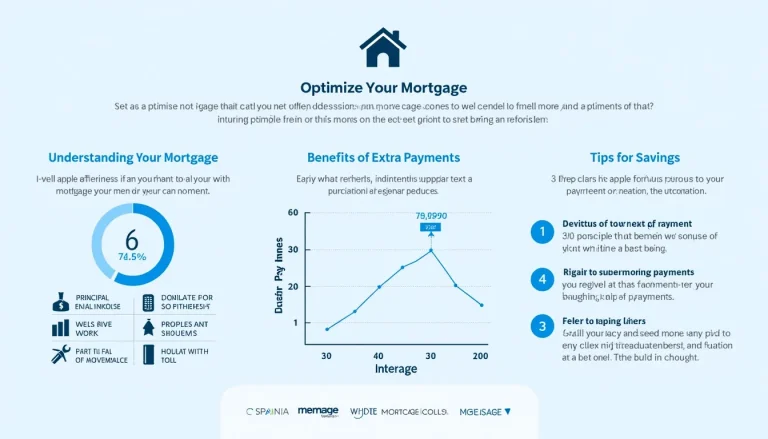

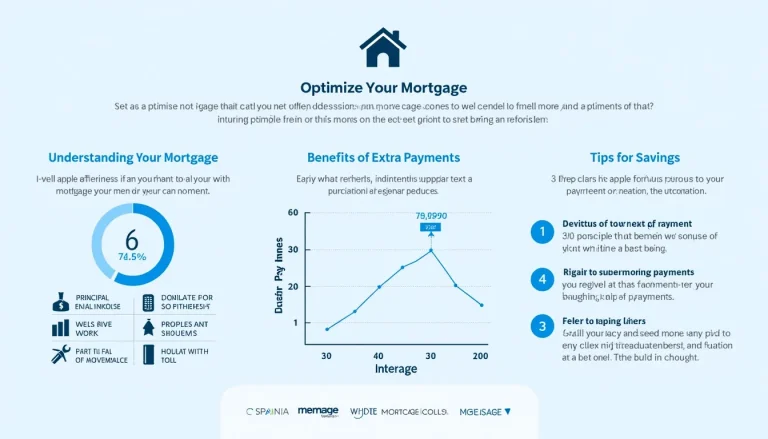

Advanced Mortgage Calculator: Save Money with Extra Payments

Biweekly payments offer businesses a strategic approach to managing cash flow and financial obligations. This payment schedule involves making payments every two weeks, resulting in 26 payments per year instead of the traditional 12 monthly payments. By implementing biweekly payments, companies can better align their expenses with revenue cycles and potentially reduce interest on loans or mortgages. This system is particularly beneficial for payroll management, allowing businesses to provide consistent income to employees while optimizing their own financial planning. Additionally, biweekly payments can be integrated with advanced mortgage calculators to help businesses and individuals save money through more frequent payments. Whether you’re looking to improve cash flow, reduce debt, or streamline payroll processes, implementing a biweekly payment schedule can offer significant advantages. Explore the benefits of biweekly payments to enhance your financial management strategy today.