RMD Calculator

Is this tool helpful?

How to use the tool

Type your December 31 balance. Example A: $425,000. Example B: $910,000.

Enter your age on December 31. Example A: 75. Example B: 80.

Select an account type—Traditional IRA, 401(k), 403(b), SEP IRA, SIMPLE IRA—to receive tailored notes.

Tap “Calculate RMD.” The script sends your entries to the server (process_llm_form action) and returns the result.

Review or copy the output for tax planning or adviser discussions.

Formula & checked examples

The calculator applies

$$ frac{\text{RMD}}{1}= frac{\text{Prior-year 12⁄31 balance}}{\text{Distribution period (IRS Uniform Lifetime Table)}}$$

- $425,000 ÷ 22.9 = $18,556.33 for age 75 (factor 22.9).

- $910,000 ÷ 20.2 = $45,049.50 for age 80 (factor 20.2).

Quick-Facts

- RMDs now start at age 73 for most savers (SECURE 2.0, §107).

- Failing to withdraw the full amount triggers a 50 % excise tax (IRS Pub. 590-B, 2023).

- Uniform Lifetime factors run from 27.4 at age 72 to 6.7 at age 95 (IRS Pub. 590-B, 2023).

- First-year deadline: April 1 of the following year (IRS Pub. 590-B, 2023).

- Lifetime RMDs do not apply to Roth IRAs (IRS FAQ “Roth Accounts”).

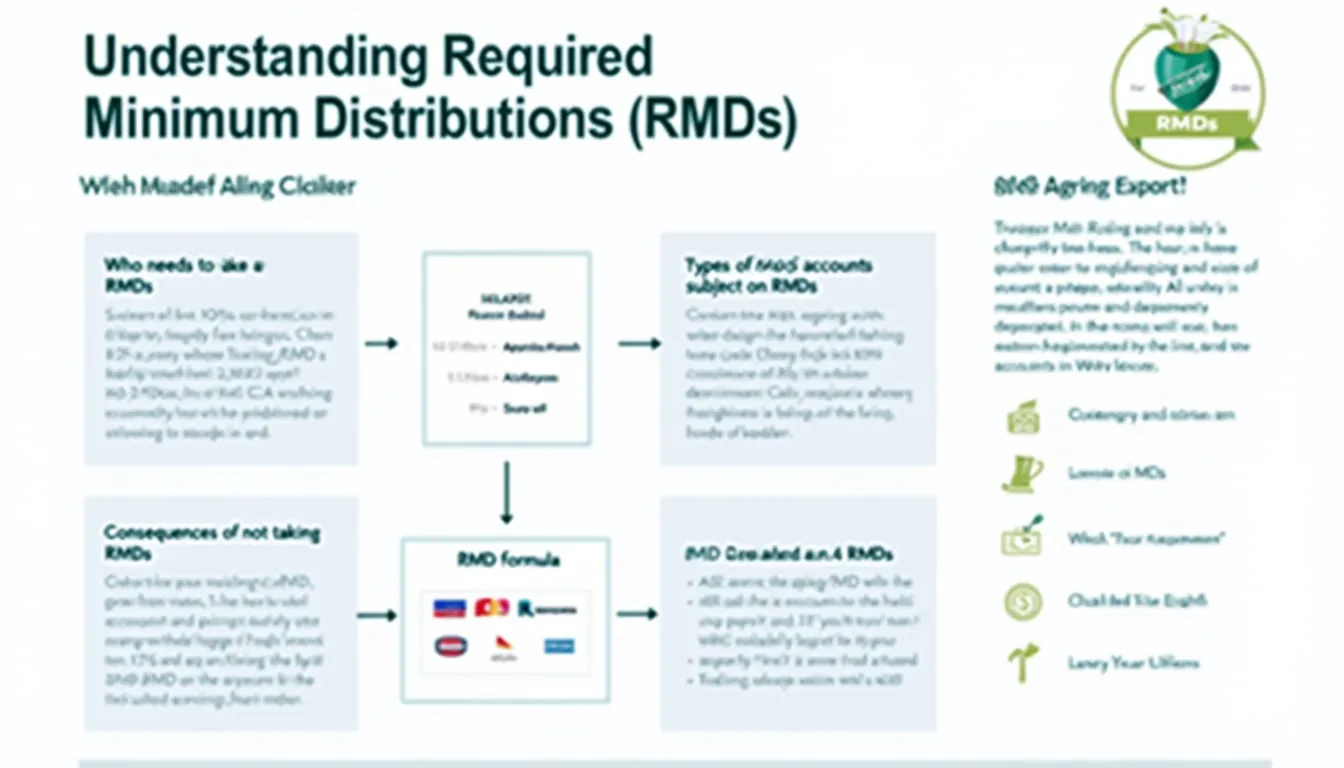

What is a Required Minimum Distribution?

Your RMD is the least you must withdraw yearly from tax-deferred retirement accounts once you reach the start age (IRS Pub. 590-B, 2023).

When must you start taking RMDs?

If you turn 73 in 2024 or later, your first payout is due by April 1 of the next year (SECURE 2.0, §107).

How does the calculator compute your RMD?

It divides your reported balance by the age-based “distribution period.” “The distribution period is determined by the Uniform Lifetime Table” (IRS Pub. 590-B, 2023).

Which accounts require RMDs?

Traditional IRA, SEP IRA, SIMPLE IRA, 401(k), 403(b), and governmental 457(b) plans all carry RMD obligations (IRS FAQ “RMD”).

What happens if you miss an RMD?

The IRS assesses an excise tax equal to 50 % of the amount not withdrawn (IRS Pub. 590-B, 2023).

Are Roth IRAs subject to RMDs?

Owner lifetime RMDs do not apply to Roth IRAs, but inherited Roth accounts do face them (IRS FAQ “Roth Accounts”).

Can you aggregate RMDs across accounts?

You may combine RMDs from multiple IRAs, but each employer plan’s RMD must be taken separately (IRS FAQ “Aggregation”).

How can market swings affect your RMD?

Your RMD uses last year’s balance; a 15 % drop lowers this year’s withdrawal by the same proportion (Vanguard Market Outlook 2023).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.