Simple and Compound Interest Calculator

Is this tool helpful?

How to use the tool

1. Fill in each field

- Principal ($) – type the initial sum, e.g., $7 500 or $22 350.

- Annual Interest Rate (%) – enter the yearly rate, such as 3.2 % or 7.75 %.

- Time + Unit – supply the duration and unit: 30 months or 1 850 days.

- Interest Type – choose Simple or Compound.

- Compounding Frequency (only for compound) – pick Monthly, Quarterly, etc.

2. Formulas used

- Simple interest $$I = P \times r \times t$$ Total $$A = P + I$$

- Compound interest $$A = P\left(1 + rac{r}{n}\right)^{nt}$$ Interest $$I = A – P$$

3. Worked examples (double-checked)

a. Simple interest example

Input: P = $7 500, r = 0.032, t = 2.5 years (30 months).

$$I = 7 500 \times 0.032 \times 2.5 = 600$$ Total $$A = 7 500 + 600 = 8 100$$

b. Compound interest example (daily compounding)

Input: P = $20 000, r = 0.07, n = 365, t = 10 years.

$$A = 20 000\left(1 + rac{0.07}{365}\right)^{365 \times 10} \approx 40 030.85$$ Interest $$I \approx 20 030.85$$

4. Interpret the results

- Interest Earned shows growth or cost.

- Total Amount combines principal and interest.

- The pie chart visualises the split.

5. Optimise your plan

- Run “what-if” scenarios by adjusting rate or time.

- Compare compounding frequencies to see acceleration.

- Export figures into budgeting spreadsheets.

Quick-Facts

- U.S. savings account yields range 0.01-4.5 % APY (FDIC Weekly National Rates, 2024).

- Daily compounding adds about 0.3 % extra annual return versus annual compounding at 5 % (Matheson, 2023, https://mathesonfinance.com).

- Rule of 72 estimates doubling time: 72 ÷ rate ≈ years (Investopedia, https://www.investopedia.com).

- SEC recommends comparing APY, not nominal rate, for accurate growth projections (SEC Investor Bulletin, 2023).

FAQ

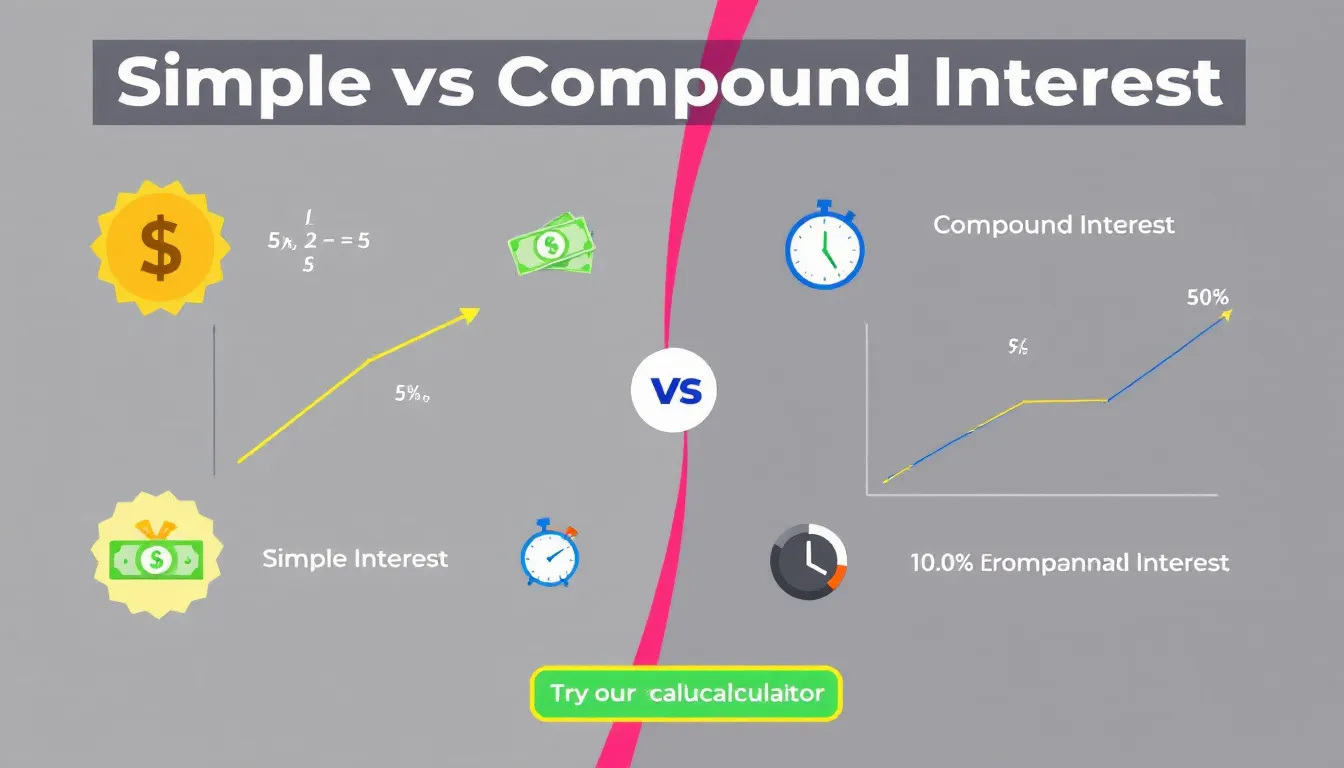

What is simple interest?

Simple interest grows only on the original principal; you do not earn “interest on interest” (Investopedia, https://www.investopedia.com).

How does compound interest work?

Compound interest adds earned interest back to principal, so each period’s base expands—Albert Einstein called it “the eighth wonder of the world” (Einstein quoted in SEC bulletin, 2022).

Does compounding frequency matter?

Yes. More frequent compounding raises the effective annual rate; monthly compounding at 6 % equals 6.17 % EAR (Federal Reserve Board, 2023).

How do I choose the right frequency?

Select the frequency offered by your bank or lender; you cannot override it, but you can compare products to find the best option (CFPB, 2022).

Can the calculator handle loan scenarios?

Yes. Enter loan principal, interest rate, term and choose simple interest for most personal loans or compound interest for amortising mortgages.

Why is my result different from bank disclosures?

Banks may include fees and rounding rules; the calculator isolates pure interest, so slight differences are normal (FDIC Consumer Guide, 2023).

How accurate are the calculations?

The tool uses exact formulas; accuracy equals that of any scientific calculator, assuming input data reflect real contract terms.

Does the tool adjust for inflation?

No. Subtract expected inflation to estimate real returns; current U.S. 10-year break-even inflation is 2.3 % (St. Louis Fed FRED, 2024).

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.