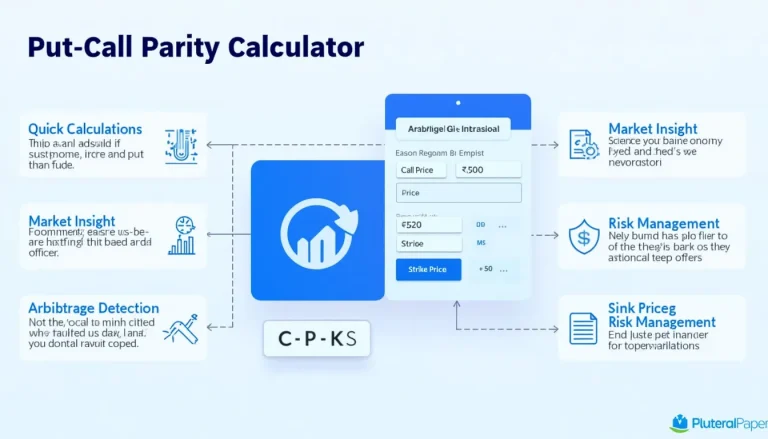

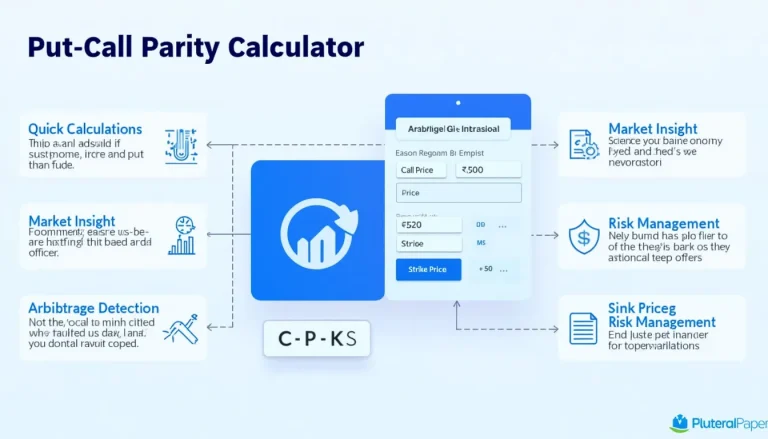

Put-Call Parity Calculator: Determine Future Price in Options Trading

Call options are financial contracts that give the holder the right, but not the obligation, to buy an underlying asset at a predetermined price within a specific time frame. These versatile instruments play a crucial role in options trading, offering investors opportunities for leverage, income generation, and risk management. Understanding call options is essential for developing advanced trading strategies, such as those involving put-call parity. Traders and investors can use call options to speculate on price movements, hedge existing positions, or generate income through premium collection. By mastering call options, financial professionals can enhance their trading toolkit and potentially improve their overall market performance. Explore our resources to deepen your knowledge of call options and their applications in modern finance.