Sustainable Growth Rate Calculator

Is this tool helpful?

How to Use the Sustainable Growth Rate Calculator Effectively

The Sustainable Growth Rate (SGR) Calculator is designed to help businesses determine their maximum achievable growth rate without external financing. Here’s a step-by-step guide to using the calculator:

- Return on Equity (ROE): Enter your company’s ROE as a percentage. For example, if your company has a net income of $2 million and shareholders’ equity of $10 million, your ROE would be 20%.

- Dividend Payout Ratio: Input the percentage of earnings distributed as dividends. For instance, if your company pays $500,000 in dividends from $2 million in earnings, enter 25%.

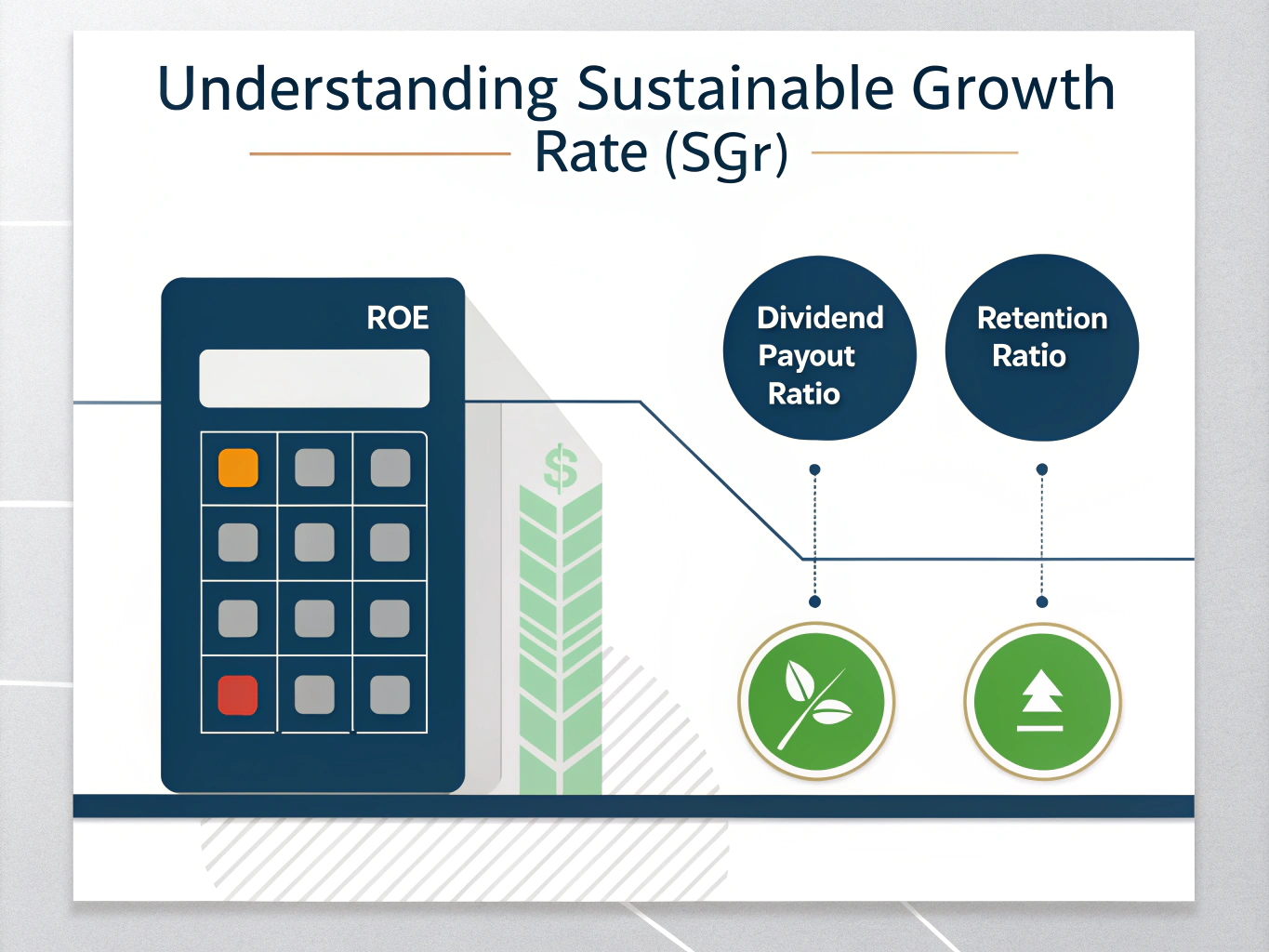

Understanding the Sustainable Growth Rate Model

The Sustainable Growth Rate represents the maximum rate at which a company can grow using only internal financing. The formula for calculating SGR is:

$$ \text{SGR} = \text{ROE} \times (1 – \text{Dividend Payout Ratio}) $$Components of the SGR Formula

- Return on Equity (ROE): Measures a company’s profitability in relation to shareholders’ equity

- Dividend Payout Ratio: The proportion of earnings paid to shareholders as dividends

- Retention Ratio: (1 – Dividend Payout Ratio) represents the portion of earnings retained for reinvestment

Benefits of Using the SGR Calculator

- Strategic Planning: Helps companies set realistic growth targets

- Financial Stability: Prevents over-leveraging and unsustainable expansion

- Resource Allocation: Guides decisions about reinvestment and dividend policies

- Risk Management: Identifies potential funding gaps before they occur

- Investor Relations: Provides clear communication about growth expectations

Practical Applications and Problem Solving

Case Study 1: Manufacturing Company

Consider a manufacturing company with:

- ROE: 18%

- Dividend Payout Ratio: 40%

Using the SGR calculator:

SGR = 18% × (1 – 0.40) = 10.8%

This indicates the company can grow at 10.8% annually without external financing.

Case Study 2: Technology Startup

For a growing technology company with:

- ROE: 25%

- Dividend Payout Ratio: 0% (reinvesting all earnings)

The sustainable growth rate would be:

SGR = 25% × (1 – 0) = 25%

Industry-Specific Applications

Retail Sector

Retail businesses typically maintain lower sustainable growth rates due to:

- Higher dividend payout ratios to attract investors

- Lower ROE due to competitive pressures

- Significant working capital requirements

Technology Sector

Technology companies often show higher sustainable growth rates because of:

- Higher ROE from intellectual property assets

- Lower dividend payout ratios

- Minimal physical infrastructure requirements

Strategic Implementation

Growth Management Strategies

- Improving operational efficiency to increase ROE

- Adjusting dividend policies to retain more earnings

- Optimizing working capital management

- Developing sustainable competitive advantages

Financial Planning Integration

- Incorporating SGR into annual budgeting processes

- Using SGR for long-term strategic planning

- Aligning growth targets with sustainable rates

- Monitoring actual growth against sustainable rates

Frequently Asked Questions

What is a good sustainable growth rate?

A good sustainable growth rate varies by industry and company maturity. Generally, rates between 8% and 15% are considered healthy for established companies, while high-growth sectors might sustain higher rates.

Can the sustainable growth rate be negative?

Yes, if a company has negative ROE, the sustainable growth rate will be negative, indicating the business is contracting rather than growing.

How often should I calculate the sustainable growth rate?

It’s recommended to calculate SGR quarterly or at least annually, especially when making significant changes to dividend policy or experiencing substantial changes in profitability.

Should startups use the sustainable growth rate model?

While startups can use SGR for planning, they typically require external financing for growth, making the model less relevant in early stages.

How does SGR relate to competitive advantage?

Companies with strong competitive advantages often maintain higher ROEs, leading to higher sustainable growth rates without external financing.

Can SGR help in merger and acquisition decisions?

Yes, SGR helps evaluate whether potential acquisitions can be financed internally and if they align with sustainable growth objectives.

Best Practices for SGR Implementation

Regular Monitoring

- Track actual growth against calculated SGR

- Adjust strategies when actual growth deviates significantly

- Review and update inputs quarterly

Strategic Decision Making

- Use SGR as a benchmark for growth initiatives

- Consider SGR when evaluating expansion opportunities

- Align dividend policies with growth objectives

Industry Benchmarking

- Compare SGR with industry peers

- Analyze differences in ROE and payout ratios

- Identify opportunities for improvement

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.