5-Year Rolling Return Calculator

Is this tool helpful?

How to Use the Rolling Return Analyzer Effectively

The Rolling Return Analyzer is designed to calculate the annualized 5-year rolling returns for S&P 500 investments. To use this tool effectively, follow these steps:

- Enter Starting S&P 500 Price: Input the index value at the beginning of your investment period. For example, if you started investing in January 2015, you might enter 2058.20 (the S&P 500 value at that time).

- Enter Ending S&P 500 Price: Input the index value at the end of your investment period. For instance, if your period ended in January 2020, you might enter 3329.62.

- Review Results: The calculator will display the annualized return and generate a visual representation of the value progression over the five-year period.

Understanding Rolling Returns in Investment Analysis

Rolling returns represent the annualized average rate of return for a specific period, calculated on a rolling basis from one period to the next. This method provides a more comprehensive view of investment performance compared to simple point-to-point returns.

$$ \text{5-Year Rolling Return} = \left(\frac{\text{End Price}}{\text{Start Price}}\right)^{\frac{1}{5}} – 1 $$Core Components of Rolling Return Analysis

- Time Period: Fixed 5-year windows

- Price Points: Start and end values of the S&P 500

- Annualization: Converting total return into yearly performance

- Geometric Average: Accounts for compounding effects

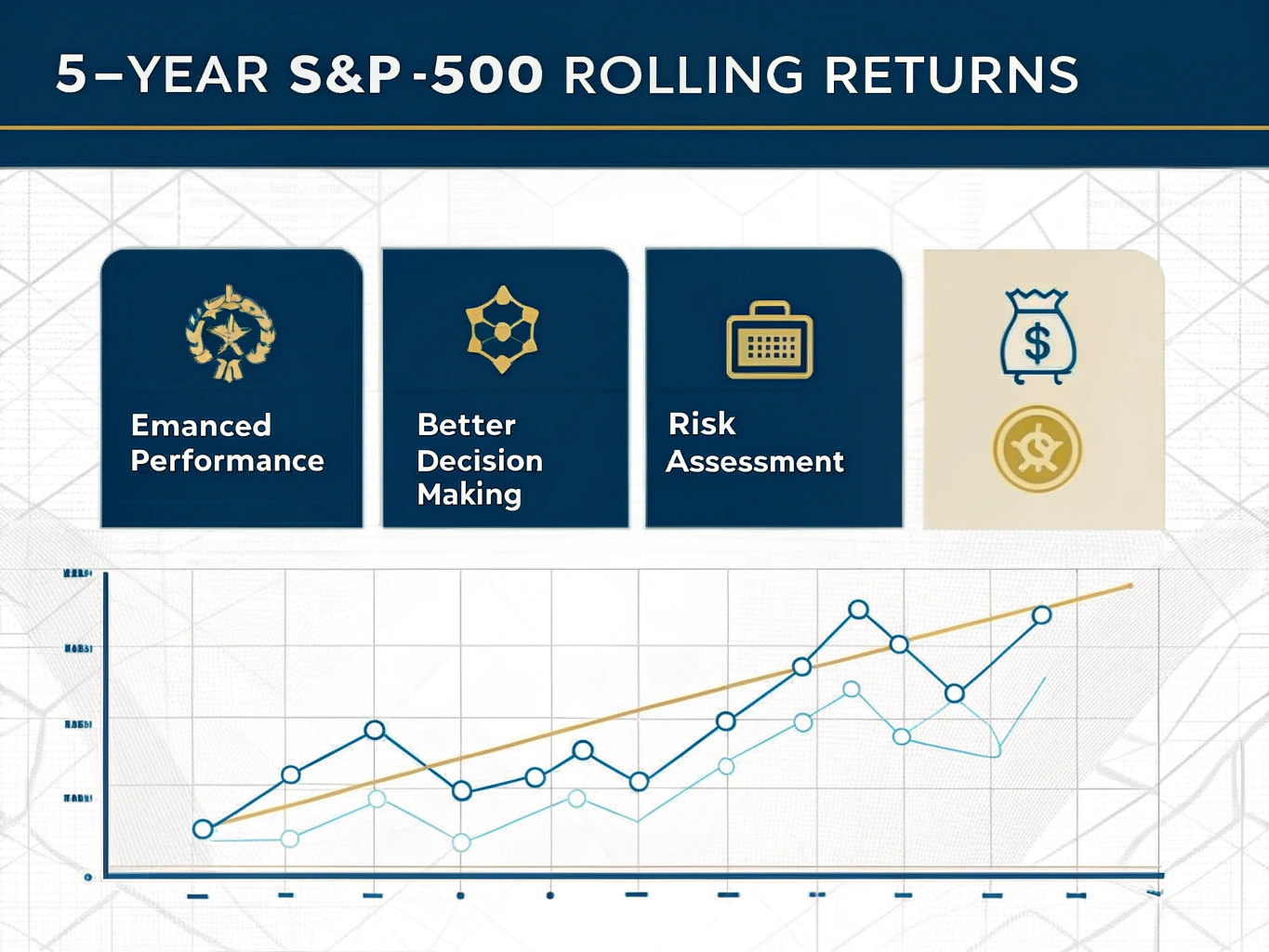

Benefits of Using Rolling Returns for Investment Analysis

Rolling returns offer several advantages for investors and analysts:

1. Enhanced Performance Perspective

- Eliminates endpoint sensitivity bias

- Provides a more stable performance metric

- Captures multiple market cycles

2. Better Decision Making

- Helps set realistic return expectations

- Improves investment timing strategies

- Supports long-term planning

3. Risk Assessment

- Identifies performance patterns

- Reveals market cyclicality

- Highlights historical volatility

Practical Applications and Example Calculations

Example 1: Market Recovery Analysis

Consider analyzing the market recovery period from 2009 to 2014:

- Starting S&P 500 Value (March 2009): 676.53

- Ending S&P 500 Value (March 2014): 1872.34

- 5-Year Rolling Return: 22.6% annualized

Example 2: Bull Market Performance

Examining the bull market period of 2013-2018:

- Starting S&P 500 Value (January 2013): 1498.11

- Ending S&P 500 Value (January 2018): 2872.87

- 5-Year Rolling Return: 13.9% annualized

Use Cases for Rolling Return Analysis

1. Portfolio Performance Evaluation

Investment managers use rolling returns to:

- Compare fund performance against benchmarks

- Evaluate consistency of returns

- Assess investment strategies across market cycles

2. Financial Planning

Financial advisors utilize rolling returns for:

- Setting realistic client expectations

- Developing retirement planning strategies

- Illustrating long-term investment potential

3. Market Research

Analysts employ rolling returns to:

- Identify market trends

- Study historical patterns

- Develop investment theses

Frequently Asked Questions

What are rolling returns?

Rolling returns are annualized average returns for a specific time period, calculated by “rolling” the time window forward. This method provides a series of overlapping periods, offering a more comprehensive view of investment performance.

Why use 5-year rolling returns?

Five-year periods are long enough to smooth out short-term market volatility while being short enough to remain relevant for most investment planning horizons. This timeframe captures both bull and bear market cycles.

How do rolling returns differ from traditional returns?

Traditional returns measure point-to-point performance between two specific dates. Rolling returns consider multiple overlapping periods, providing a more robust analysis of investment performance across different market conditions.

Can I use rolling returns for other investments?

Yes, rolling returns can be calculated for any investment with regular price data, including individual stocks, mutual funds, ETFs, and other market indices.

How should I interpret the results?

The rolling return percentage represents the annualized rate of return over the five-year period. A 10% rolling return means the investment grew at an average rate of 10% per year over the five-year period, accounting for compounding.

Are rolling returns useful for market timing?

While rolling returns provide valuable historical context, they should be used as one of many tools for investment decision-making rather than as a sole timing indicator.

Additional Tips for Using the Rolling Return Analyzer

1. Data Selection

- Use consistent data sources for price inputs

- Consider dividend-adjusted prices for total return analysis

- Verify historical data points for accuracy

2. Analysis Best Practices

- Compare results across different time periods

- Consider market conditions during the analysis period

- Use rolling returns alongside other analytical tools

3. Interpretation Guidelines

- Focus on long-term trends rather than individual data points

- Consider the broader economic context

- Use results to inform, not dictate, investment decisions

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.