Treynor Ratio Calculator: Measure Risk-Adjusted Portfolio Performance

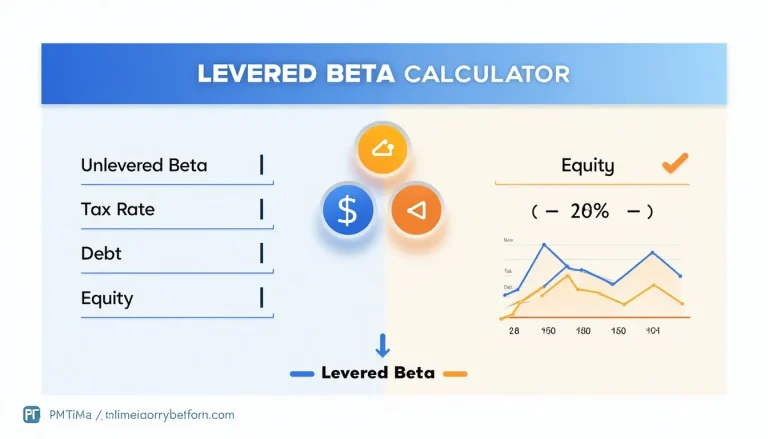

Beta coefficient is a crucial financial metric that measures a stock’s volatility in relation to the overall market. This powerful tool helps investors and financial professionals assess risk and optimize portfolio performance. By understanding beta, you can make more informed investment decisions and better manage your risk exposure. Beta is an integral component of various financial models, including the Capital Asset Pricing Model (CAPM) and the Treynor Ratio, which are used to estimate expected returns and evaluate risk-adjusted performance. Whether you’re calculating the cost of equity or analyzing levered beta, this metric provides valuable insights for optimizing your investment strategy. Explore the beta coefficient to enhance your financial analysis and make data-driven investment choices.