes gains or losses from property sales that don’t represent ongoing operations

- Includes interest expense to reflect the cost of property financing

- Provides a clearer picture of operational cash flow

Benefits of Using the REIT FFO Evaluator

1. Standardized Calculation

The tool ensures consistency with NAREIT (National Association of Real Estate Investment Trusts) guidelines, providing:

- Accurate FFO calculations following industry standards

- Comparable results across different REITs

- Professional-grade analysis capabilities

2. Time Efficiency

Users can:

- Calculate FFO instantly without complex spreadsheets

- Update calculations quickly when variables change

- Generate results for multiple scenarios efficiently

3. Investment Decision Support

The tool helps:

- Compare different REITs effectively

- Evaluate investment opportunities

- Track performance over time

Problem-Solving Applications

Example Calculation Scenario

Consider a REIT with the following financial data:

- Net Income: $7,500,000

- Depreciation: $2,300,000

- Gains on Sales: $1,200,000

- Interest Expense: $1,800,000

Using the FFO Evaluator, the calculation would be:

$7,500,000 + $2,300,000 – $1,200,000 + $1,800,000 = $10,400,000

Practical Applications and Use Cases

1. Investment Analysis

Financial analysts use the FFO Evaluator to:

- Compare multiple REIT investments

- Determine fair valuation metrics

- Assess dividend sustainability

2. Portfolio Management

Portfolio managers utilize the tool for:

- Regular performance monitoring

- Portfolio rebalancing decisions

- Investment strategy adjustment

3. Financial Planning

Real estate professionals employ the evaluator for:

- Business valuation purposes

- Strategic planning

- Performance benchmarking

Frequently Asked Questions

What is FFO in REIT analysis?

FFO is a standardized measure used to evaluate REIT performance, providing a more accurate picture of operational cash flow by adjusting for depreciation, property sales, and interest expenses.

Why is FFO preferred over net income for REITs?

FFO better reflects a REIT’s operating performance by excluding non-cash depreciation and one-time property sales gains, while including relevant interest expenses.

How often should FFO be calculated?

FFO should be calculated quarterly and annually to align with standard financial reporting periods and enable proper performance tracking.

Can FFO be negative?

Yes, FFO can be negative if a REIT’s operational losses and adjustments exceed its income, though this is relatively uncommon in well-established REITs.

How does FFO relate to dividend payments?

FFO is often used as a benchmark for sustainable dividend payments, with many REITs targeting a specific FFO payout ratio.

Are there different types of FFO calculations?

Yes, while this calculator uses the standard NAREIT definition, some REITs also report adjusted FFO (AFFO) or normalized FFO for specific circumstances.

How can investors use FFO metrics?

Investors can use FFO to compare different REITs, evaluate dividend sustainability, and assess overall operational efficiency and performance.

Additional Considerations for REIT Analysis

Market Context

When using the FFO Evaluator, consider:

- Current market conditions

- Property sector trends

- Interest rate environment

- Regional economic factors

Comparative Analysis

For comprehensive REIT evaluation:

- Compare FFO with industry peers

- Track FFO growth trends

- Consider FFO per share metrics

- Analyze FFO payout ratios

Integration with Other Metrics

Combine FFO analysis with:

- Price to FFO ratios

- Debt to FFO metrics

- Operating margin analysis

- Occupancy rates

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.